6.28.23: U.S Markets get ready to wrap up an exceptionally strong first half of the year this week

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: 1H 2023 has been incredibly strong for U.S. markets, and barring any unexpected events over the next 2 trading days, we will probably see one of the strongest performances in the Nasdaq-100 QQQ recorded in history.

At today’s levels, I would say the market has essentially transformed the recession scenario to become a contrarian view.

I do not change my opinion that a recession is more likely than not, and when the narrative evolves to reflect this, we will be ready.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash (yielding 4.5%+ on idle cash) at Interactive Brokers

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4378.41

KWEB (Chinese Internet) ETF: $27.75

Analyst Team Note:

“While above an upward ticking 40-week MA, the S&P 500 (SPX) takes the bullish fork in the road. The 2023 YTD pattern resembles the bullish shifts in the cyclical trend for the index seen in 2020 (COVID-19), 2019 (US trade war with China), 2016 (Brexit vote and Trump elected President) and 2013 (Eurozone debt crisis). Defending the 40-week MA near 4018 on dips, even with a brief undercut, would maintain this view.” - BofA

Macro Chart In Focus

Analyst Team Note:

Despite elevated recession concerns amid tight credit conditions leading to some volatility, public assets have delivered positive returns over the past year and market risk indicators are below average…

HY spreads are quite tight and have shown no signs of widening while the VIX remains quite muted…

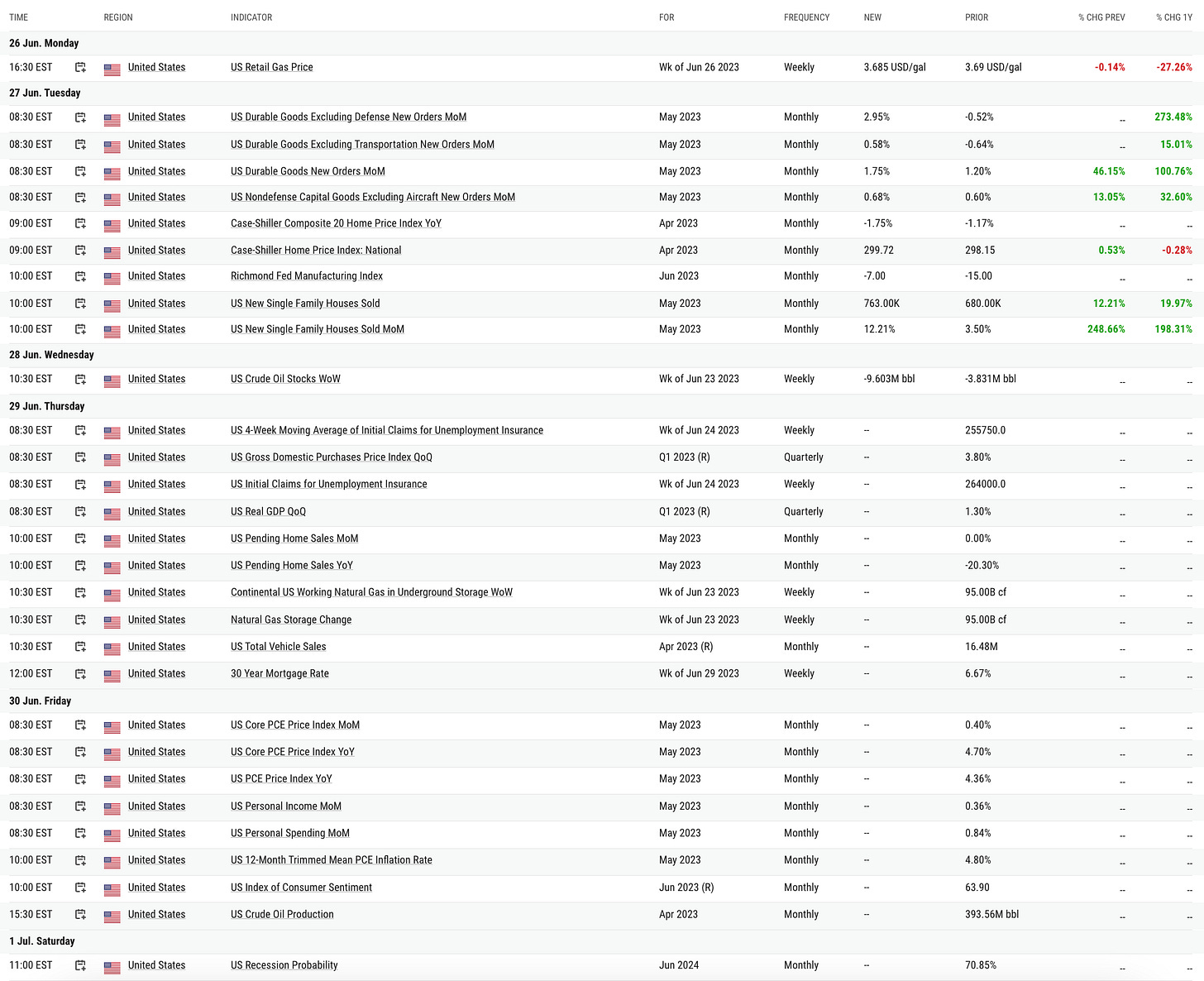

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

Fed Chair Jerome Powell recently indicated that interest rates may be raised in July and September to counteract sustained price pressures and regulate a robust US labor market.

While the Fed has maintained steady rates after 15 months of hikes to assess the impacts of increased borrowing costs and banking strains on the economy, Powell stated that tighter policies may be required to control inflation, which is currently running at double the Fed's 2% target. Market predictions indicate the possibility of a further half-point increase in the benchmark rate this year, from the existing range of 5% to 5.25%.

Despite tightening measures, the US economy has shown resilience, with recent data revealing new home sales at their fastest pace in over a year, robust durable goods orders, and consumer confidence at its highest since the beginning of 2022. While Powell acknowledged the potential for an economic downturn, he doesn't foresee a recession as the most likely scenario.

He indicated that while supply-chain disruptions are lessening and the headline inflation rate is decreasing, core inflation is not expected to return to the Fed's 2% target until 2025, hinting at prolonged high interest rates.

Chart That Caught Our Eye

Analyst Team Note:

BlackRock recently filed for a Bitcoin ETF, fueling a surge in Bitcoin's price to $31,000, the highest in a year, and prompting similar filings from rivals. However, the broader cryptocurrency market is witnessing a downturn, due to a risk-off sentiment and the abrupt switch of tech investors from crypto to AI. The subsequent impact on investor sentiment caused global crypto VC funding to drop to $2.4 billion in Q1 of this year, marking an 80% decline YoY, as per Pitchbook data.

Further exacerbating the pessimistic climate in the crypto world, the SEC has initiated legal actions against Coinbase and Binance, alleging regulatory violations. This stricter regulatory approach poses potential challenges to the approval of BlackRock's proposed Bitcoin ETF, as several similar filings have already been rejected by the SEC.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.