7.11.22: Bloomberg and CNBC got everyone excited about China at local highs while we discussed caution internally.

Key U.S. and China brief market notes by Larry's Analyst Staff Team

Note to Readers: Larry’s Analyst Team emails are typically sent out on M/W/F. Read more about how we recently advocated for caution in Chinese Internet in our July 1st Research Report as Alibaba approached 16X Forward P/E before the recent new regulation clampdown announced in our Investment Community.

We also discussed caution on Chinese Internet back on July 6th in a public email note out of our care to our public audience here. Please read this prior note before reading today’s update. Quoted from July 6th email (link below):

Continued discussions from the Biden administration about rolling back some tariffs on Chinese goods. The environment for Chinese stocks continue to improve. That said, Strategist Larry discussed in our July notes released on the first of the month that the asset class rating for Chinese Internet moved from buy in June to “hold". This was discussed when KWEB was near 34/shr. We believe the LT outlook on China is still positive, but given the large pace of gains in the past 45 days, it is the buyers who were willing to buy early who now have stronger hands. LT outlook still looks good; ST outlook requires more positive data to keep momentum going.

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

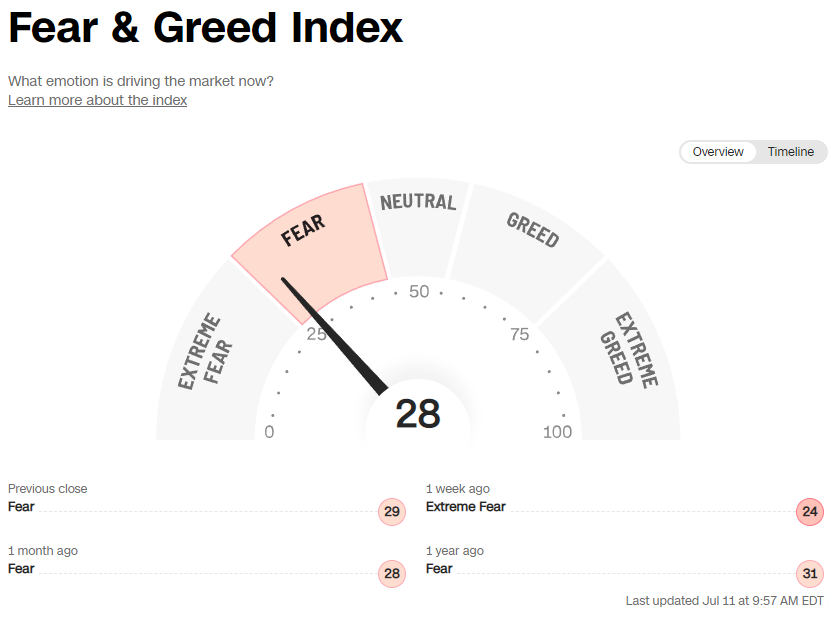

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 3899.38

KWEB (Chinese Internet) ETF: $32.11

Analyst Team Note:

“Some factors that may contribute to the market forming a bottom: (i) at least 2 consecutive CPI prints that are lower; (ii) visibility in the end of the Fed’s tightening cycle; (iii) a stabilization in margin expectations; and (iv) a decline in housing and/or rental prices.” - JPM

Meanwhile, China’s June total social financing, RMB loans and M2 all came in above expectations.

“We see two main reasons behind the strong monetary and credit data in June: 1) activity growth recovery in June, including investment and “pent-up” property transactions, which contributed to the recovery of credit demand; 2) the strong policy push contributed both to credit demand and credit supply.” - Goldman

Macro Chart In Focus

Analyst Team Note:

A combination of steep Federal Reserve interest-rate hikes and economic growth fears have lifted the dollar higher.

Per Morgan Stanley’s Mike Wilson: “The dollar is unlikely to show any signs of demise until the Fed pivots, which seems unlikely”.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

Big CPI and Beige Book release this week. Consensus estimate for CPI YoY is 8.8% vs. 8.6% previous.

“Rates markets are pricing in this print as the inflation peak. Bonds have already priced a 75bps hike for July. Is the impact primarily on September expectations? If we fail to see moves in yields, is the path of least resistance for Equities still higher? The answer may depend on how we start earnings season with Banks kicking off this week.” - JPM

Chart That Caught Our Eye

Analyst Team Note:

“US EPS is now well above trend. The geometric trend is consistent with an EPS CAGR in real terms of 4.1%. On this basis, the return to trend would require a 24% decline in real trailing earnings (and clearly in prior recessions earnings have gone from above to below trend). Consensus expects a weighted average 4.5% inflation over the next 18 months, again consistent with 20% nominal decline in EPS to get back to trend.

“From a valuation perspective, assuming earnings fall to trend would imply the US market multiple moving from its current 19x trailing earnings, to 25x, all else equal.” - Credit Suisse

Sentiment Check

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs

Make sure to check Larry’s most recent market updates via his personal newsletter. See you in our next update.