6.27.22: Use this time to plan your next move. The market is in Consolidation

Key U.S. and China brief market notes by Larry's Analyst Staff Team

Note to Readers: This is a new concise email newsletter format sent as part of Larry’s Investment Analyst Team communications to his public audience. To read his personal opinions, please read his separate public letters here. This email format will be sent out at select times throughout the week based on our Research work capacity. More qualitative commentary along with our actionable conclusions is provided inside our Investment Community.

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

Thanks for reading Larry's Analyst Team! Subscribe for free to receive new posts and support my work.

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 3911.74

KWEB (Chinese Internet) ETF: $33.41

Analyst Team Note:

Is a China counter-cyclical recovery coming?

“China remains the economy in the region that can provide the strongest boost to domestic demand, and easing is already well underway, even before this bout of external demand slowdown. In this context, when China takes up a ‘living with Covid’ stance, its stronger domestic demand recovery can act as a countercyclical force for the region.” - Morgan Stanley

Macro Chart In Focus

(Powered by our Channel Financial Data Provider YCharts)

Analyst Team Note:

The CBOE VIX Index’s long run (1990 – present) average is 20, with a standard deviation of 8 points.

That means VIX closes above 28 are unusual (occurring just 12 percent of the time since 1990) and levels above 36 are genuinely rare (just 4 pct of closes since 1990).

“If recent history repeats itself, the S&P should be able to rally for a few more days, until the VIX hits 24 – 25 (halfway between the mean and the 28 level). It closed on Friday at 27.” - DataTrek Research

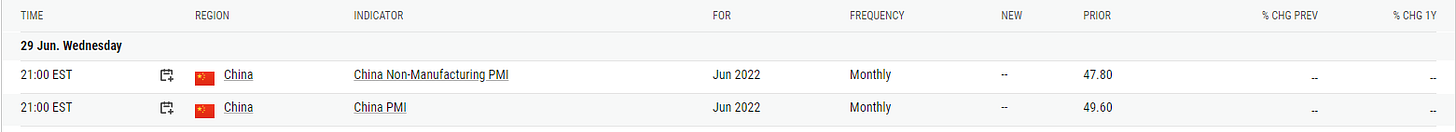

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

Will be watching PCE, ISM manufacturing numbers, Chinese PMIs, and US personal spending…

Chart That Caught Our Eye

Analyst Team Note:

“If there is no recession – which is our view – then risky asset prices are too cheap. For instance, small cap stocks in the US currently trade near the lowest valuations ever. Many equity market segments are down 60- 80%. Positioning and sentiment of investors is at multi-decade lows. So it is not that we think that the world and economies are in great shape, but just that an average investor expects an economic disaster, and if that does not materialize risky asset classes could recover most of their losses from the first half.” - J.P. Morgan

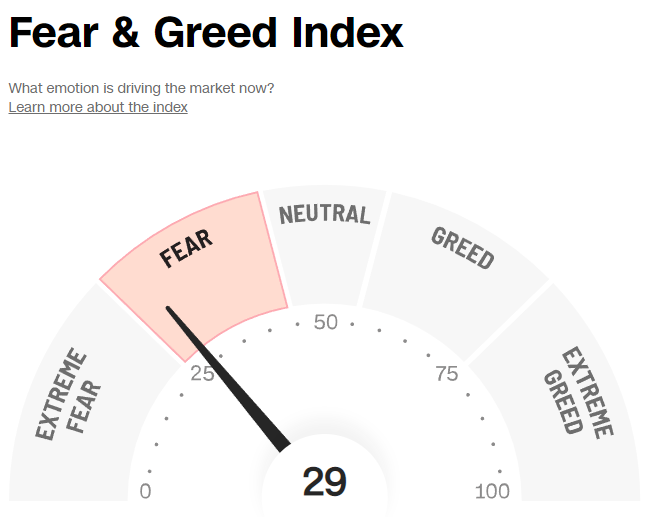

Sentiment Check

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs

Make sure to check Larry’s most recent market updates via his personal newsletter. See you in our next update.