7.10.24: JPow Expresses Cautious Optimism on Inflation

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 5,619.78

KWEB (Chinese Internet) ETF: $27.93

Analyst Team Note:

Macro Chart In Focus

Analyst Team Note:

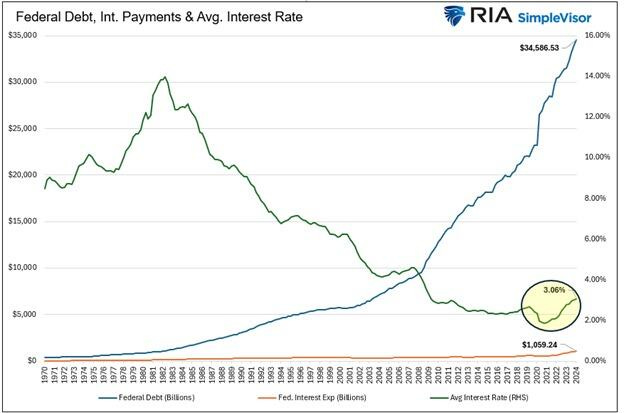

The U.S. government has added $2.5 trillion in debt over the past year, with over $1 trillion going towards interest payments on its total debt. Despite recent high interest rates, the average interest rate on the debt remains relatively low at 3.06%.

However, this situation is concerning because even a small increase in the average interest rate has a significant impact due to the rapid growth of federal debt, which has increased by 8.5% annually over the last decade.

As older, low-interest debt matures and is replaced by new, higher-interest debt, the government's interest expenses are expected to rise substantially.

If the average interest rate reaches 4.75%, the annual interest expense could climb to $1.65 trillion, surpassing Social Security as the largest government expenditure and doubling defense spending.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

Federal Reserve Chair Jerome Powell expressed cautious optimism today about inflation receding but emphasized that it hasn't yet sustainably slowed to the central bank's 2% goal.

He highlighted the need for more data to confirm this trend and avoided signaling the timing of interest rate cuts, noting the balanced risks of moving too quickly or too slowly.

Powell also discussed ongoing efforts to reduce the Fed's balance sheet and hinted at forthcoming changes to bank capital requirements.

The Fed is expected to maintain its current rate range in the upcoming July meeting, with markets watching for potential clues about future rate cuts in September.

Chart That Caught Our Eye

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.