6.3.24: Hedge Funds Dump Software, Load up on Chip Makers

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 5264.87

KWEB (Chinese Internet) ETF: $29.03

Analyst Team Note:

Hedge funds are shifting away from software stocks due to concerns about their future in the AI boom. Last week, they sold information technology shares heavily, with a focus on software, leading to the lowest net exposure to software in over five years.

Instead, hedge funds are increasingly investing in semiconductor and semiconductor equipment stocks, which are expected to benefit significantly from the growing demand for AI processing power.

While the S&P Semiconductors and Semiconductor Equipment index has surged 57% this year, the S&P Software and Services index has only seen a 2.2% increase.

Macro Chart In Focus

Analyst Team Note:

With interest rates at decade-highs, many S&P 500 companies are earning significant interest income, often surpassing their debt expenses.

More than three dozen firms, including Alphabet, Tesla, and Johnson & Johnson, reported substantial increases in interest income due to elevated cash reserves invested in money-market funds, government securities, and CDs.

For example, Nvidia earned $359 million in interest income in the first quarter, covering its debt expenses and dividends. Corporate cash holdings have swelled, with institutional investors' money-market fund holdings growing nearly 20% since 2022.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

China lifted its cap on foreign securities investment for the first time since July, raising the quota for qualified domestic institutional investors to $167.8 billion.

This move aims to meet the increasing demand for overseas assets amid efforts to bolster domestic markets.

The program had previously been restricted to curb capital outflow and ease pressure on the yuan, which has depreciated about 2% YTD.

Chart That Caught Our Eye

Analyst Team Note:

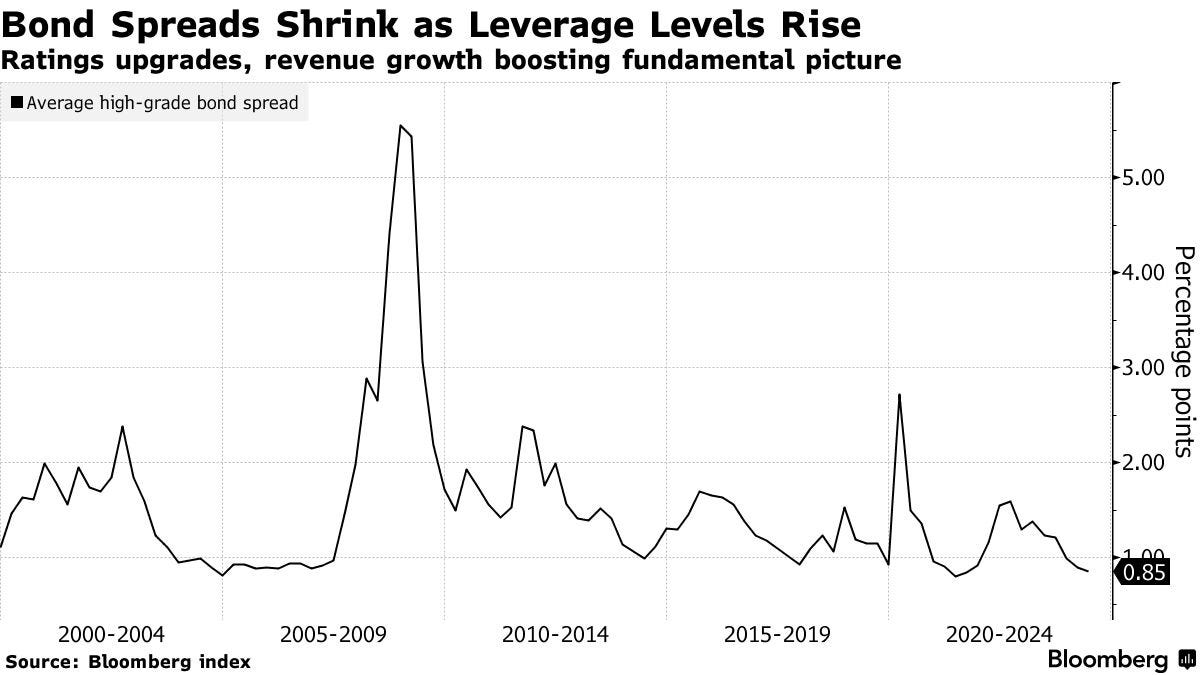

US companies are finding it cheaper to borrow from the investment-grade market, thanks to a wave of credit rating upgrades, faster earnings growth, and improving profit margins.

Despite rising leverage, with first quarter gross leverage hitting a high since mid-2021, the tightening risk premiums and the improving debt-to-enterprise value ratio indicate a stronger fundamental outlook for large corporations.

Credit ratings for high-grade companies are improving, with significant net upgrades, and median year-over-year EBITDA growth has accelerated, suggesting a favorable borrowing environment despite increased leverage.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.