5.24.23: NVDA Earnings Keep Bulls In Charge For Another Day

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: NVDA’s rosy forecast sends the company to near the $1T valuation club. I was anticipating the Stock to potentially revisit 330 in an upside case post-earnings from my personal Dashboard, but this level of outperformance has greatly exceeded my forecast for the name. I was hoping for a pullback into the 260 region per the Dashboard where I’d be a first tranche buyer, but didn’t get one, so will find other opportunities in the market.

Congratulations to the holders of NVDA - the share price action has been truly impressive.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash (yielding 4.5%+ on idle cash) at Interactive Brokers

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4145.58

KWEB (Chinese Internet) ETF: $26.30

Analyst Team Note:

Biggest inflows in 8 months: Last week (S&P 500 +1.6%, best week since March), BofA clients were net buyers of US equities with the biggest inflows since Oct. (+$4.4B). Both stocks and ETFs saw inflows, led by the former. Despite “risk on” flows, inflows were chiefly in large caps (mid caps also saw inflows – largest since Dec.).

Macro Chart In Focus

Analyst Team Note:

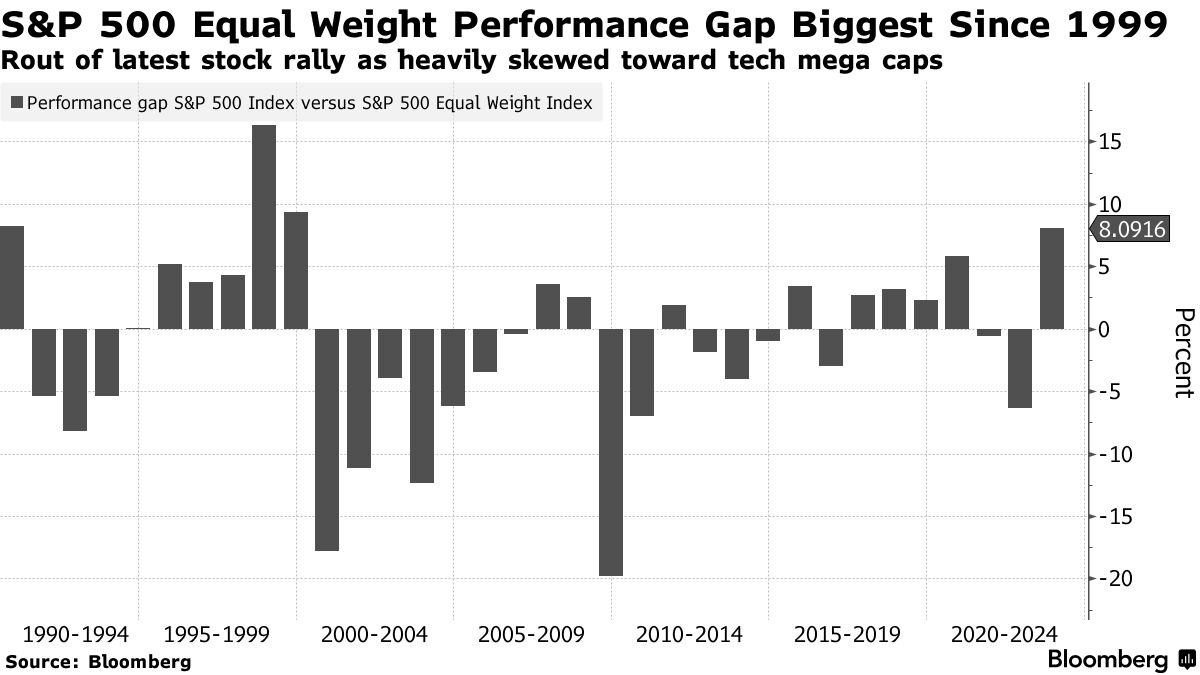

The stock market recovery in 2023 has been led by a handful of large tech companies. The preference for US mega-cap tech stocks was so strong that they became the top long positions for many hedge funds in Q1, according to Goldman Sachs. However, this lack of market breadth may pose a risk should the upward momentum falter. Already, some technical indicators such as the RSI for the Nasdaq 100 Index are hinting at a sell signal. To sustain the rally, it might be necessary for risk-taking to spread more broadly among different sectors.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

A new poll found that half of Americans believe the US debt ceiling should be increased without any conditions, while only 25% believe it should be tied to spending cut negotiations led by House Republicans. The survey also showed that 42% of adults fear significant economic fallout if the $31 trillion debt limit isn't lifted, resulting in a default, whereas 30% consider this an overstatement and 28% had no opinion. Negotiations between President Joe Biden and House Speaker Kevin McCarthy on raising the borrowing cap are currently at a standstill, primarily due to disagreements over the magnitude of spending cuts.

The poll also revealed a general dissatisfaction with how all parties are managing the issue, with just 34% approving of President Biden's approach, 29% approving the GOP lawmakers' strategy, and 32% approving congressional Democrats' handling. Biden’s overall approval rating remained at 41%.

Chart That Caught Our Eye

Analyst Team Note:

What might be next for the 60/40 asset allocation? The traditional portfolio construct, made up of a 60% allocation to Equities and a 40% allocation to Fixed Income, declined roughly 16% in 2022, its worst calendar year return since 2008.

The investment strategy came under pressure as the diversification benefits of the allocation mix broke down amid a simultaneous drawdown in stocks and bonds and an increase in correlation between the asset classes. So far in 2023, the strategy is up around 7% year-to-date.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.