6.12.24: Fed Planning One Rate Cut This Year, Down From Three

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Letters From Larry is brought to you by our friends at YCharts.

Taxes are inevitable, but minimizing your clients' tax burdens is a key part of your role as a financial advisor. Instead of getting bogged down with manual calculations, spreadsheets, and multiple software tools, simplify your workflow with YCharts’ new Transition Analysis Tool.

With automated processes for generating quick reports and providing insights into a client’s current positions and tax implications, you can free up your time from tedious tasks and focus more on building impactful client relationships.

Click here to start your free YCharts trial to explore the new tool, and get 15% off your initial YCharts Professional subscription when you tell them I sent you (new customers only).

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 5,427.97

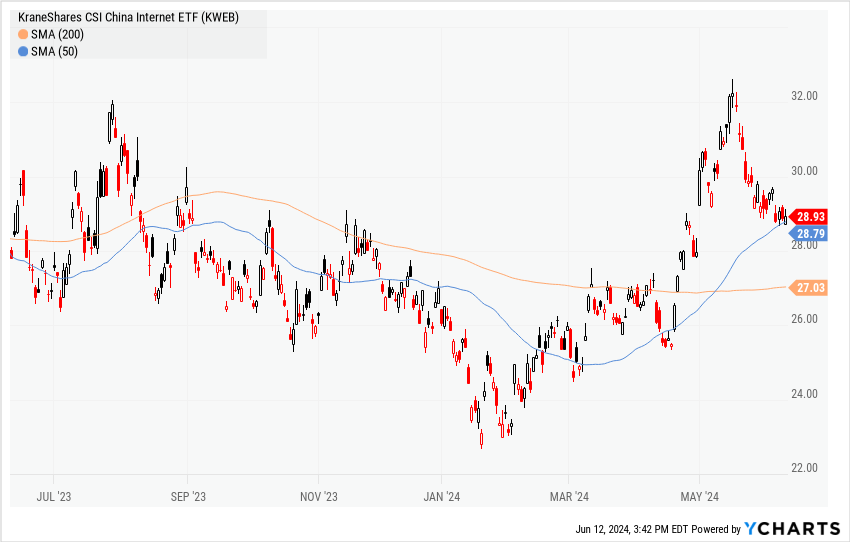

KWEB (Chinese Internet) ETF: $28.93

Analyst Team Note:

Macro Chart In Focus

Analyst Team Note:

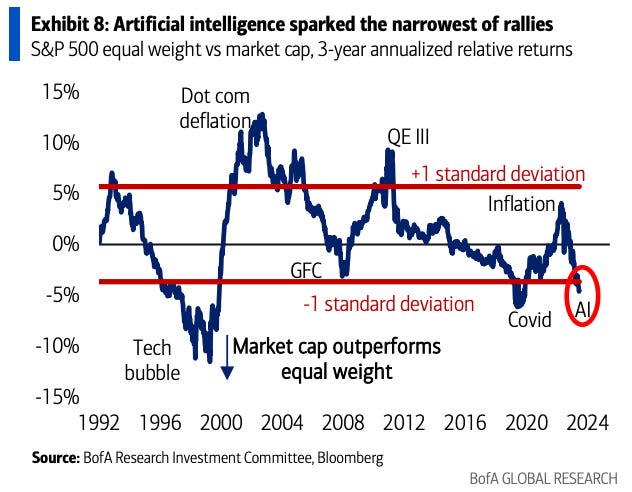

Core CPI rose 0.2% in May, marking a second consecutive month of cooling inflation and bringing the year-over-year increase to 3.4%, the slowest pace in over three years.

This unexpected decline may signal the start of a downward trend in inflation, though Federal Reserve officials will need several months of consistent data before considering interest rate cuts.

Despite the positive news, core CPI's three-month annualized rate still stands at 3.3%, indicating that inflationary pressures, especially in shelter prices, remain significant.

