6.24.24: Median Home Prices Hit All-Time High

Note to Readers: This is a concise email newsletter format sent as part of Larry’s Investment Analyst Team communications to his public audience. To read his personal opinions, please read his separate public letters here. This email is designed to be primarily data-driven and will be sent out on Mondays/Wednesdays/Fridays. More qualitative commentary along with our actionable conclusions is provided inside our Investment Community.

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 5,447.87

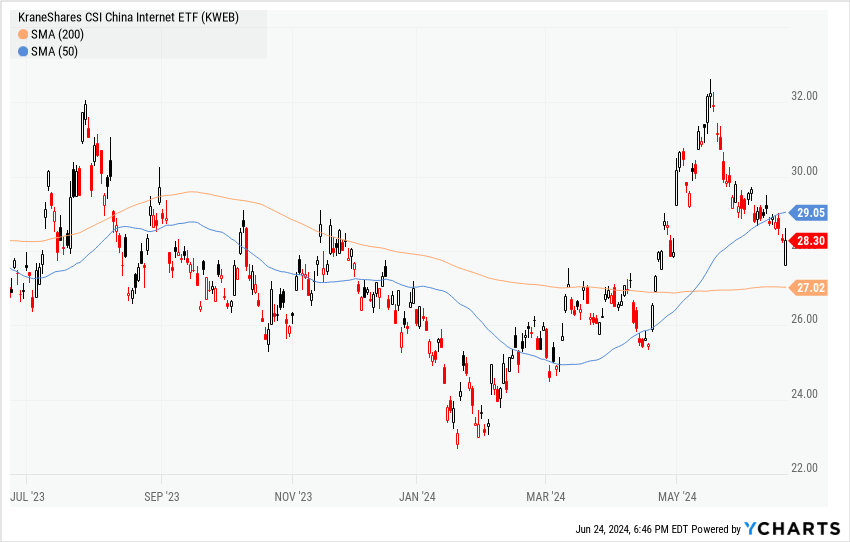

KWEB (Chinese Internet) ETF: $28.30

Analyst Team Note:

The ETF market is showing mixed signals with significant activity in a few key funds. The TQQQ, a 3x leveraged Nasdaq 100 ETF, has seen outflows, while the inverse SQQQ has gained inflows.

In contrast, the NVDL, a 2x leveraged ETF on NVDA, has seen substantial inflows despite broader market risk aversion.

Equal-weighted ETFs like QQQE and RSP have not attracted as much interest, highlighting the market's intense focus on a few major stocks.

Macro Chart In Focus

Analyst Team Note:

Goldman trader John Flood warns that the US presidential election could significantly impact the USD and the performance of domestic versus internationally-exposed firms.

As the first debate approaches, online prediction markets show slightly higher odds for a Trump victory, with a notable probability of a Republican sweep.

Goldman economists anticipate that a Trump win, especially with proposed tariffs on imports, would strengthen the USD but create headwinds for internationally-reliant stocks due to potential retaliatory tariffs and geopolitical tensions.

Tech stocks, with high international sales exposure, would be most affected, particularly those dependent on suppliers from Greater China.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

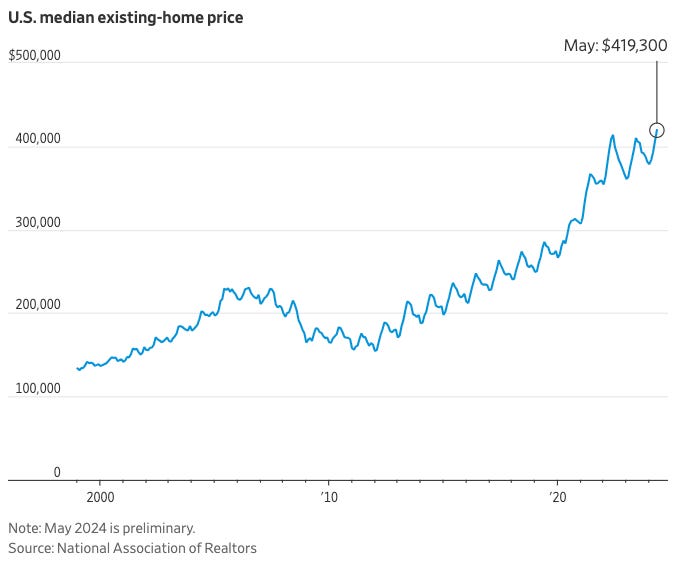

In May, home prices reached a new high with the national median existing-home price hitting $419,300, up 5.8% from the previous year, despite sales decreasing due to limited inventory and high mortgage rates.

The National Association of Realtors reported that sales of previously owned homes fell 0.7% from the previous month and 2.8% annually, marking the third consecutive monthly decline.

Sales of high-priced homes are increasing faster than those of mid-priced or affordable homes, further pushing up the median price.

Chart That Caught Our Eye

Analyst Team Note:

The price of uranium is experiencing a significant resurgence, reminiscent of the 2004-2007 period when prices soared by over 650%, driven by supply constraints and a more nuclear-optimistic outlook before the Fukushima disaster in 2011.

Currently, a surge in reactor infrastructure, particularly in China and India, has fueled this price boom.

Bloomberg reports that 61 new nuclear plants are under construction worldwide, with over 90 in planning and more than 300 proposed, signaling robust incremental demand for nuclear projects.

Sentiment Check

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs

Make sure to check Larry’s most recent market updates via his personal newsletter. See you in our next update.

Thanks for reading Larry's Analyst Team! Join our email community for 3X market updates like these each week.