6.20.22: Getting ready for this week with S&P 500 near oversold levels

Key U.S. and China brief market notes by Larry's Analyst Staff Team

Note to Readers: This is a new concise email newsletter format sent as part of Larry’s Investment Analyst Team communications to his public audience. To read his personal opinions, please read his separate public letters here. This email is designed to be primarily data-driven and will be sent out on Mondays/Wednesdays/Fridays. More qualitative commentary along with our actionable conclusions is provided inside our Investment Community.

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

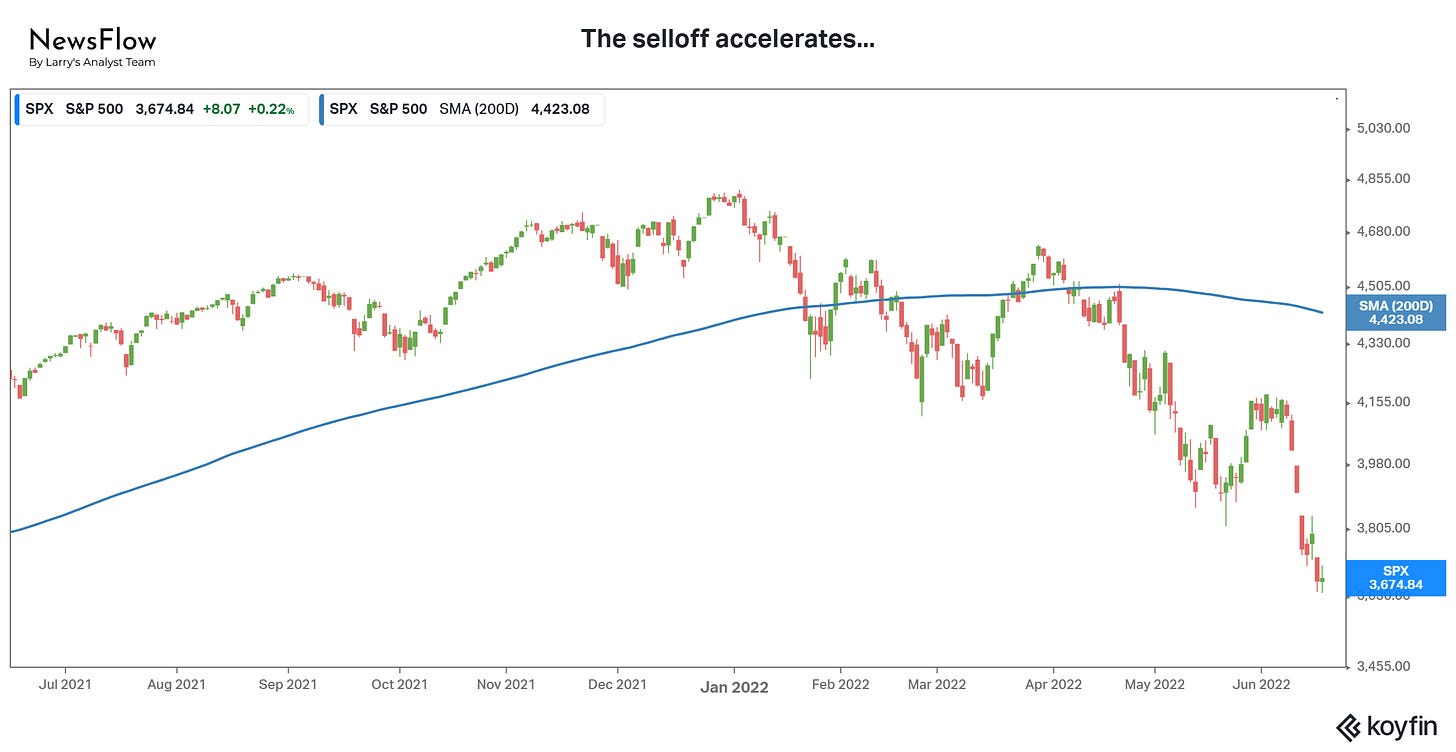

S&P 500 Index: 3,674.84

KWEB (Chinese Internet) ETF: $31.22

Analyst Team Note:

The S&P 500 is now trading at 15.71x forward earnings… It’s 20-year average forward earnings multiple is 17.74x.

The end of China lockdowns and reports of potential loosening of monetary policy could be tailwinds for continued KWEB resiliency.

Macro Chart In Focus: Junk Bond Yields Spike

Analyst Team Note:

An abrupt end to cheap financing will be brutal for younger companies that are forced to borrow in the near term.

We could see many younger ‘growth’ companies fall apart and will have more challenging hurdles to get access to financing.

A meaningful portion of Russell 2000 has companies with below-investment grade credit ratings.

Upcoming Economic Calendar

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

Demand indicators in China remain soft, suggesting that the PBoC will have to ease monetary policy further in the months ahead. Easy monetary policy will generally benefit Chinese stocks.

Jobless claims have picked up slightly over the past few months, but the Fed needs claims to increase further to help bring balance to the labor market and cool down wage inflation.

Chart That Caught Our Eye

Analyst Team Brief Notes:

“Defensive stocks are trading at almost record premium over Cyclicals (98th percentile now vs. 5th percentile in Feb ‘21).

At the current juncture, Defensive stocks possess valuation risk while flushed out Cyclicals, Growth, Small-caps are presenting an increasingly attractive risk/reward.

Investors are likely to rotate out of Defensive stocks if this sell-off proves to be another mid-cycle scare. Alternatively, if the economy actually falls into a recession, defensive stocks (“last one standing”) are likely to rollover as investors use it for source of funding.” - J.P. Morgan

Sentiment Check

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs

Make sure to check Larry’s most recent market updates via his personal newsletter. See you in our next update.