5.3.24: US Job Growth Sees Significant Slowdown as Unemployment Ticks Up

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 5127.34

KWEB (Chinese Internet) ETF: $30.65

Analyst Team Note:

According to data from Goldman Sachs, hedge funds increased their defensive equity positions at the fastest rate in eight months, focusing particularly on health care stocks while reducing holdings in consumer discretionary stocks.

Investors are leaning towards sectors like health care, which are less cyclical and currently offer more attractive valuations compared to tech stocks.

Macro Chart In Focus

Analyst Team Note:

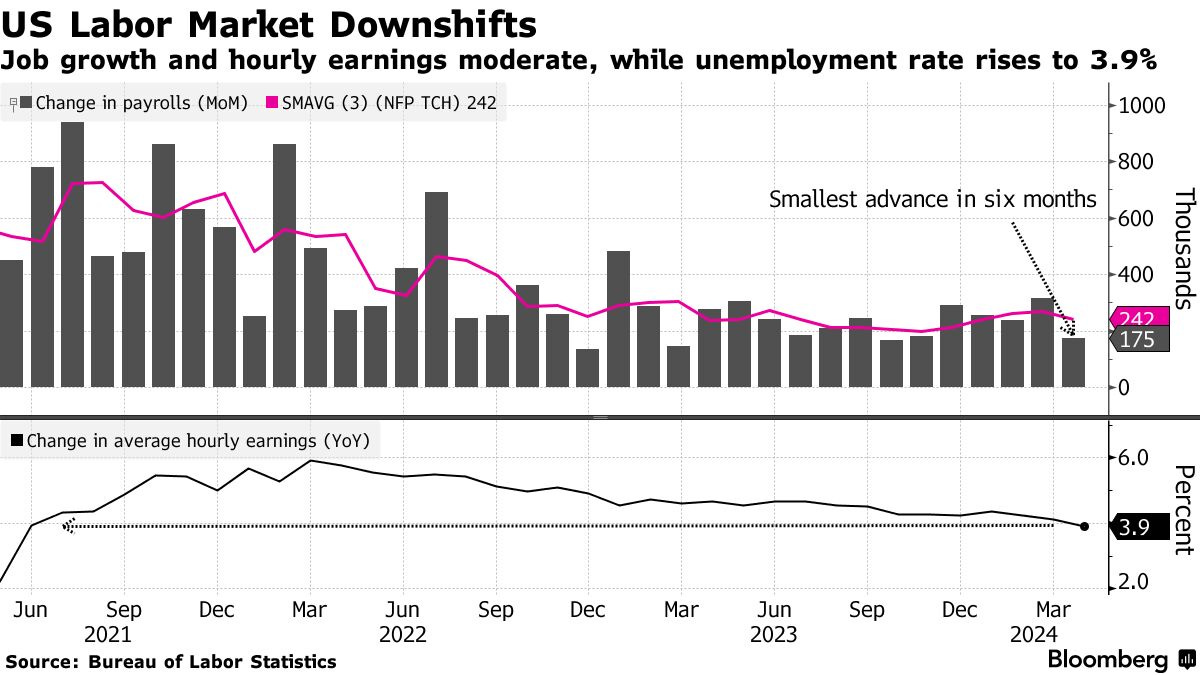

In April, U.S. job growth experienced a significant slowdown with nonfarm payrolls adding only 175,000 jobs, marking the smallest gain in six months and falling short of expectations.

The unemployment rate increased to 3.9%, and average hourly earnings grew by just 0.2% month-over-month, reflecting the slowest pace since June 2021.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

