6.7.24: FOMO Buying Increases as Volatility Ticks Higher

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Letters From Larry is brought to you by our friends at YCharts.

Taxes are inevitable, but minimizing your clients' tax burdens is a key part of your role as a financial advisor. Instead of getting bogged down with manual calculations, spreadsheets, and multiple software tools, simplify your workflow with YCharts’ new Transition Analysis Tool.

With automated processes for generating quick reports and providing insights into a client’s current positions and tax implications, you can free up your time from tedious tasks and focus more on building impactful client relationships.

Click here to start your free YCharts trial to explore the new tool, and get 15% off your initial YCharts Professional subscription when you tell them I sent you (new customers only).

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 5,346.99

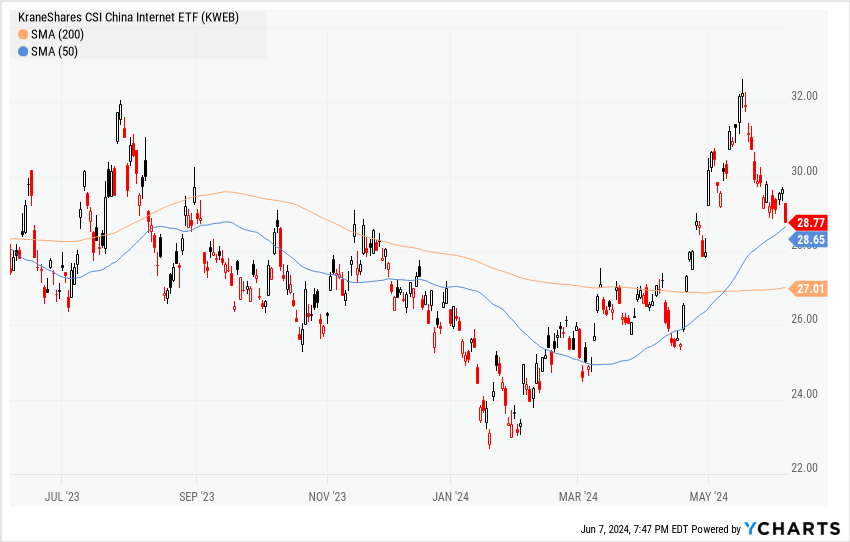

KWEB (Chinese Internet) ETF: $28.77

Analyst Team Note:

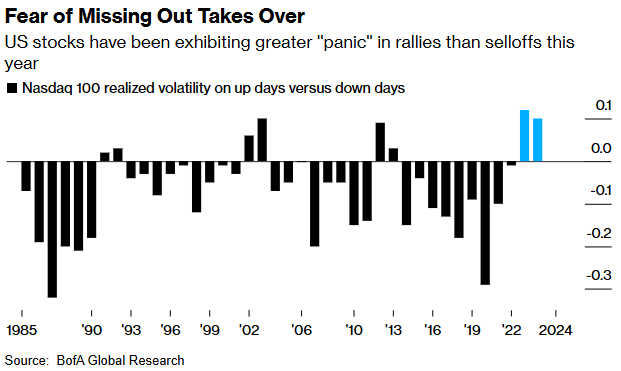

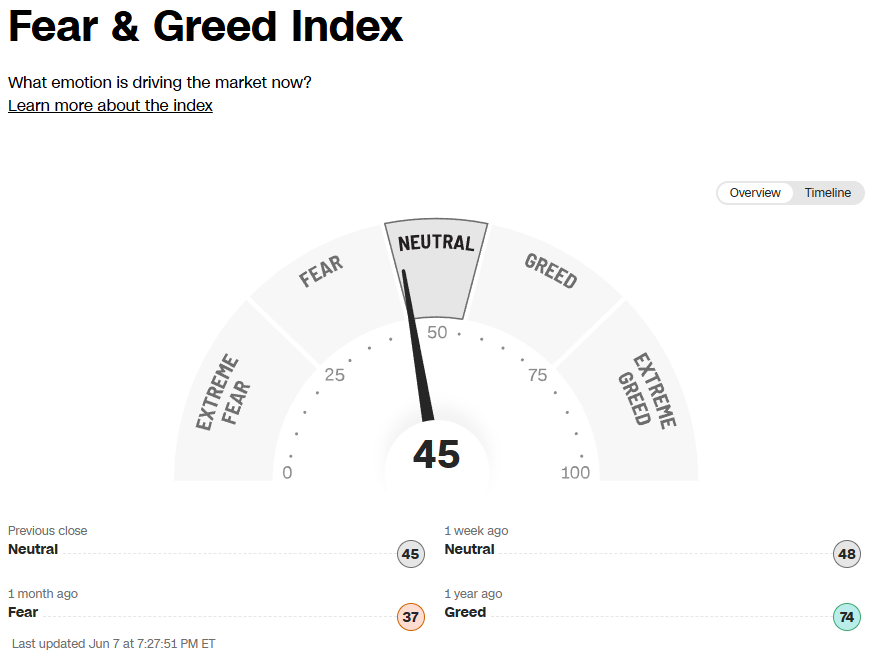

Recent trading activity, specifically in ‘meme stocks’ have showcased the speculative euphoria in risky assets. Despite robust payroll data reducing hopes for interest-rate cuts, the S&P 500 and Nasdaq 100, showed resilience and continued to rise.

This market behavior, characterized by high bullish sentiment and low volatility, is likely being driven by investors' fear of missing out on further gains.

