6.9.23: Markets Reach 2023's Highest Levels Ahead of June FOMC

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

About today’s public newsletter partner: Gainy is an investing app that has a special feature called Thematic Trading Fractional (TTF). TTFs have the best pre-screened 10-20 companies in the field around the topic you’re looking for and it’s also a good number for diversification. The weights of stocks are optimized to control for risk and this rebalance happens to your portfolio automatically.

We can choose from over 70 model portfolios starting from popular ones such as Cybersecurity, to new ones like AI and Machine learning, to event-driven like Inflation-Proof or Inverse Market TTF. Gainy's recommendation engine tailors investments to your unique needs based on your interests and investment goals, helping you make informed decisions and reach your financial objectives faster.

Note to Public Readers from Larry: Markets impressively have shrugged off all worries and trade at 2023’s highest levels ahead of June FOMC next week.

My latest Strategy note to Members highlights my view of the U.S. market’s setup if it experiences sector rotation. Check it out below.

Public Commentary to Readers from my Analyst Staff

On U.S. Stocks

In 2023, a familiar group of mega-cap companies, Nvidia, Apple, Microsoft, Amazon, Meta, Alphabet (Google), Tesla, and Netflix, has come to dominate the market. This resurgence comes amidst shifts in market behavior, particularly concerning interest rates. These mega-cap stocks seem less influenced by the Federal Reserve's actions, sparking debates about the sustainability of this new market narrative.

These companies are considered attractive for several reasons. Most are cash-generative with solid balance sheets, making them attractive "quality" stocks. Their continued growth despite broader economic trends is also appealing given the slower economic growth. Further, the increasing role of artificial intelligence in various sectors has made these companies more valuable, especially Nvidia, which is already profiting from the AI boom. Additionally, with interest rates allegedly nearing their peak, these stocks, which were previously affected by rising rates, have become less sensitive.

Despite outperforming other stocks, investment in these mega-cap companies carries risks. The two main errors investors make are overpaying for already known winners, such as Nvidia in the AI sector, and misunderstanding the nature of the companies.

Finally, there's the risk of not accurately pricing known risks, especially in the tech sector. For these mega-cap companies, the looming threat is new regulatory and antitrust measures as public and political sentiment towards them shifts. This risk is hard to predict and price but could have significant implications, as seen in attempts to prevent Microsoft from acquiring video game maker Activision Blizzard.

Regardless, these tailwinds have pushed the biggest stocks as measured by the Russell Top 50 Mega Cap index to beat the Russell 2000 index of smaller companies by more than 20 percentage points this year, better than any five-month period from the creation of the measure in 2002 up to the pandemic.

This record outperformance has led to Wall Street paying heavily.

Investment strategies that Wall Street pros had bet heavily on at the start of 2023 are taking a significant hit. These include divesting from big tech stocks, neglecting the US dollar, and investing in emerging markets, particularly China. The reality, however, has been a resurgence in US growth stocks, a strengthening of the dollar, and Chinese stocks sinking into a bear market. Misjudged strategies and volatile market conditions are wreaking havoc in macro-focused funds.

AI has emerged as the unexpected market force, driving significant growth in stocks associated with technology behemoths such as Microsoft and Nvidia. This trend has bucked the bearish forecasts that warned of a US recession, with the S&P 500 climbing nearly 20% since October, nearing the threshold of a bull market. The rise of AI and robust corporate earnings have overshadowed fears of a recession triggered by the bond market.

On the other hand, enthusiasm over the Chinese market has so far eluded longer-term investors. As China struggles to find its footing post-pandemic, with manufacturing contracting and local governments scrambling to manage debt, its stocks are performing poorly. This has led firms like Morgan Stanley and Goldman Sachs to revise their optimistic forecasts.

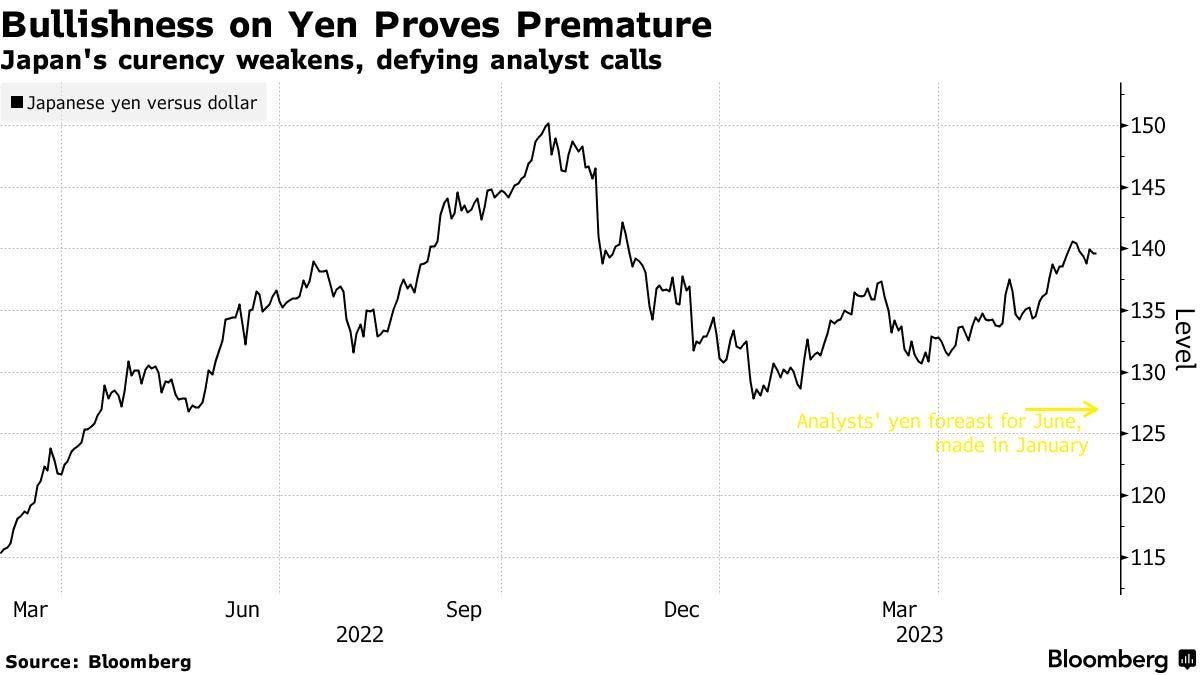

Another area where investors seem to have miscalculated is the currency market. Predictions of a declining dollar were misguided; instead, a resilient US economy and persistent inflation have kept the greenback as one of the highest-yielding currencies in the developed world. On the contrary, bullish bets on the yen have so far faltered as the Bank of Japan's easy monetary policy continues, leading to a further fall in the yen's value against the dollar.

However, there will be a time when this trend reverses.

Despite the current market conditions, investors and strategists are cautiously optimistic about the rest of the year.

In the near-term, the market’s momentum continues to be higher.