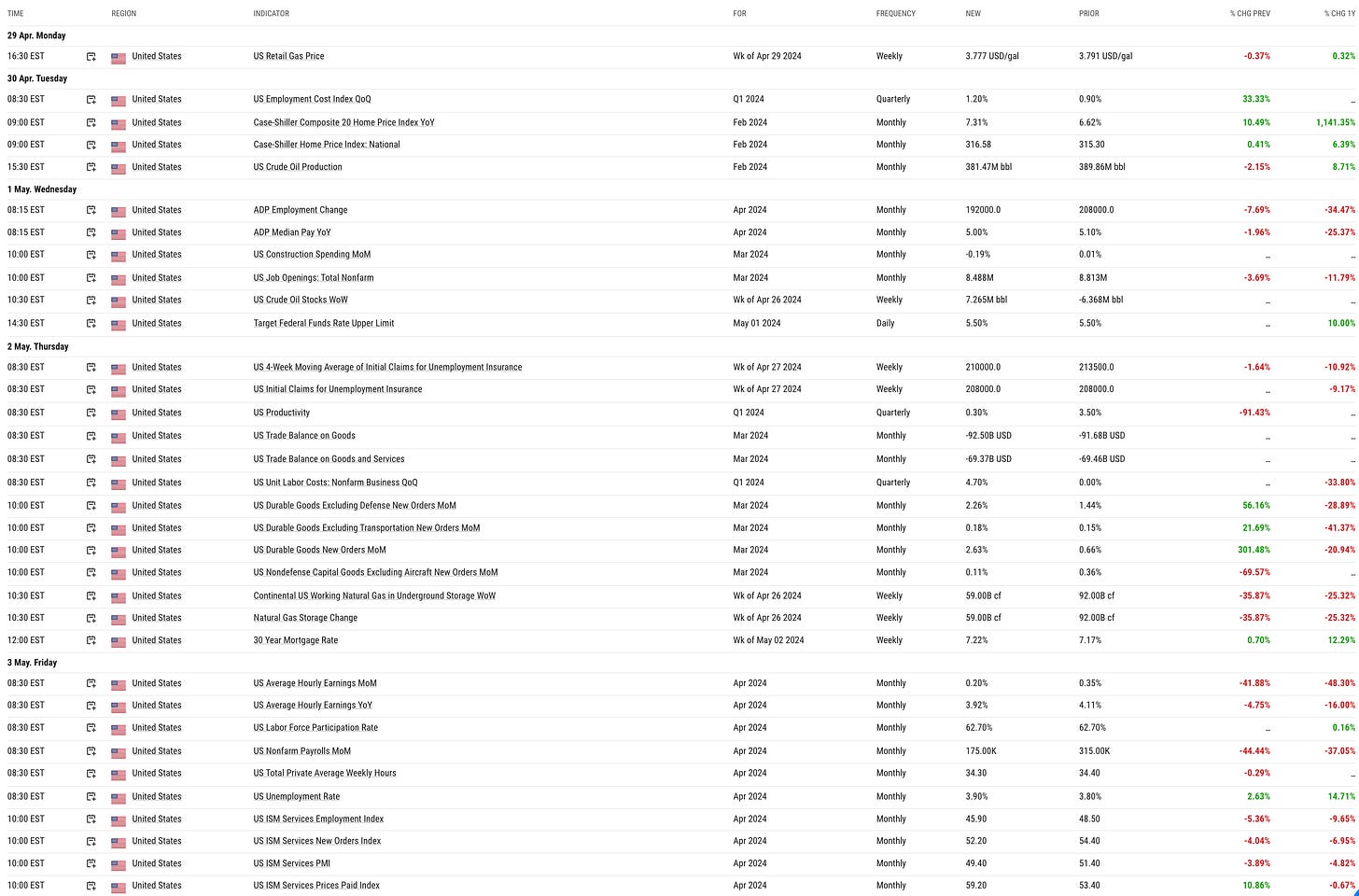

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

In April, the U.S. services sector contracted for the first time since 2022.

Additionally, rising input costs are creating pressure, evidenced by increases in the prices paid index and ongoing challenges in hiring and supply chain management across various industries.

Despite some sectors like accommodation and food services experiencing growth, the overall sentiment suggests cautiousness with heightened inventory levels and a decrease in new orders.

Chart That Caught Our Eye

Analyst Team Note:

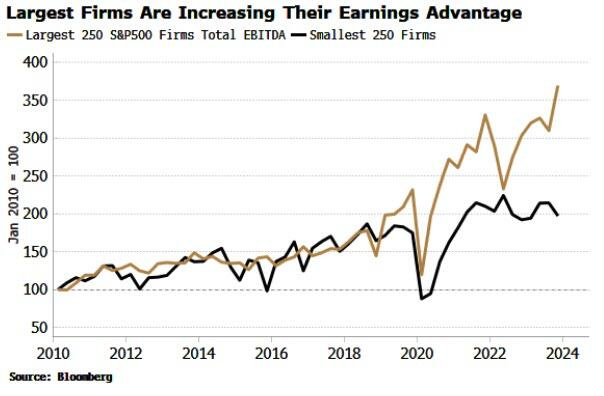

The top 50 largest companies in the S&P 500 now represent 35% of total S&P 500 EBITDA.

EBITDA for these leading 50 firms has more than tripled since 2020, whereas for the smallest 250 companies in the S&P, it has merely doubled.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.