7.10.23: Markets continue consolidating ahead of key macro inflation data released on Wednesday

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Informal Note to Public Readers from Larry: Markets continue sideways action until clear catalysts drive the next directional move. My recent premium strategy note to Members from this past weekend can be found here.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash (yielding 4.5%+ on idle cash) at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4398.95

KWEB (Chinese Internet) ETF: $27.48

Analyst Team Note:

Investors are increasingly gravitating towards cash and short-term government bonds, driven by expectations of further interest rate hikes by the Federal Reserve. The iShares 0-3 Month Treasury Bond ETF saw a significant inflow of nearly $572 million last week, marking the biggest weekly influx since the March banking crisis. Money-market fund assets also hit a record high, reversing a trend of three consecutive weeks of outflows. The market's hawkish bias, coupled with solid performance from equities and corporate debt so far in 2023 has investors leaning towards caution ahead of the upcoming corporate earnings season.

Macro Chart In Focus

Analyst Team Note:

According to Federal Reserve data, US consumer borrowing in May 2023 has seen the slowest growth since November 2020, with total credit increasing by only $7.2 billion. This is largely due to a decline in non-revolving credit, which covers loans for school tuition and vehicle purchases, of $1.3 billion. This decrease marks the first of its kind since April 2020. Moreover, auto sales have dipped and five-year lending rates for new vehicle purchases have hit a high of 7.81%, the steepest since 2006.

On the other hand, revolving credit, which includes credit cards, rose by $8.5 billion but this still represents a slowdown compared to the previous two months. Credit cards issued by commercial banks had an interest rate of 20.68% in May, marking a historical high since 1972. Looking ahead, household finances, particularly those with student debt, are expected to be further strained with the resumption of student-loan payments for more than 40 million Americans in the fall.

