6.15.23: Markets enter a Frenzy and Mania after June FOMC

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: For my public readers, be on the lookout for a separate email from me where I will share paywalled content for free now that premium members have had full opportunity to take advantage of the move in Adobe, UNH, Target, Five Below, and China.

For members inside my Investment Community, please practice patience in this environment. I will not and cannot guide on speculative setups now that the market has entered a different paradigm of thinking.

Cheers Folks!

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash (yielding 4.5%+ on idle cash) at Interactive Brokers

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index (SPY): 437.18

KWEB (Chinese Internet) ETF: $29.25

Analyst Team Note:

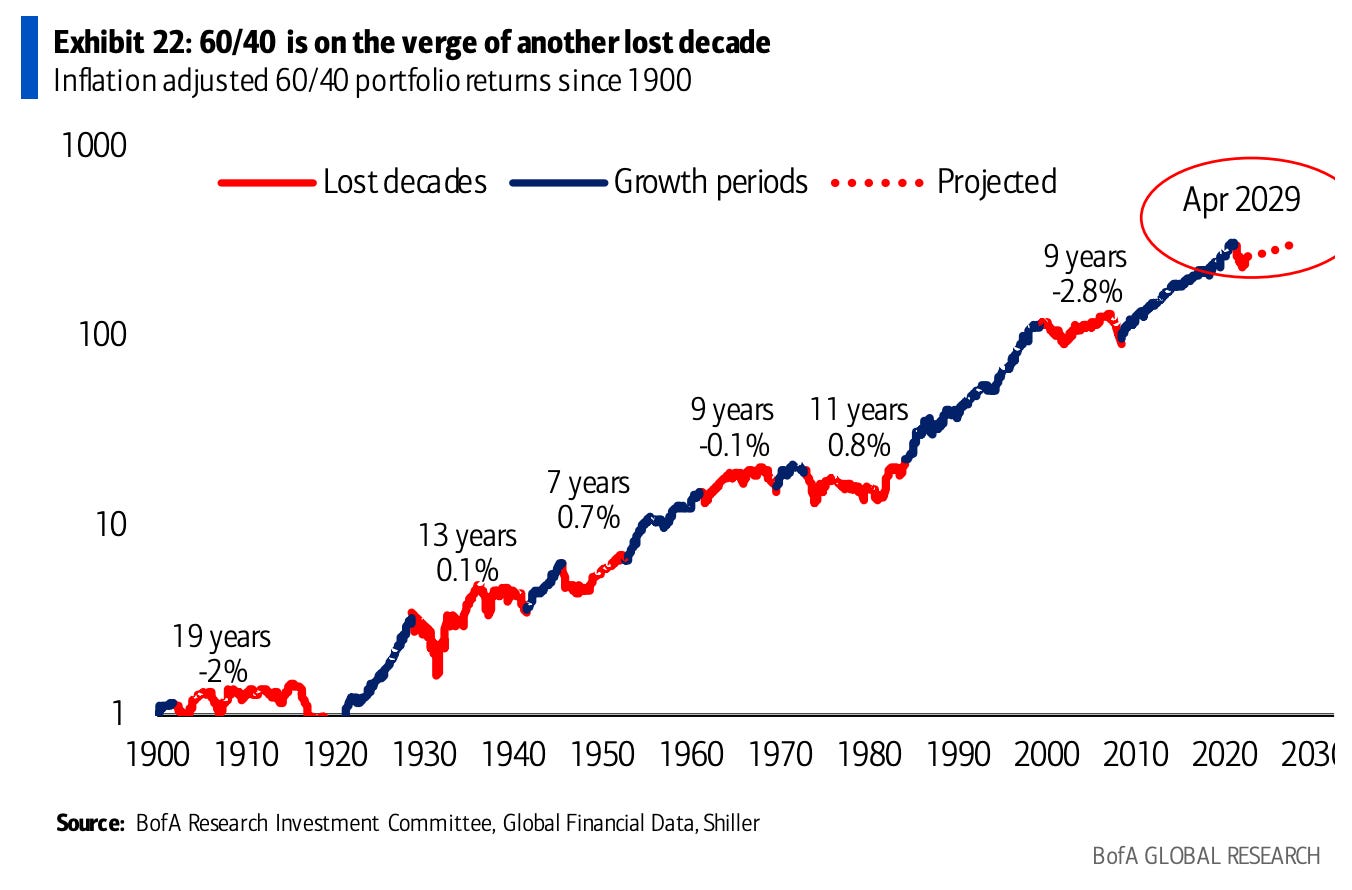

“Looking forward, it’s another lost decade. Even if the future looks very much like the recent deflationary past, owning Treasuries seems like a poor use of capital; and in a future of structurally higher inflation and interest rates, the need for better fixed-income portfolios will be even more urgent. Assuming 7.5% annual returns for equities (based on current valuations) and average bond returns of the past century, 60/40 portfolios may have to wait 6.5 years until they break even in real terms.

