5.5.23: Apple Delivers A Blow To Bears. But Bears are not yet quite finished.

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: Here’s the most recent piece that we made public from our Investment Community on the latest banking turmoil, where I believed key names like American Express and Interactive Brokers would stage a near-term decent recovery.

Hope you all have a good weekend. Will be back with more STRAT later. ✌️

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash (yielding 4.5%+ on idle cash) at Interactive Brokers

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4061.22

KWEB (Chinese Internet) ETF: $27.33

Analyst Team Note:

Markets can remain irrational longer than you can remain solvent.

Macro Chart In Focus

Analyst Team Note:

“0% to 5% in 15 months; Fed hiking cycles always ‘break’ something…this time US regional banking system (Chart 3); credit event normally means panic Fed ease, but inflation too high, unemployment too low, so sell the last rate hike.” - Michael Hartnett, BofA

“Yesterday’s Fed rate hike brings fed funds rate to highest since 2007; upper bound of 5.25% is what terminal rate was in that cycle…back then, it took 2 years to get there from prior lower bound; this time, it took just over a year…y/y change (orange) still fastest since 1980s” - Liz Ann Sonders, Charles Schwab

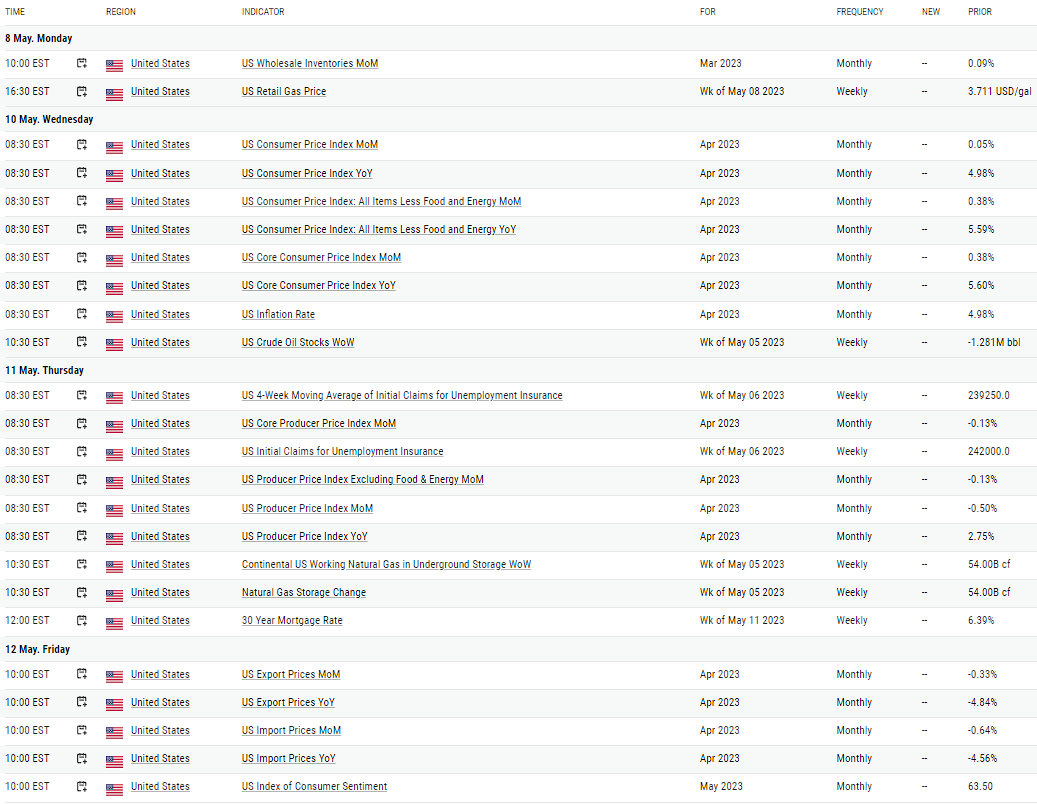

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

In April, US hiring and workers' pay gains accelerated, demonstrating labor-market resilience and increasing inflationary pressures amid economic challenges. Nonfarm payrolls rose by 253,000, and the unemployment rate dropped to a multi-decade low of 3.4%.

Despite concerns about high interest rates, inflation, and tightening credit conditions, labor demand remains resilient. The Federal Reserve recently raised interest rates for a potential final time in this cycle to control inflation. In April, average hourly earnings increased by 0.5%, the highest in about a year, and were up 4.4% from a year ago.

Chart That Caught Our Eye

Analyst Team Note:

Market Funds saw $47 billion of INFLOWS, pushing the aggregate to a record high of $5.31 trillion. That is over $100 billion of inflows in two weeks...

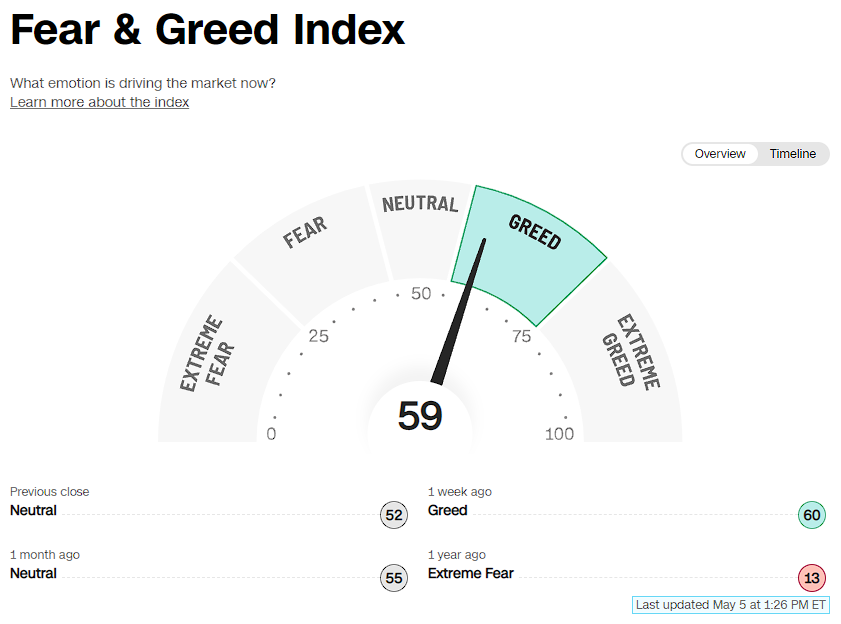

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.