6.16.23: The Market Rally Frenzy slightly pauses after a gigantic week in tech outperformance

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: What a great week for Members inside our Investment Community. An email was sent to public folks with premium content unlocked until Father’s Day as my committment to help the folks get a clear understanding of my simple-to- understand actionable research process.

I’ll be back with more premium content for Members later this long weekend.

This was an action packed week, and I couldn’t get any Youtube content out as I dramatically increased the frequency of my Substack/Patreon research notes to help folks take advantage of special market conditions in ADBE, UNH, and beaten down Retail Stocks. I need to review my personal journaling, rest, and recharge to think about next market steps. It’s been a hectic week (in a good way) for me personally.

Cheers everyone. Please, please take a moment to follow me on Instagram and Twitter as my communications there are the fastest way to get my thoughts out and periodically provides behind the scenes content on ideas in action discussed inside the Community.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash (yielding 4.5%+ on idle cash) at Interactive Brokers

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4425.84

KWEB (Chinese Internet) ETF: $29.81

Analyst Team Note:

The QQQ Index has seen an insane performance this year, up 38%, largely due to the boom in AI, lower Treasury yields easing valuation pressures, and optimism about earnings.

The "Big Seven" tech companies, Apple, Microsoft, Alphabet, Amazon, Meta, Nvidia, and Tesla, have boosted their profits by 14% annually in the decade through 2022. Despite a slump in their combined earnings last year, Wall Street is (optimistically) expecting a swift recovery of at least 15% over the next two years is anticipated, which will take their profits to $362 billion in 2024, surpassing the 2021 peak of $336 billion.

This rising confidence has allowed the Nasdaq 100 (QQQ) to regain most of its losses from the 2022 selloff when plotted against the S&P 500. However, the Big Seven is trading at 35 times this year's earnings, pushing their total market cap to $11 trillion. Despite the elevated price-earnings ratio, the historical precedent from 2020, when the P/E ratio ended at 40, did not slow down gains, suggesting that the rally may continue even further.

Macro Chart In Focus

Analyst Team Note:

“The shift from bearish to bullish sentiment has been steady since the beginning of March. However, recently, there was an apparent capitulation as bearish investors turned bullish. As the market climbed, the “Net Bullish Ratio” (bullish, less bearish investors) of retail and professional investors turned sharply higher in recent weeks. While not at levels usually associated with market peaks, the sharp turn higher suggests a capitulation by the bears.” - Real Investment Advice

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

Fed Governor Christopher Waller and Richmond Fed President Thomas Barkin recently expressed concerns over the persistent nature of core inflation. Despite a strong labor market and the effects of policy rates on some sectors, Waller highlighted that core inflation hasn't decreased significantly. Barkin echoed these sentiments, stating that inflation remained "too high" and "stubbornly persistent." He also warned against prematurely loosening policy, pointing to the lessons learned from the inflation dynamics of the 1970s.

In addition to these concerns, a new report by the Federal Reserve suggests that the tightening of US credit conditions due to bank failures in March could impact economic growth. The FOMC has stated that the extent of additional policy tightening will depend on incoming data.

They reiterated the goal of returning inflation to 2% over time.

Chart That Caught Our Eye

Analyst Team Note:

Confidence in the US stock market rebound is building as money-market funds saw their first outflows in nearly two months, and institutional investors' cash reserves reached their lowest point in over a year. Total assets in US money-market funds fell by $4.7 billion to $5.45 trillion, with these funds having reached a record high earlier in June due to high yields and historically low borrowing costs. The rise in yields was in part due to the Federal Reserve raising interest rates to mitigate inflation, which led to an influx of investment after the collapse of SVB Financial and Signature Bank, as investors preferred the safety of Treasury securities.

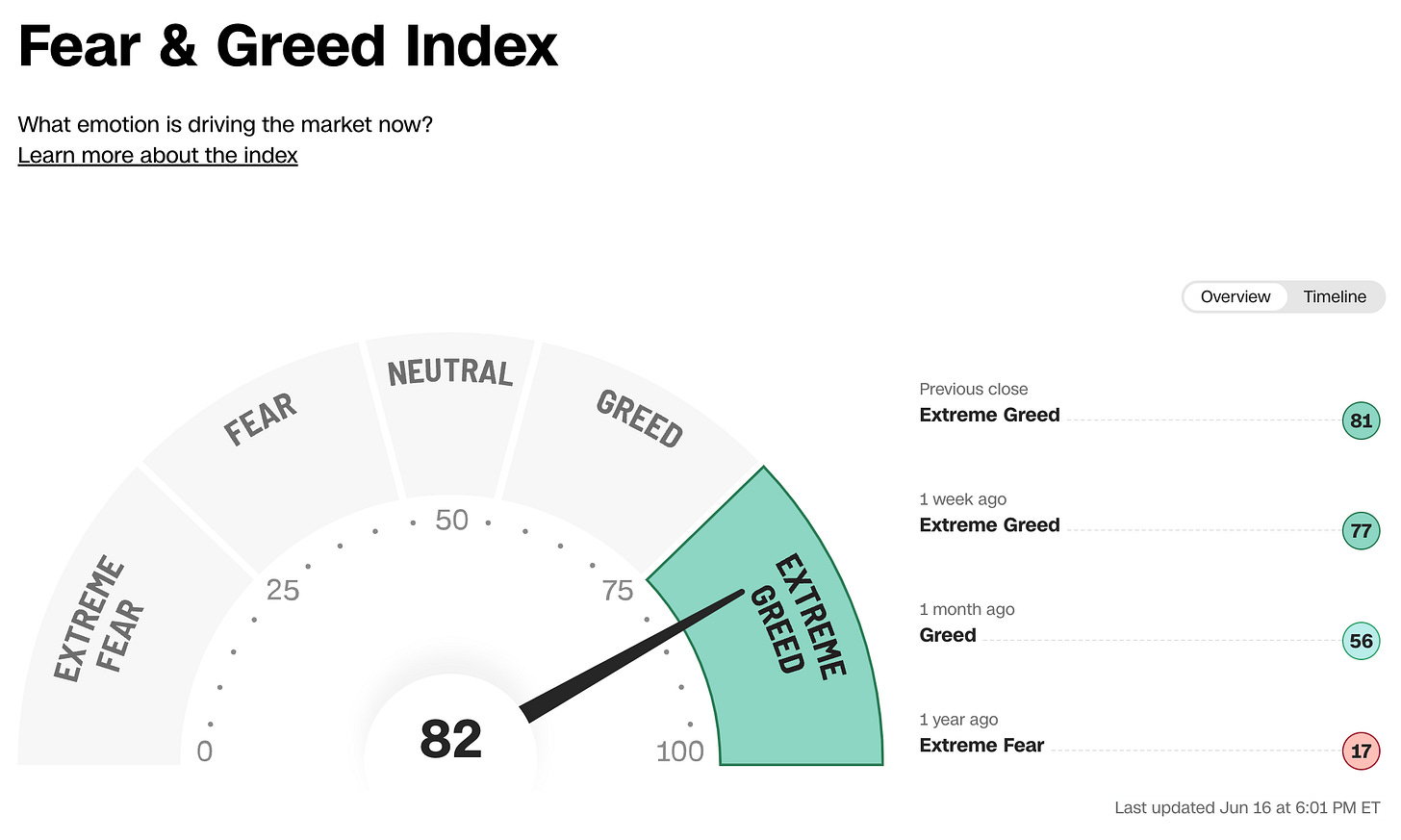

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.