5.3.23: Traps Are Starting To Activate Against Late Bulls

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: To put it simply, the market is now a very dangerous place where traps are laid in almost every sector. The FOMC today did not add anything constructive to revitalize the bullish narrative.

We wish to help you. If you are a public reader, Join our Community. Today.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash (yielding 4%+ on idle cash) at Interactive Brokers

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4119.58

KWEB (Chinese Internet) ETF: $26.90

Analyst Team Note:

According to Citigroup strategists, traders added $9 billion in new long positions on S&P 500 futures, while Nasdaq 100 futures saw the largest weekly change in positioning, with bullish bets dominating. Almost 70% of S&P 500 companies have reported quarterly earnings, with over 79% beating estimates. This positive performance has helped offset weak economic data, such as disappointing US GDP figures.

Macro Chart In Focus

Analyst Team Note:

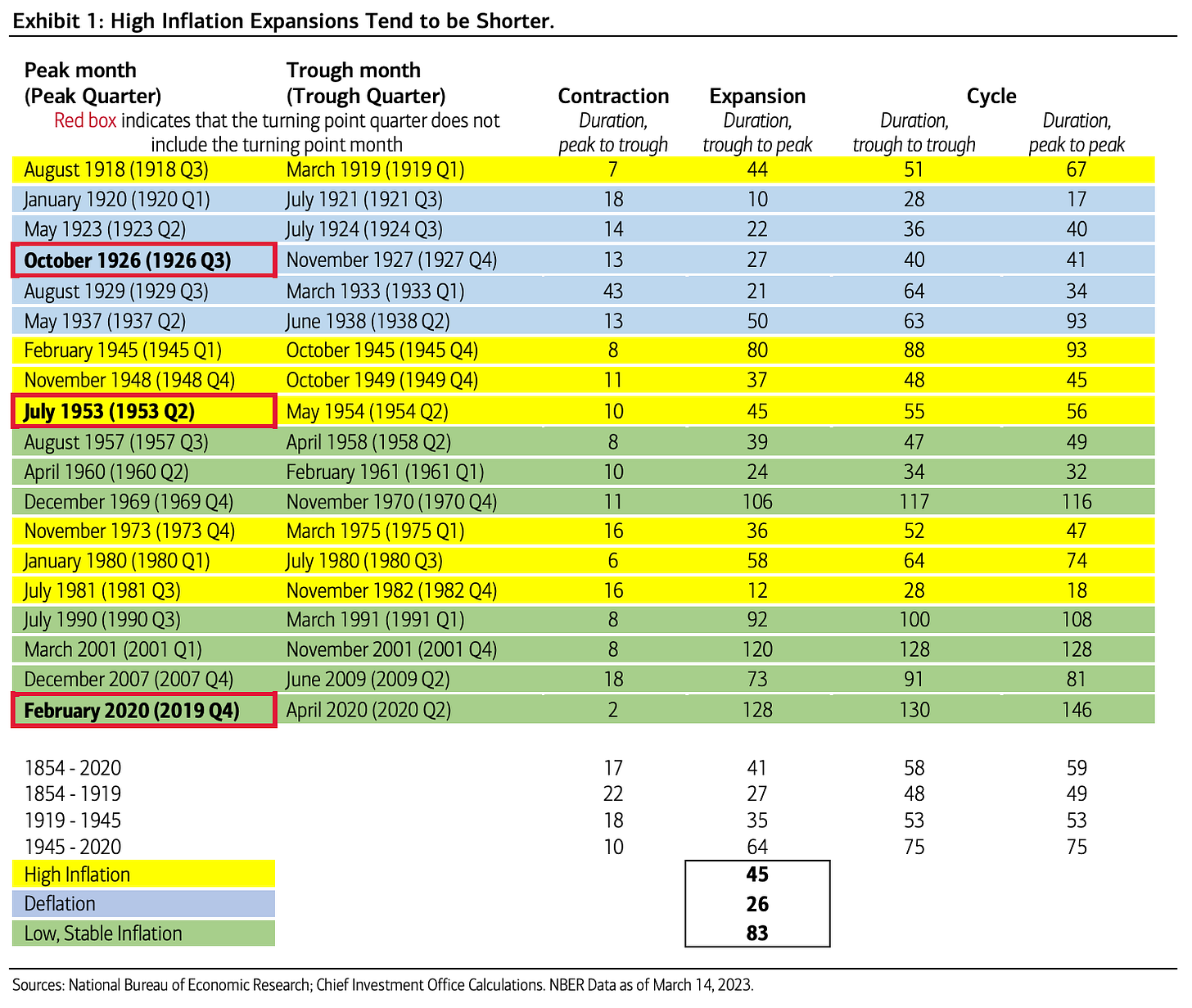

Since 1845, data suggest that business cycle expansions during high inflation periods tend to be shorter than average, lasting around three-and-a-half years. The current expansion has been ongoing for three years. In contrast, low and stable inflation periods often lead to longer expansions, with post-Great Financial Crisis expansions averaging over eight-and-a-half years. High inflation periods also typically result in shorter recessions, while deflationary environments have led to longer ones.

