6.26.23: A Rollover Formation Has Taken Hold among FAAMG Stocks

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: I’ve produced a new premium note for Members inside our Investment Community - linked below. Have a great week!

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash (yielding 4.5%+ on idle cash) at Interactive Brokers

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4348.33

KWEB (Chinese Internet) ETF: 26.76

Analyst Team Note:

The aggressive monetary policy tightening by the Federal Reserve, coupled with stricter bank lending criteria, has led to a significant downturn in the U.S. economy and housing market. Corporate profit margins have slumped to near-decade lows. According to KKR, market drawdowns of 25% or more often provide favorable entry points, as investors who lean into these declines generally receive substantial returns over the long term.

Real interest rates are expected to increase which would likely mean limited upside in equity multiples going forward. When real rates are low, equities are often more attractive as investments due to the lower discount rate applied to future cash flows, thus increasing valuation multiples.

However, as real rates rise, the discount rate applied to future earnings also increases, lowering the present value of these earnings and potentially reducing equity valuations.

Macro Chart In Focus

Analyst Team Note:

The current geopolitical situation in Russia, although sparking much analysis and speculation, may not significantly impact the equity market volatility as suggested by the history of correlation between the Geopolitical Uncertainty Index and the VIX. This pattern implies that equity markets rarely show a persistent response to geopolitical uncertainties.

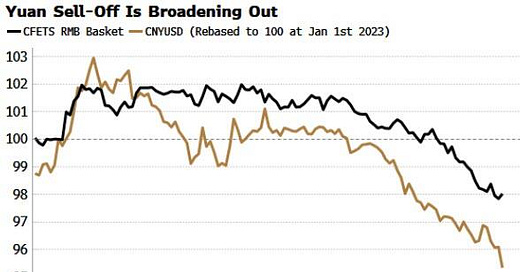

On the other hand, China's economic health is a more significant influence on the US stock market. Recent data indicates that China's economy is struggling to recover from the pandemic's impact. The yuan has weakened to a seven-month low versus the dollar, as well as weakening against several other Asian currencies.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

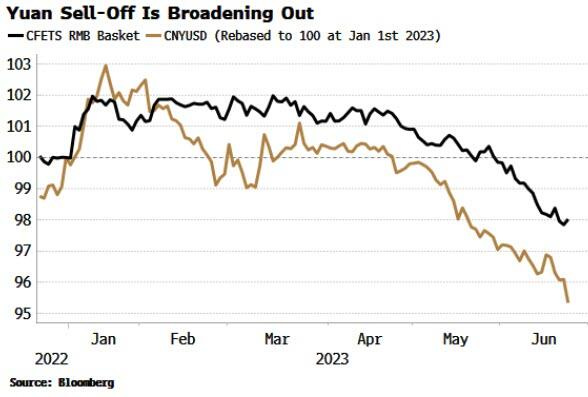

China's consumer-driven economic recovery is losing momentum as spending decreases across multiple sectors, including holiday travel, cars, and homes. The recent dragon boat festival's domestic travel expenditure fell below pre-pandemic levels, while home sales and estimated June car sales also declined from the previous year.

Despite the consumption rebound following China's COVID-19 control measures, confidence remains low, and increasing evidence indicates that the economy may need additional support. Following a cut in policy rates by the central bank earlier this month, there are expectations that there will be further monetary and fiscal stimulus.

Chart That Caught Our Eye

Analyst Team Note:

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.