The 60/40 portfolio has experienced 6 lost decades since 1900, during which real returns averaged -0.5%. Lost decades tend to happen during periods of disruption. Wars (WWII), big government policies (Great Society), scarcity (OPEC & inflation) and bursting bubbles (dot-com)… the kinds of catalysts that historically have punished investors seem to be returning.” - BofA

Macro Chart In Focus

Analyst Team Note:

The Federal Reserve paused its interest-rate hikes after 15 months of consecutive increases but signaled further tightening to combat inflation. The FOMC decided to maintain the federal funds rate at 5% to 5.25%, providing the committee a chance to evaluate additional data. The Fed's new dot plot shows a median projection of borrowing costs rising to 5.6% by the year-end.

All 18 policymakers unanimously voted for this pause, with 12 expecting rates at or above 5.5% to 5.75%, indicating further tightening to control inflation. Chairman Jerome Powell indicated that nearly all Fed officials agree that a "somewhat further" increase in interest rates will be appropriate in 2023. However, Powell refused to confirm if another hike could occur as soon as July.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

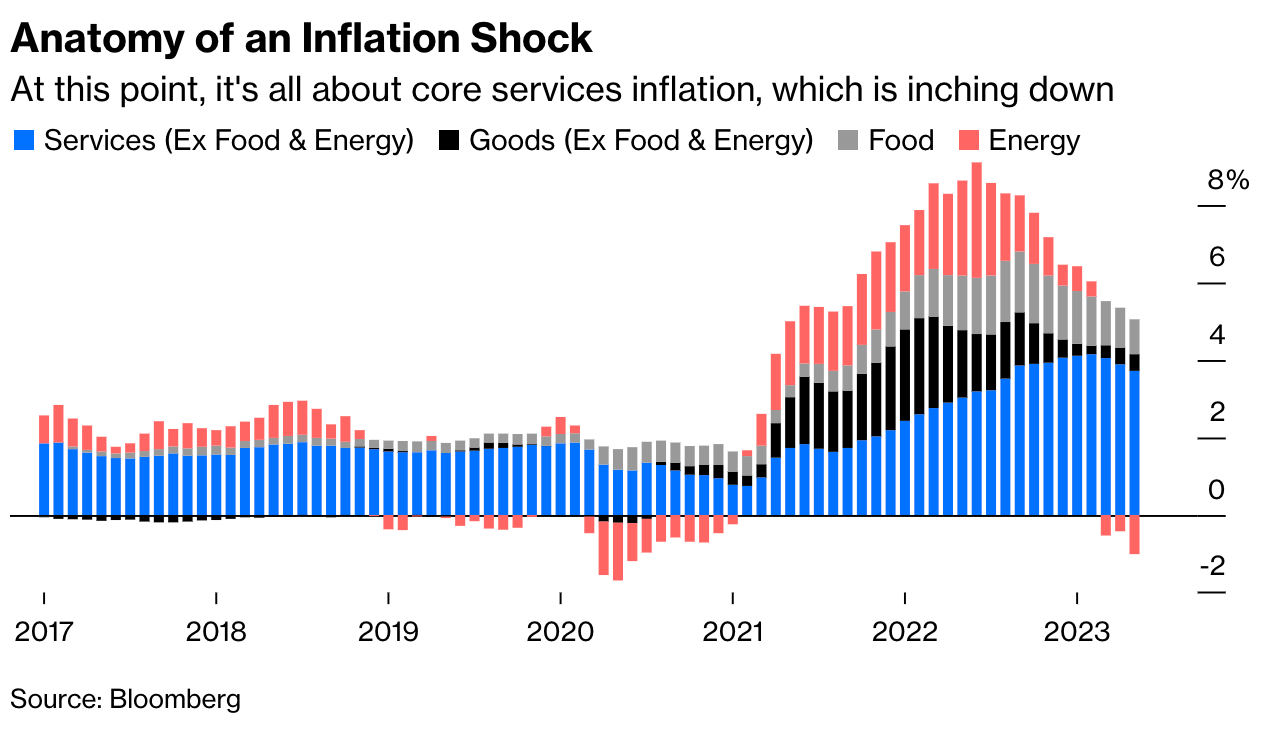

Inflation rose 4% year-over-year in May, the smallest advance since March 2021, indicating a cooling of inflation that allows the Federal Reserve to potentially pause interest rate hikes. While inflation remains above the Fed's 2% target, the central bank is expected to forgo a rate increase this week after 10 consecutive hikes. Core inflation, excluding food and energy items, remained high, but underlying details suggest encouraging trends. Factors like falling used car prices and smaller rent increases may contribute to a slowdown in core inflation. As a result, despite a potential pause in rate hikes, the Fed is unlikely to cut rates in the near future. The next CPI report in July will be critical for Fed decisions in subsequent policy meetings.

