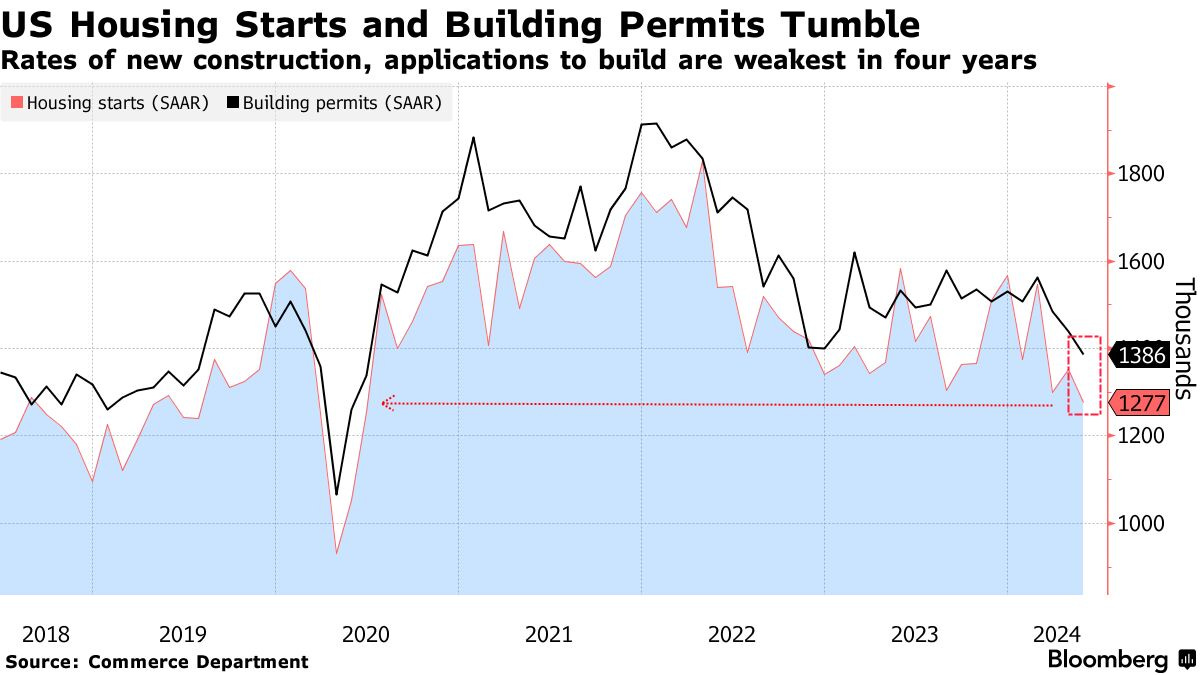

6.20.24: US Housing Starts and Building Permits Tumble

Note to Readers: This is a concise email newsletter format sent as part of Larry’s Investment Analyst Team communications to his public audience. To read his personal opinions, please read his separate public letters here. This email is designed to be primarily data-driven and will be sent out on Mondays/Wednesdays/Fridays. More qualitative commentary along with our actionable conclusions is provided inside our Investment Community.

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 5,489.36

KWEB (Chinese Internet) ETF: $28.51

Analyst Team Note:

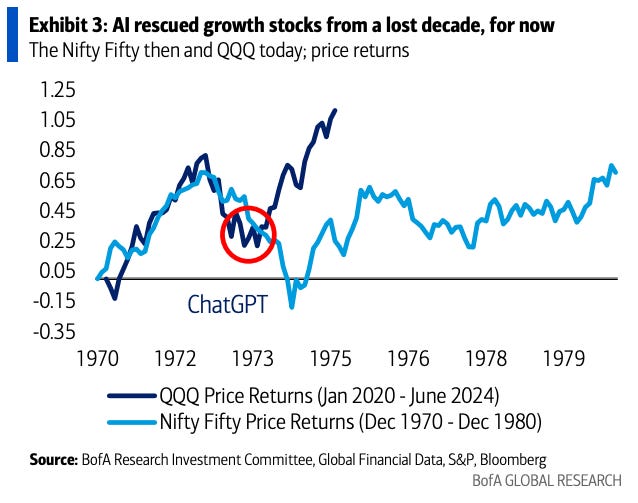

Macro Chart In Focus

Analyst Team Note:

