6.24.22: The S&P 500 Has Bounced ~7% From the 2022 Lows (3,636)

Note to Readers: This is a new concise email newsletter format sent as part of Larry’s Investment Analyst Team communications to his public audience. To read his personal opinions, please read his separate public letters here. This email is designed to be primarily data-driven and will be sent out on Mondays/Wednesdays/Fridays. More qualitative commentary along with our actionable conclusions is provided inside our Investment Community.

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

S&P 500 Index: 3795.73 (as of writing)

KWEB (Chinese Internet) ETF: $32.22

Analyst Team Note:

Valuations for the U.S. market are no longer overextended…

“At the start of the year, the 100 most expensive stocks in the S&P 500 traded at a premium of 25.8x multiple points to the rest of the market. Following the market’s correction, they currently trade at a 15.1x premium, in-line with long-term averages.” - Credit Suisse

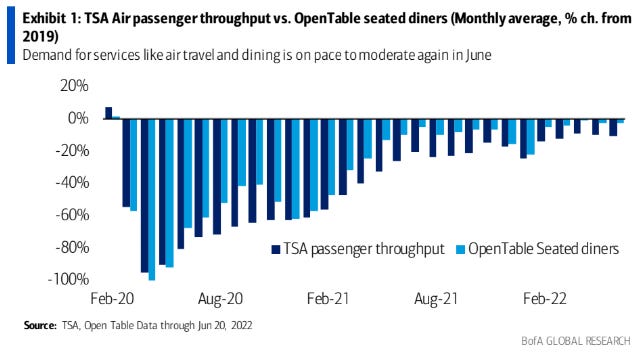

Macro Chart In Focus:

Analyst Team Note:

Data on the consumer suggest that the pace of demand growth for leisure services such as air travel and dining out is starting to cool off… Is demand destruction in progress as prices climb higher?

“The households in the bottom 40% of the income distribution account for 22% of overall consumer expenditure. This is high relative to their share of income (11%) but low relative to their share of the population. Due to vigorous fiscal stimulus programs, consumption of lower-income households showed remarkable resilience through the pandemic. More recently, however, rising gas and food prices seem to be restraining the spending of these households, consistent with recent earnings report from retailers.” - Citigroup

Upcoming Economic Calendar

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

This is the third consecutive weekly reading of around 230k in initial jobless claims. While this is a decent increase from the sub-200k readings we saw in February through May, claims need to keep rising to bring the labor market into a better balance. Many layoffs from high-profile companies have already happened and will likely continue to happen…

The UMich Consumer Sentiment index hit 50, a record low. The index is down 14.4% month-over-month and 41.5% year-over year… “47% of consumers blamed inflation for eroding their living standards, just one point shy of the all-time high last reached during the Great Recession” - UMich Survey of Consumers Director

Chart That Caught Our Eye

Analyst Team Note:

Non-cyclicals (i.e. defensives) went from a -5x multiple discount to the S&P 500 to reasonably valued relative to the S&P over the past ~2.5 years. Now is not the time to hide in defensives… Cyclicals now almost 2 STD below its historical relative valuation to the S&P…

“Cyclical valuations are the most favorable of any group, trading at the largest discounts relative to history.” - Credit Suisse

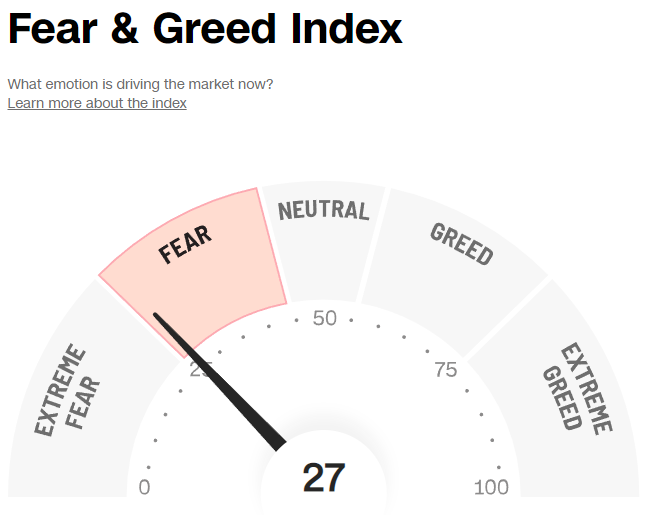

Sentiment Check

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs

Make sure to check Larry’s most recent market updates via his personal newsletter. See you in our next update.