Macro Chart In Focus

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

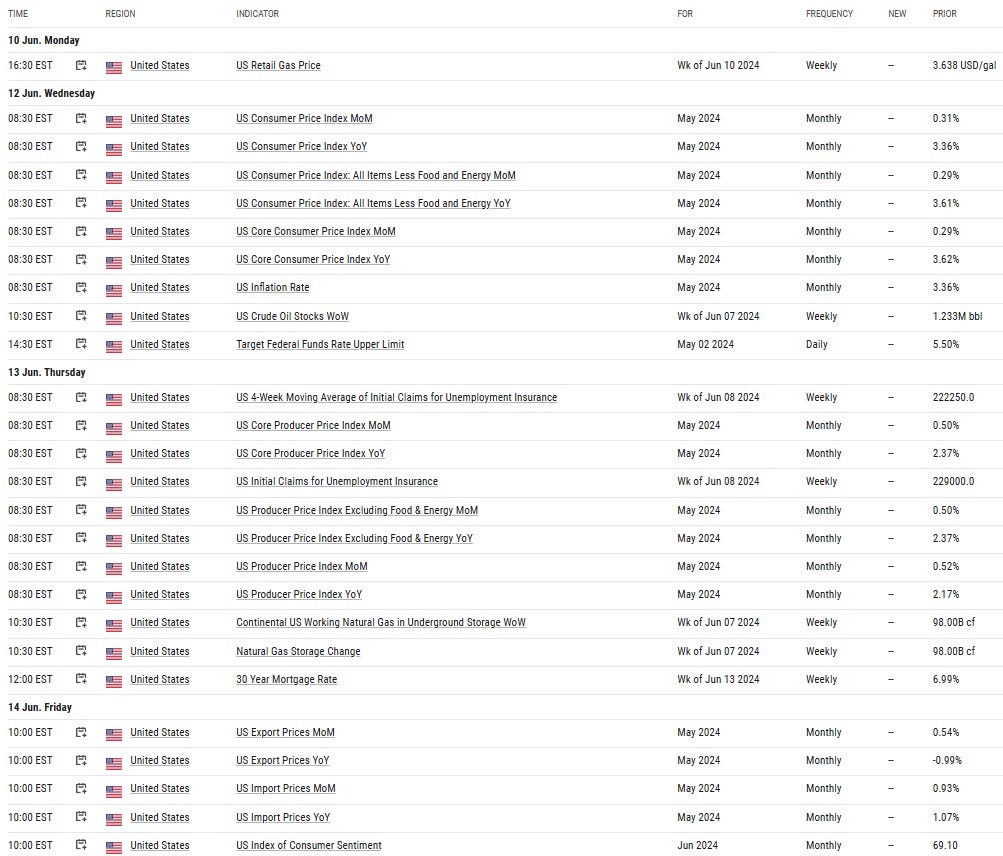

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

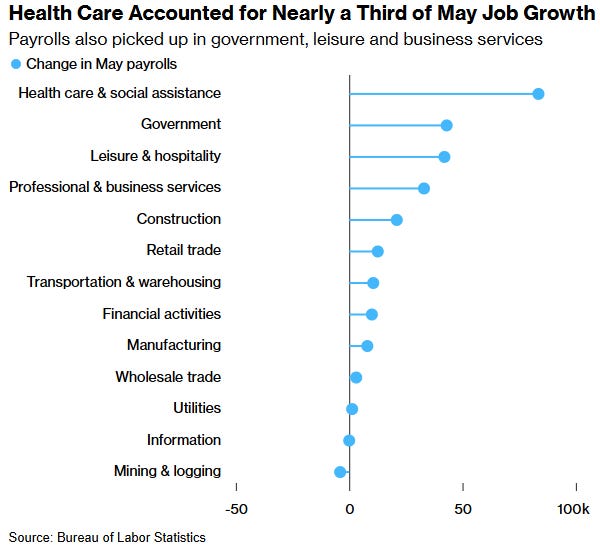

US job growth surged in May with nonfarm payrolls increasing by 272,000, surpassing expectations, and average hourly earnings rising by 0.4% MoM and 4.1% YoY, prompting traders to delay expectations of Federal Reserve interest-rate cuts.

The unemployment rate rose to 4%, its highest in over two years, as more people returned to the labor force but did not find work.

Chart That Caught Our Eye

Analyst Team Note:

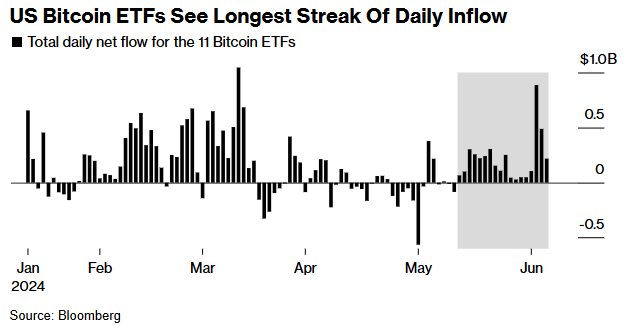

US ETFs investing directly in Bitcoin have seen net inflows for an unprecedented 18 consecutive days, driving total assets to $62.3 billion and pushing Bitcoin towards record highs, trading around $70,925.

The SEC's grudging approval of spot-Bitcoin ETFs in January, following a court reversal, and the subsequent approval for Ether funds have further supported this growth.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.