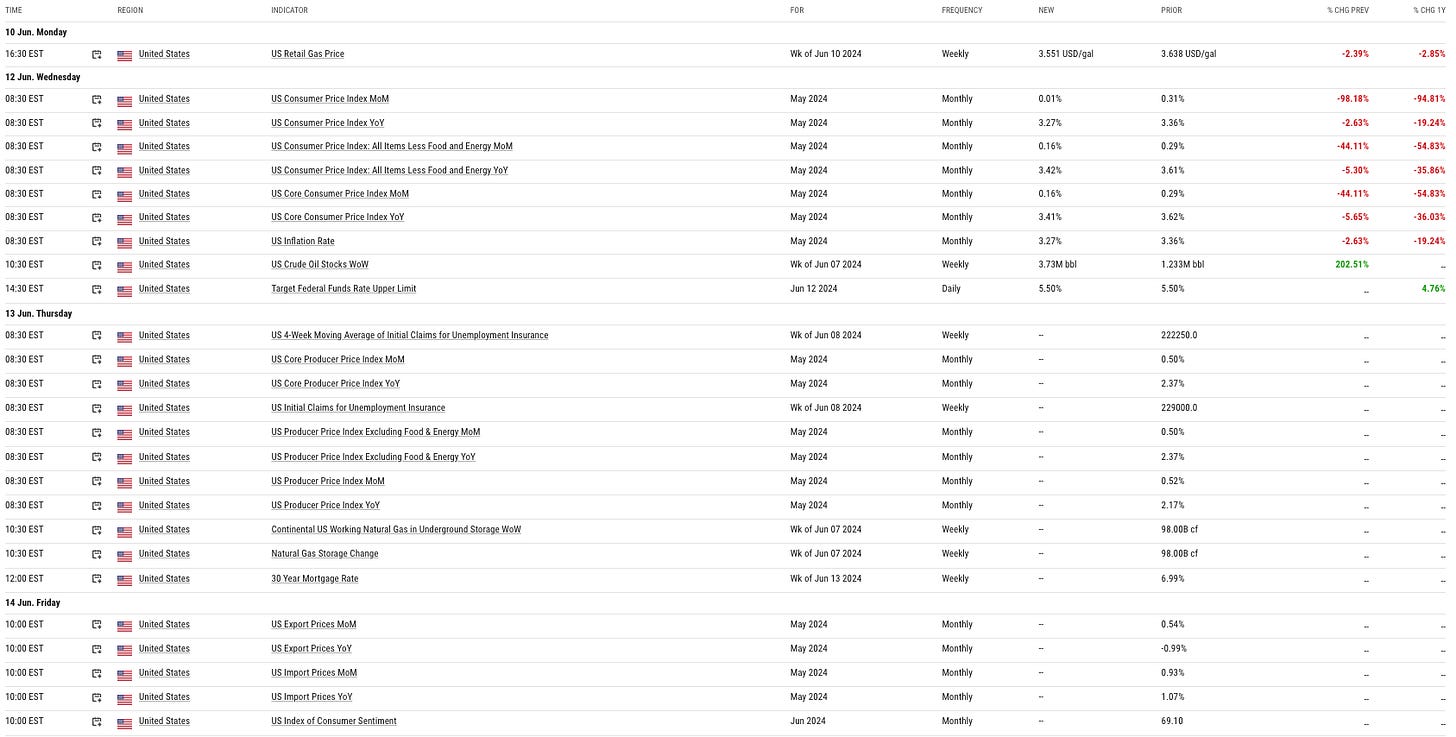

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

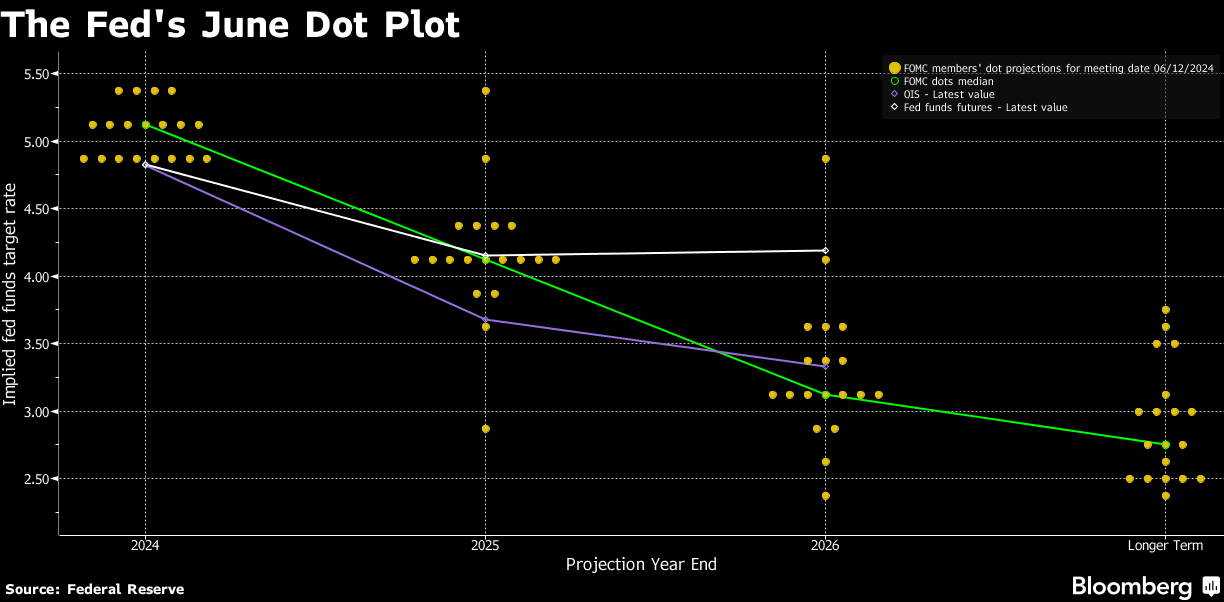

Federal Reserve officials are planning just one interest rate cut this year, down from three previously forecasted, maintaining the federal funds rate at 5.25% to 5.5%, a two-decade high.

Policymakers expect four cuts in 2025.

Chair Jerome Powell emphasized the need for more favorable inflation data before reducing rates, despite recent progress. The Fed adjusted its language to acknowledge modest inflation progress and raised its inflation forecast to 2.8%.