Chart That Caught Our Eye

Analyst Team Note:

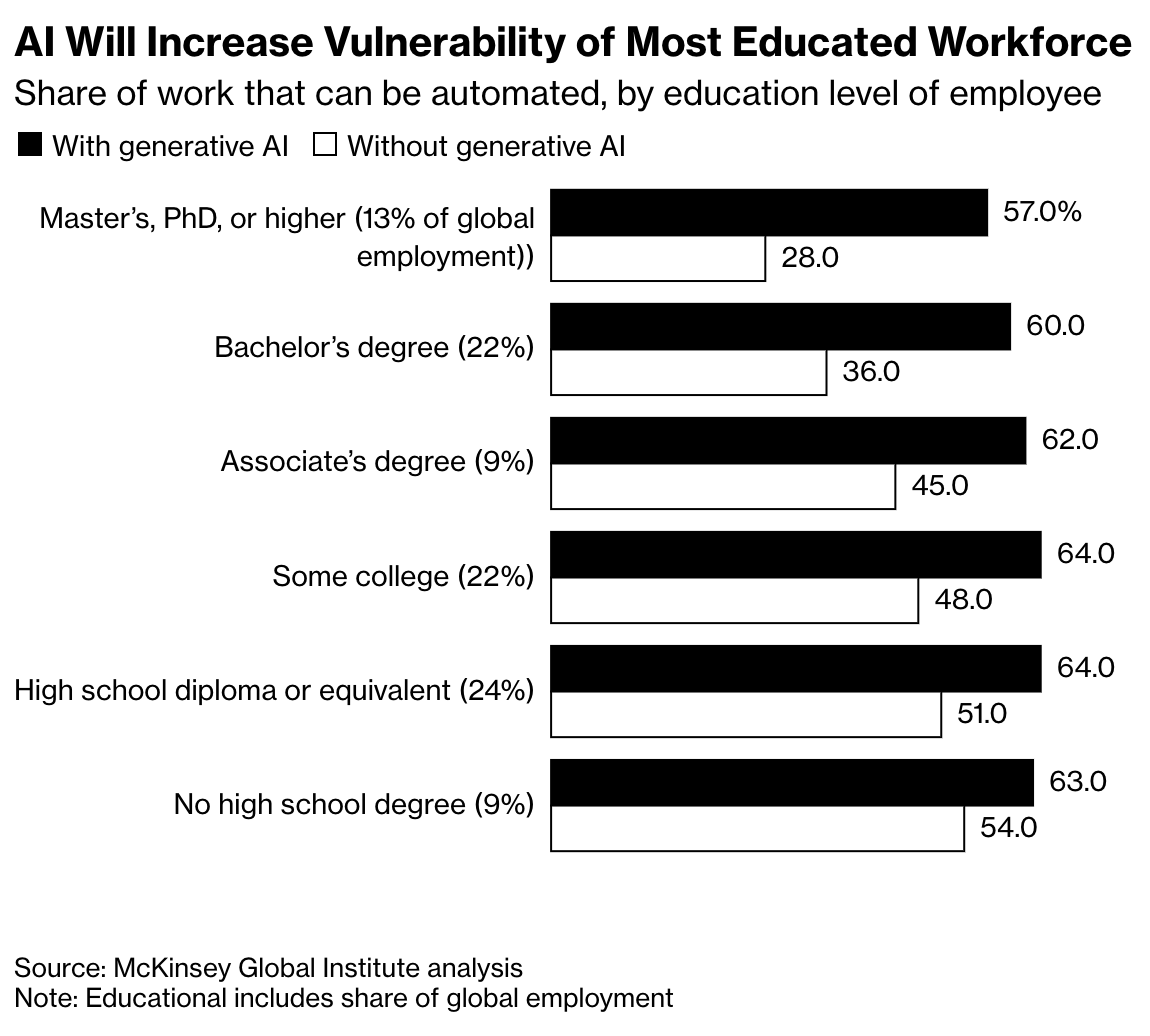

The global surge in generative AI could result in significant productivity increases and economic benefits, but also pose significant disruption, especially to knowledge workers, according to a McKinsey report. The study predicts that business operations from sales to customer service will increasingly be embedded in software, leading to potential economic benefits of up to $4.4 trillion, or about 4.4% of global economic output. The application of generative AI could increase productivity by 0.1% to 0.6% over the next two decades, depending on its adoption and implementation.

However, the study warns of an intensified impact on the labor force, particularly higher-wage knowledge workers who were previously considered relatively immune to automation. McKinsey previously estimated that about half of global worker hours could be automated, but that figure is now revised up to 60-70%.

About 75% of the potential value from applied generative AI is expected to come from customer operations, marketing and sales, software engineering, and R&D. The speed of automation adoption is predicted to be faster in developed economies, reversing the trend of major technology upgrades primarily affecting lower-wage, less-educated workers.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.