5.17.24: Core Inflation Declines for First Time in 6 Months

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 5298.32

KWEB (Chinese Internet) ETF: $32.24

Analyst Team Note:

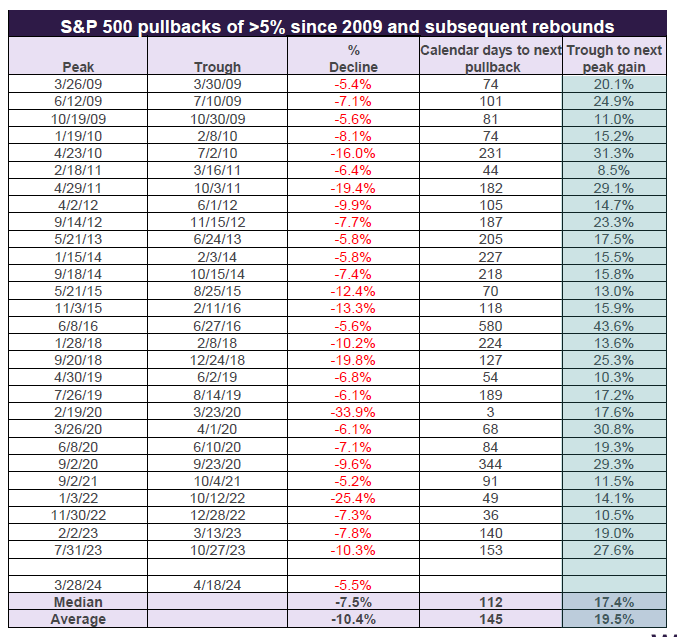

The S&P 500 has achieved its 23rd record high in 2024 after experiencing its first 5% pullback of the year.

Historically, following the end of similar 5% declines, the median gain before the next correction has been 17.4%, with the smallest advance being 8.5%, as observed since the market bottomed out during the financial crisis in 2009.

Macro Chart In Focus

Analyst Team Note:

Core inflation in the US declined in April for the first time in six months providing some progress in the direction Fed officials would like to see before cutting rates.

Overall CPI rose 0.3% from the prior month and 3.4% from a year ago. Shelter and gasoline accounted for over 70% of the increase.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

N/A

Analyst Team Note:

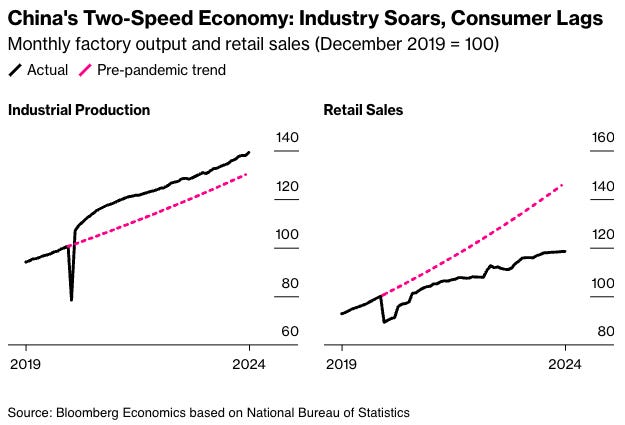

China's economic recovery has increasingly leaned towards manufacturing, making it more susceptible to trade barriers, and underscoring the importance of boosting domestic demand.

Consumer spending growth slowed to 2.3% in April, the lowest since 2022, while industrial output surged to 6.7%.

China's property sector continued to decline, prompting Beijing to introduce new measures to support it, including easing borrowing rules and committing public funds to home purchases.

Chart That Caught Our Eye

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.