Although the labor market remains strong, officials debated the effectiveness of higher borrowing costs, with some suggesting the neutral rate may have risen post-pandemic.

Chart That Caught Our Eye

Analyst Team Note:

Leveraged loan issuers are taking advantage of a repricing wave to save over $1.4 billion in annual interest expenses amid the Federal Reserve's "higher for longer" interest rate stance.

Companies, particularly those with sub-investment-grade ratings, are reworking their debt terms to cut margins by about 50 basis points on average, as investors seek opportunities in a market with limited new issuance.

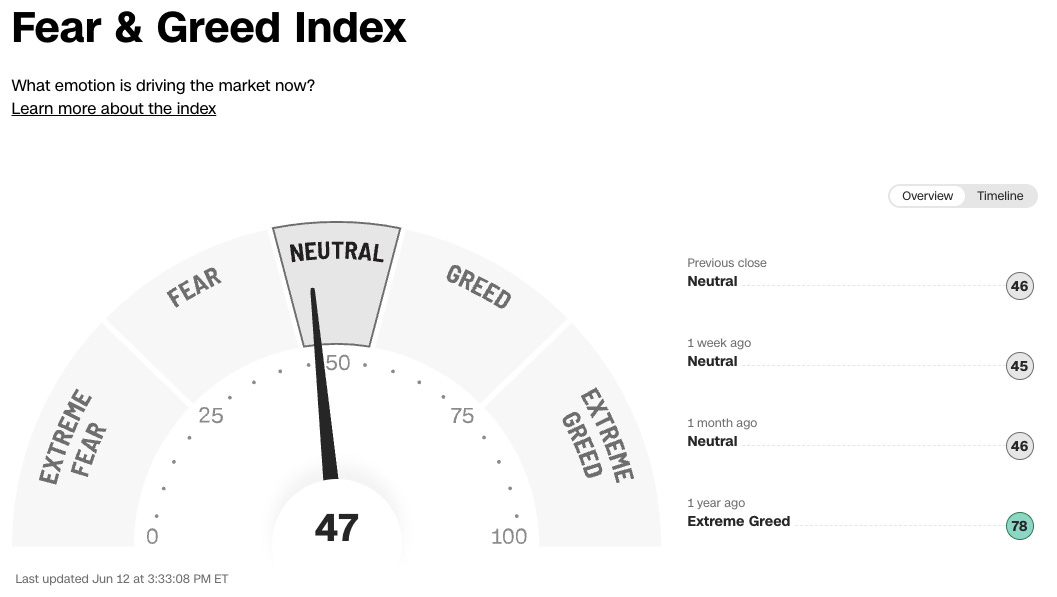

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.