6.7.23: Markets Pullback In A Healthy Fashion Ahead of June FOMC Next Week

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to readers from Larry: This public newsletter edition is written by my Staff Analyst Tim. We hope you enjoy the read.

As for markets, I will have strategy update for members by the end of this week. Stay tuned.

This email is for our public readers & friends.

Analyst Staff Notes of Notable News:

On U.S. Real Estate

Two of San Francisco’s largest hotels have defaulted on their mortgage payments. The Hilton San Francisco Union Square and Parc 55 is stopping mortgage payments and planning to surrender the properties.

Park Hotels & Resorts halted payments on a $725 million loan due in November and anticipates that these hotels will eventually be removed from its portfolio. The hotels may potentially be taken over by lenders or sold to a new entity as part of the foreclosure process. The Hilton, with 1,921 rooms, is the largest hotel in the city, while the Parc 55, with 1,024 rooms, ranks fourth. Together, they account for approximately 9% of the city's hotel supply.

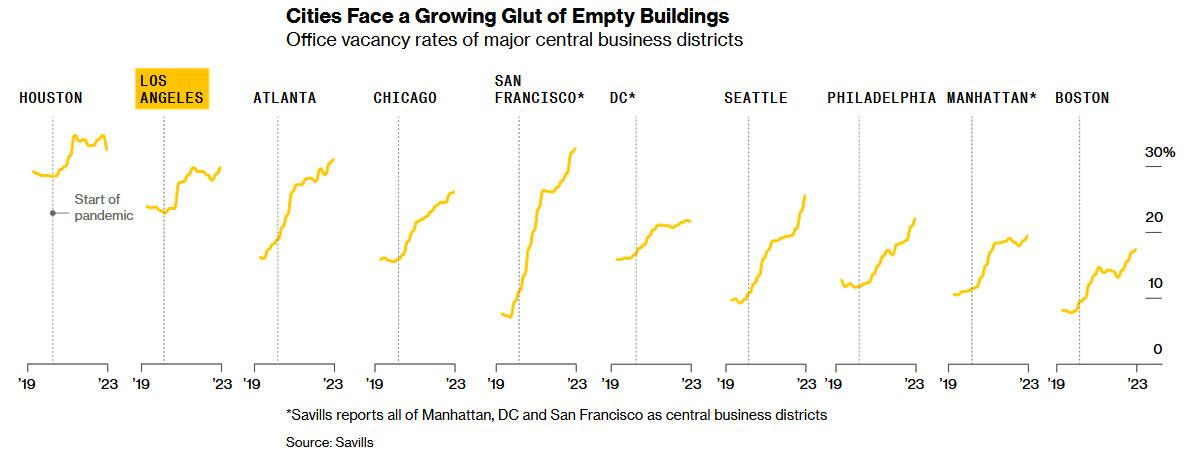

According to the CEO of Park Hotels, the decision to reduce their exposure in the San Francisco market was made in the best interests of the company's stockholders, given the city's recovery path's uncertainty and challenges. These challenges include a record high office vacancy rate of about 30%, concerns over street conditions, a lower rate of return to the office compared with other cities, and a weaker-than-expected citywide convention calendar through 2027, which is expected to negatively impact both business and leisure demand.

On Geopolitics

U.S. Secretary of State Antony Blinken is planning a visit to China for talks in the coming weeks. This would mark a significant step towards a "thaw" in relations between the two world powers, as President Joe Biden has put it. The official date for the visit has yet to be announced.

This move follows a previously postponed visit that was scheduled for February but was scrapped due to a diplomatic crisis. The crisis ensued after a suspected Chinese spy balloon flew through U.S. airspace and over sensitive military sites, which was subsequently shot down by the U.S. military.

The upcoming visit is part of the Biden administration's broader push to boost engagement with China amid escalating tensions over several issues. These include military activity in the South China Sea, Beijing's human rights record, technology competition, and issues related to Taiwan, which China believes is its own territory.

In the meantime, the State Department's top official for East Asia, Daniel Kritenbrink, has already been to Beijing for talks with Chinese counterparts. This visit is seen as a precursor to Blinken's potential trip, and both sides are said to have struck an upbeat tone during the talks. As Kritenbrink noted, the U.S. is "working hard" to manage its relationship with China.

On Private Markets

Sequoia Capital, a significant venture capital firm based in Silicon Valley, has decided to split its business into two parts, one focused on the U.S. and the other on China, with the latter headquartered in Singapore. This move by Sequoia is being viewed as a significant shift in the technology investment landscape, particularly as it relates to business between the U.S. and China.

The split came after years of internal discussions and growing concerns about China's regulatory environment, particularly in the technology sector. The decision to split its operations is significant because Sequoia has been a major player in supporting both American and Chinese tech startups. This move suggests that Sequoia sees a diverging future between the technology sectors in the U.S. and China.

This development in the business world adds another layer to the broader context of U.S.-China relations, within which Blinken's planned visit to China takes place. The split of Sequoia, a significant player in the tech industry, reflects the increasingly complex dynamics between the U.S. and China, particularly in the tech sector.

Notable Macro Chart

According to Indeed Hiring Lab, there’s been a noticeable slowing in wage growth in US job postings. The growth in advertised wages has been softening for more than a year, with the current rate suggesting a return to pre-pandemic levels by early 2024. Advertised wages rose 5.3% in May 2023 compared to a year earlier, a significant decrease from the peak of 9.3% seen in January 2022. This slowdown has been prevalent across various industries but is particularly pronounced in low-wage sectors, which had seen substantial gains as the economy recovered from the pandemic. The report also mentions significant pullbacks in wage growth for low-income positions and software jobs, and at the current rate, gains are expected to return to 2019 levels in six months.