5.29.24: China Growth Expectations Raised on Stimulus

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 5,280.50

KWEB (Chinese Internet) ETF: $29.41

Analyst Team Note:

The market’s current rally has major indices at record highs , yet it lacks the enthusiastic demand for call options seen in previous rallies, suggesting a tempered outlook among investors.

Despite high equity exposure, the subdued activity in call options and low volatility index readings indicate a cautious approach from investors.

Macro Chart In Focus

Analyst Team Note:

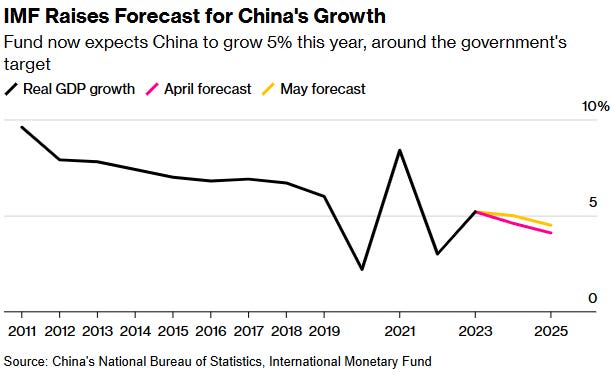

The International Monetary Fund raised its forecast for China's economic growth in 2024 to 5% from 4.6%, reflecting strong early-year expansion and additional government support.

The IMF also increased its 2025 growth forecast to 4.5% from 4.1%, noting recovering consumption and sustained public investment, although private investment remains weak due to the ongoing housing slump.

Despite new measures to bolster the property market, the IMF emphasized the need for further fiscal intervention.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

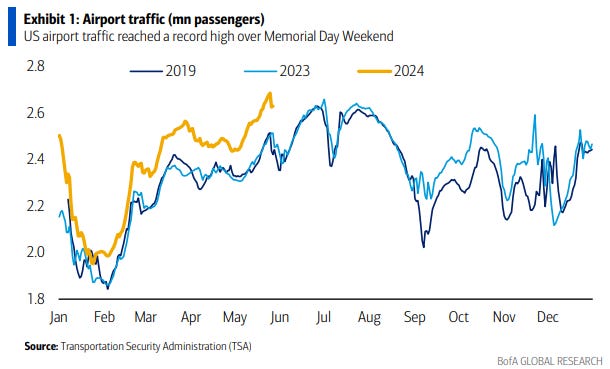

In the week ending May 25, an average of 2.69 million people per day flew out of US airports, setting a record level of air traffic that was nearly 7% higher than the same periods in 2019 and 2023.

Notably, 2023 saw five travel peaks higher than Memorial Day Weekend, suggesting that new records may be set this July.

Chart That Caught Our Eye

Analyst Team Note:

Nvidia is seeing a surge in call option trading, with trading volume reaching nearly double the 20-day average as shares hit a record high above $1,100.

This trading frenzy appears to be driven by a gamma squeeze where near-worthless call contracts expiring soon saw gains of over 1000%, compelling option dealers to buy more shares to hedge, further driving the stock price up.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.