5.20.24: China Experiences Massive Capital Outflows

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 5,310.68

KWEB (Chinese Internet) ETF: $31.83

Analyst Team Note:

Morgan Stanley's Michael Wilson, a well-known bear on Wall Street, has shifted to a more optimistic outlook, raising his S&P 500 target from 4,500 to 5,400 points.

This reversal comes despite his previous stance that the index would fall by 15% by December 2023.

Wilson now anticipates robust EPS growth and suggests a barbell strategy of quality cyclical and growth stocks, along with defensive sectors like consumer staples and utilities.

Macro Chart In Focus

Analyst Team Note:

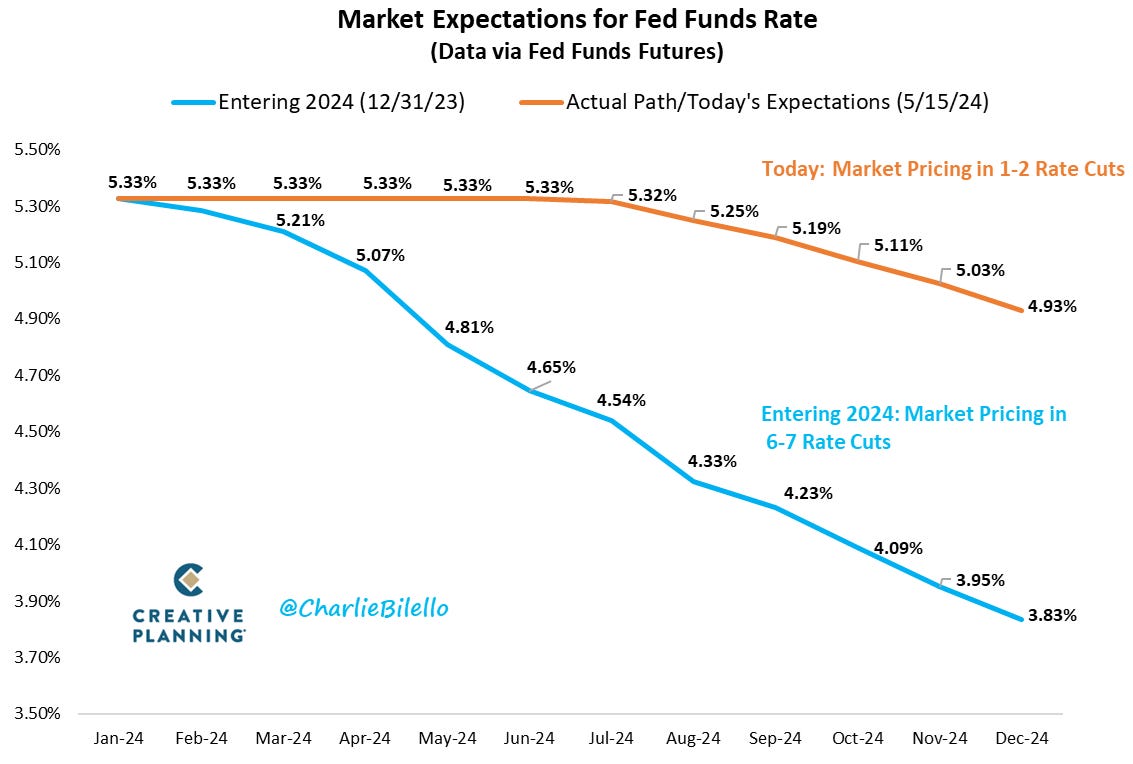

While markets were optimistic due to a better-than-expected April CPI and weaker retail sales, expectations of a 50 basis point rate cut this year might lead to disappointment.

High Q1 inflation and the persistent strength of the economy, including robust services spending and a tight labor market, suggest that a single favorable inflation print isn't enough to ensure sustained comfort, especially with potential supply challenges and upcoming elections.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

In April, China experienced significant capital outflows, reflecting concerns about the yuan amid a weak domestic economy and uncertain US Federal Reserve rate policies.

Local firms made the largest foreign exchange purchases from banks since 2016, while exporters withheld dollar conversions and residents bought foreign currencies for travel.

Chart That Caught Our Eye

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.