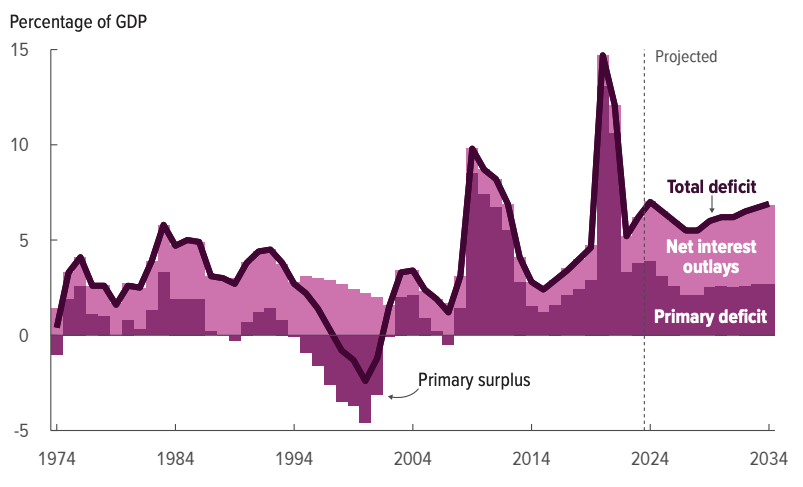

The Congressional Budget Office (CBO) raised its 2024 US budget deficit estimate by 27% to nearly $2 trillion, citing increased spending, including aid for Ukraine and student loan forgiveness, alongside higher growth and inflation projections.

The deficit is expected to widen to 6.7% of GDP, with deficits surpassing 5.5% of GDP annually from 2024 to 2034, an unprecedented trend since 1930.

Contributing factors include Biden's student loan forgiveness, international aid, reduced FDIC recoupment, and increased Medicaid spending, despite higher revenue from economic growth.

