6.29.22: No Man's Land as we approach the July 4th Weekend

Key U.S. and China brief market notes by Larry's Analyst Staff Team

Note to Readers: This is a new concise email newsletter format sent as part of Larry’s Investment Analyst Team communications to his public audience. To read his personal opinions, please read his separate public letters here. This email is designed to be primarily data-driven and will be sent out on Mondays/Wednesdays/Fridays. More qualitative commentary along with our actionable conclusions is provided inside our Investment Community.

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

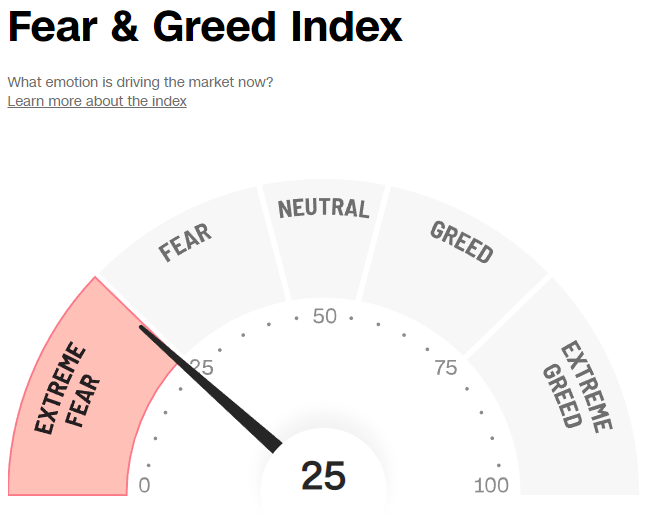

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

Thanks for reading Larry's Analyst Team! Subscribe for free to receive new posts and support my work.

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

S&P 500 Index: 3821.55

KWEB (Chinese Internet) ETF: $33.33

Analyst Team Note:

Goldman found that almost all of the S&P 500 declines YTD have been due to higher interest rates (which leads to lower valuations). With valuations getting re-rated and the market rotating (defensives beating cyclicals), the market clearly is expecting slowing growth. However, analyst estimates remain unchanged and are still showing profit margins expanding to new highs in 2023. Forward earnings multiples could be skewed as there isn’t much buffer for the uncertainty around the path of future earnings…

“The story in China shows incremental improvement, both in terms of GDP growth and supply chain normalization. Regulatory fears are subsiding allowing for a recovery in Chinese Tech names; KWEB has outerformed during this recent US Tech rebound. Should this current bounce fail to extend, it is possible that Chinese Tech outperforms as markets move lower.” - J.P. Morgan

Macro Chart In Focus

Analyst Team Note:

“While semi demand is cyclical, with the exception of 2012, semi sales have always had positive YoY growth as long as global GDP stayed above 3%, which is currently the projection for CY22/23E” - Bank Of America

Most semiconductor companies are carrying elevated inventory levels which can raise some eyebrows. However, it’s likely that the logistical issues created by regional lockdowns, geopolitical issues, and broad-based demand strength is causing a need for higher inventories.

Upcoming Economic Calendar

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

U.S. personal spending rose at an annualized 1.8% vs. the 3.1% estimate, suggesting that the economic could be on weaker footing than previously expected.

Real GDP growth was revised down by 0.1% to -1.6% in the third estimate for Q1. Large downward revisions to consumption growth was partially offset by an upward revision to inventory investment.

Per Bloomberg, “By the time the government releases its third estimate of GDP and the underlying components, the numbers don’t typically change much. The large downward revision to consumer spending -- paired with a sizable upward revision to inventories -- is quite unusual”.

Chart That Caught Our Eye

Analyst Team Note:

“The negative correlation between bonds and equities has only really been a feature of the last 20 years. For much of history, in fact, the correlation was positive. And as we have seen in 2022, it sometimes flips from negative to positive.

In many ways, the last six months have been a throwback to the 1970s, a mini rerun of the most toxic environment for financial markets – stagflation. Inflation has hit 40-year highs, real economic growth has slumped, and yet central banks are resolutely hawkish.

People forget that our modern monetary institutions were shaped by the Great Inflation, and today’s officials are haunted by the prospect of repeating the mistakes their predecessors made in the 1970s.

Should the recent stagflationary environment persist, we might find ourselves in a really nasty market equilibrium. Both asset classes would continue to sell off, with weakness in the bond market only compounding the weakness in equities.”

- TS Lombard

Sentiment Check

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs

Make sure to check Larry’s most recent market updates via his personal newsletter. See you in our next update.