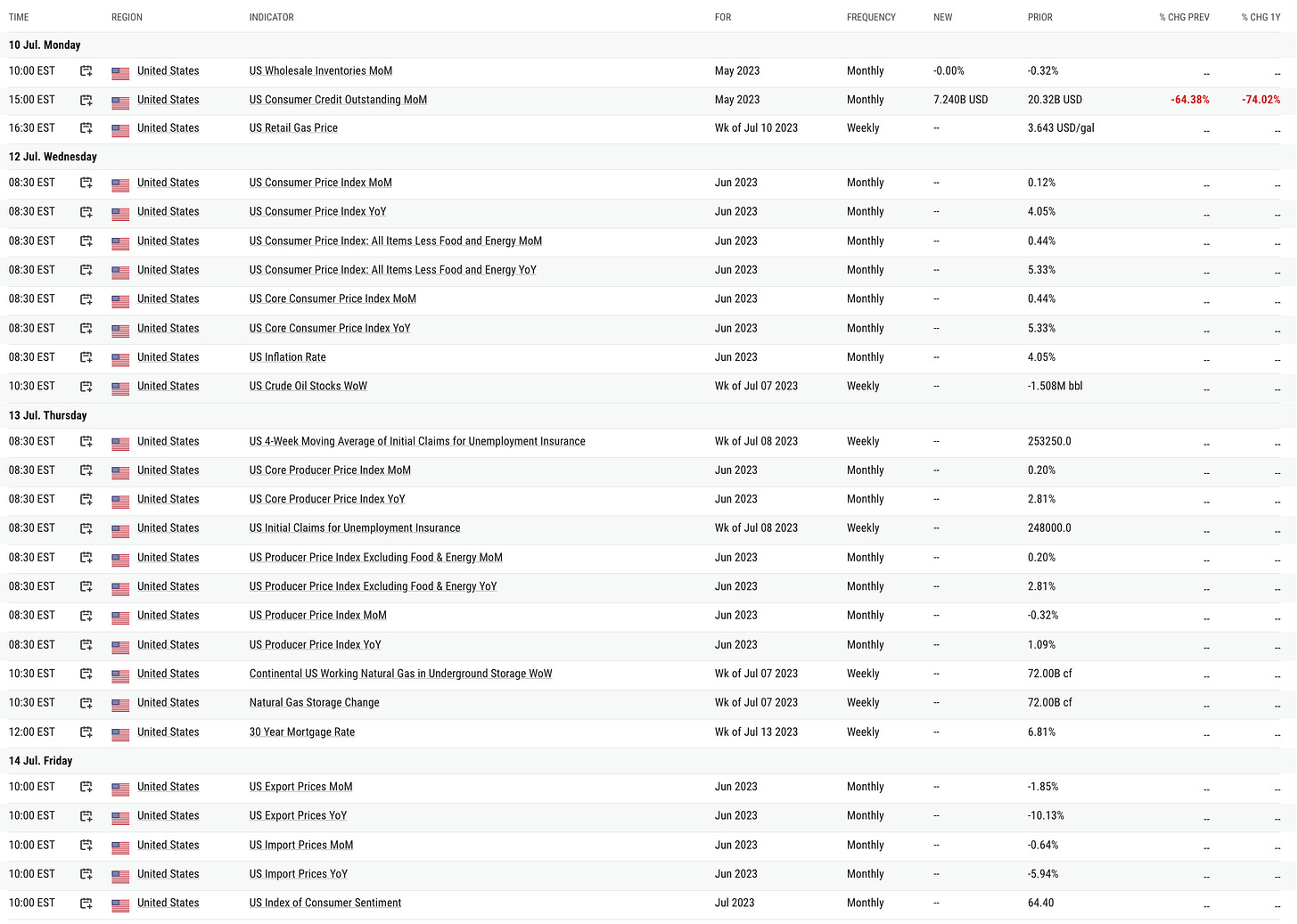

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

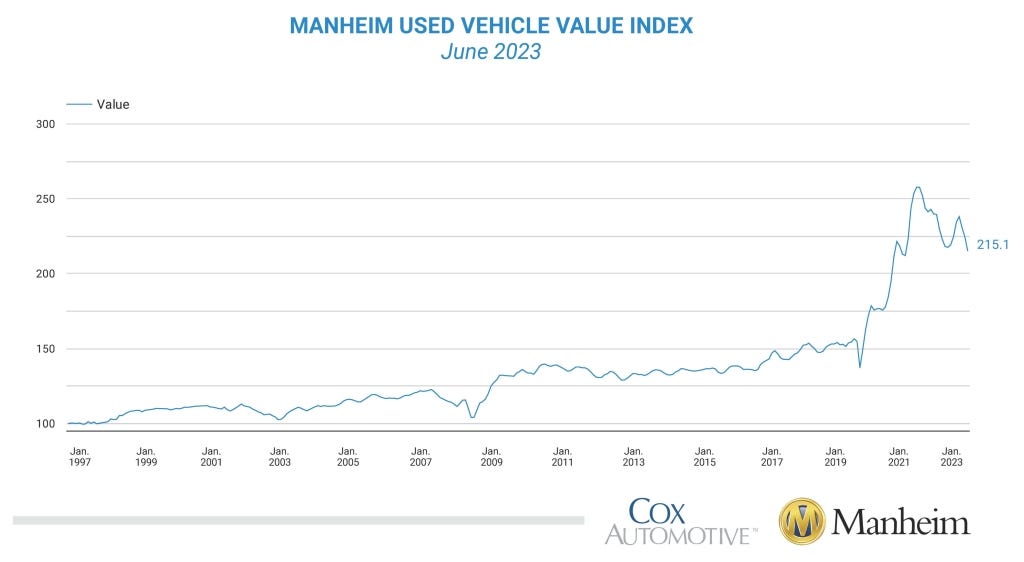

In June, wholesale used-vehicle prices experienced a 4.2% decrease from May, with the Manheim Used Vehicle Value Index declining to 215.1, marking a 10.3% fall from the previous year, according to Cox Automotive. This drop represents one of the largest in history and the biggest since the start of the pandemic in April 2020. While all major market segments saw prices decrease, sports cars were hardest hit with a 14.8% year-over-year drop.

Despite used vehicle retail sales dipping 4% from May and 6% year over year, June's new light vehicle sales saw a 19.9% increase year over year. Measures of consumer confidence also improved in June, with plans to purchase vehicles in the next six months slightly declining but steady year over year.

Chart That Caught Our Eye

Analyst Team Note:

By the close of Q1 2023, an unprecedented 963 million square feet of office space remained vacant across the United States. Every month, it is projected that between five to ten office buildings are at risk of defaulting on their loans…

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.