Stock returns during low inflation expansions have been above average, with the S&P 500 producing annualized returns of over 13% during expansions in the 1980s, 1990s, 2000s, and post-GFC. High inflation periods, such as the 1970s, saw lower nominal S&P 500 returns on average. While the current expansion is different due to the pandemic-driven recession and unprecedented monetary/fiscal stimulus, it’s worth considering that this expansion could be nearing its end, potentially leading to a retest of the October 2022 S&P 500 low and more modest annualized returns.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

N/A

Analyst Team Note:

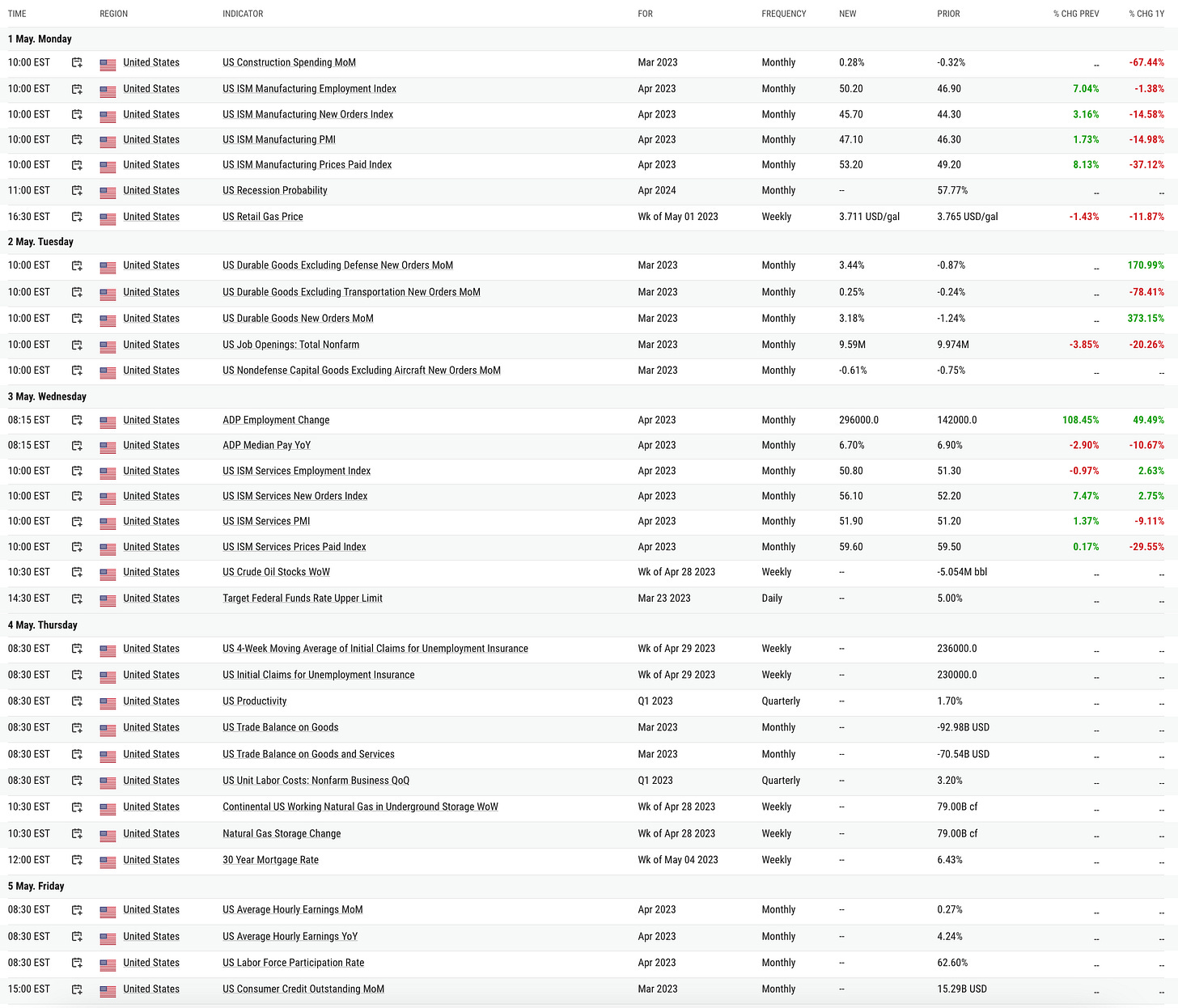

U.S. companies added 296,000 private payrolls in April, the most in nine months, indicating a resilient labor market even as the economy experiences a slowdown. The ADP Research Institute reported that the increase in employment surpassed all forecasts and was almost double the median projection. However, wage growth cooled, with the median increase in annual pay for job changers falling to 13.2%, the slowest pace since November 2021. Leisure and hospitality, education and health services, and construction sectors contributed significantly to the rise in private payrolls.

Despite the robust job growth, the labor market shows signs of cooling as layoffs spread from the technology sector to other industries due to the Federal Reserve's interest-rate increases. The Labor Department data revealed a decline in job openings for a third consecutive month in March and an increase in layoffs to the highest level since 2020.

Chart That Caught Our Eye

Analyst Team Note:

Tesla has been grappling with more supply than demand, leading to price cuts across its vehicle lineup in recent months. However, the company has raised prices on the Model S and X, as well as on the Model 3 and Y, but demand constraints persist. Tesla's reported 15 days supply of vehicles in inventory for the first quarter is relatively healthy by industry standards, but the increasing trend could pose risks.

Analysts have raised concerns about Tesla's future as its moves are increasingly similar to those of legacy automakers, such as Ford's Model T. Jefferies warned that the auto industry's structurally low returns might prevail over Tesla in the end, making it more challenging for the company to disrupt the established industry than to create a new one.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.