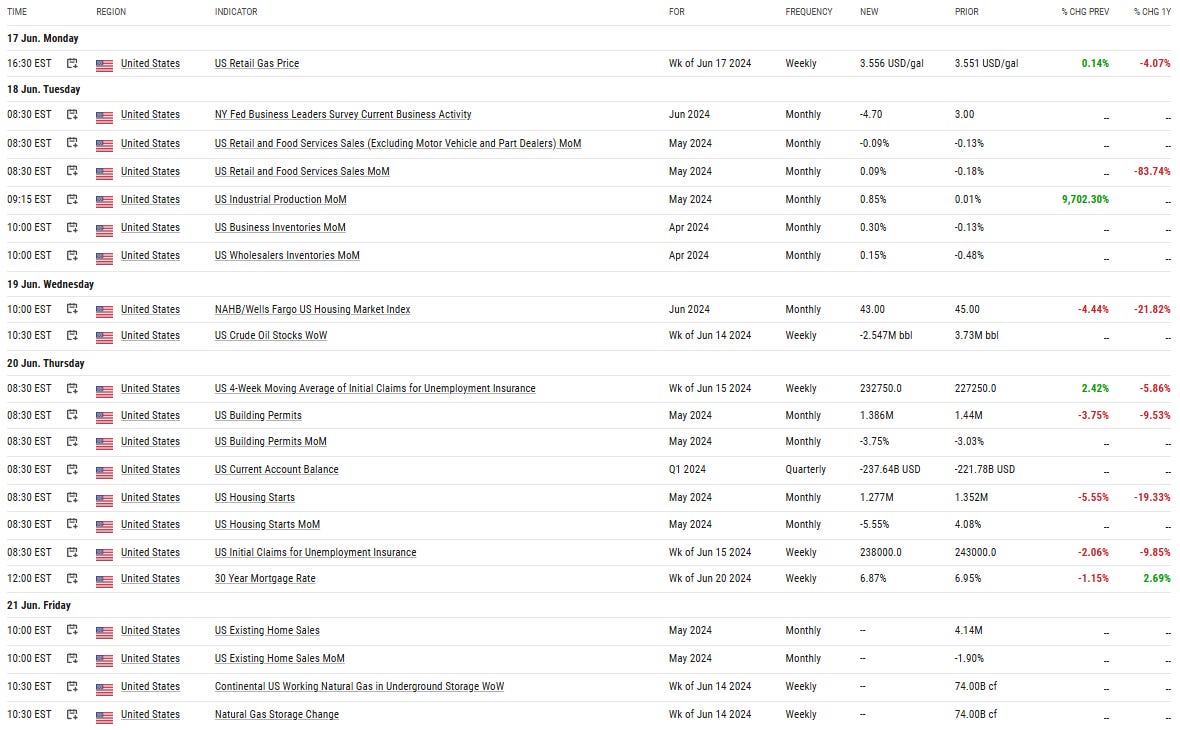

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

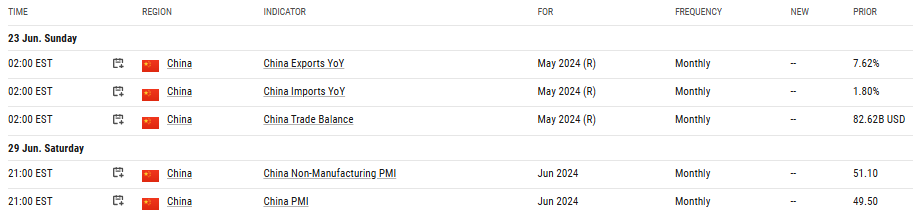

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

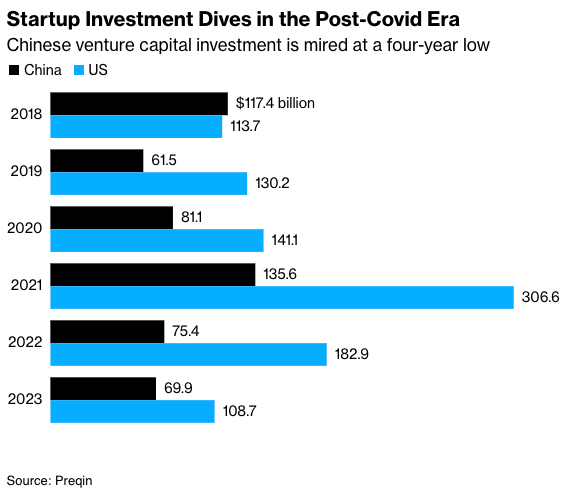

China plans to implement new measures to attract venture capital, including from international investors, into its technology sector by allowing the establishment of yuan funds for domestic investments and encouraging qualified institutions to issue corporate bonds.

This initiative is part of China's strategy to achieve technological self-sufficiency, particularly in chip design and manufacturing, amid US policy threats.

Despite this push, venture capital investment in China dropped by over 7% to a four-year low of $69.9 billion across 4,200 deals in 2023.

Chart That Caught Our Eye

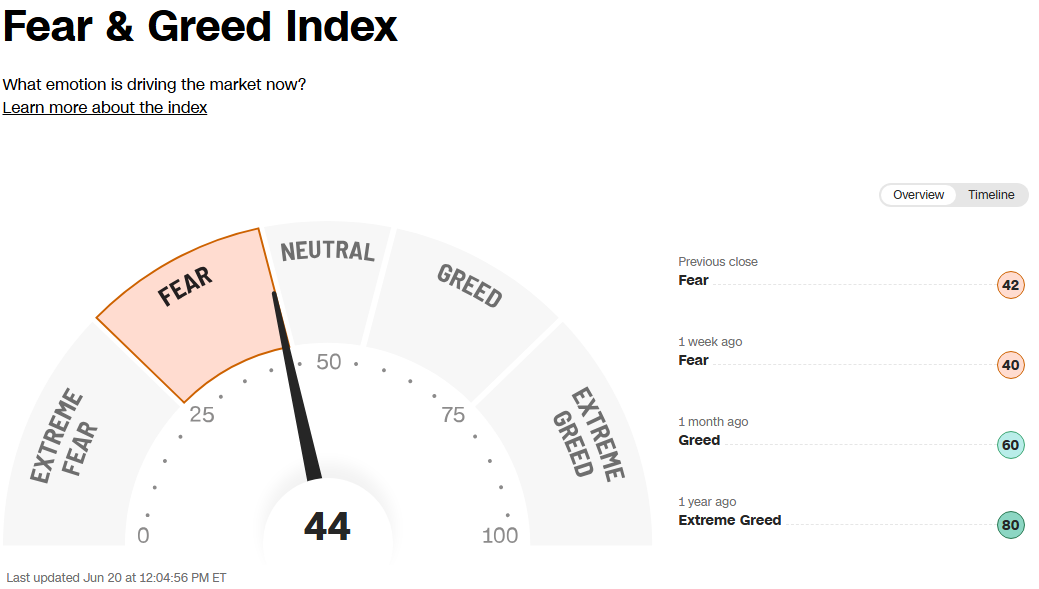

Sentiment Check

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs

Make sure to check Larry’s most recent market updates via his personal newsletter. See you in our next update.

Thanks for reading Larry's Analyst Team! Join our email community for 3X market updates like these each week.