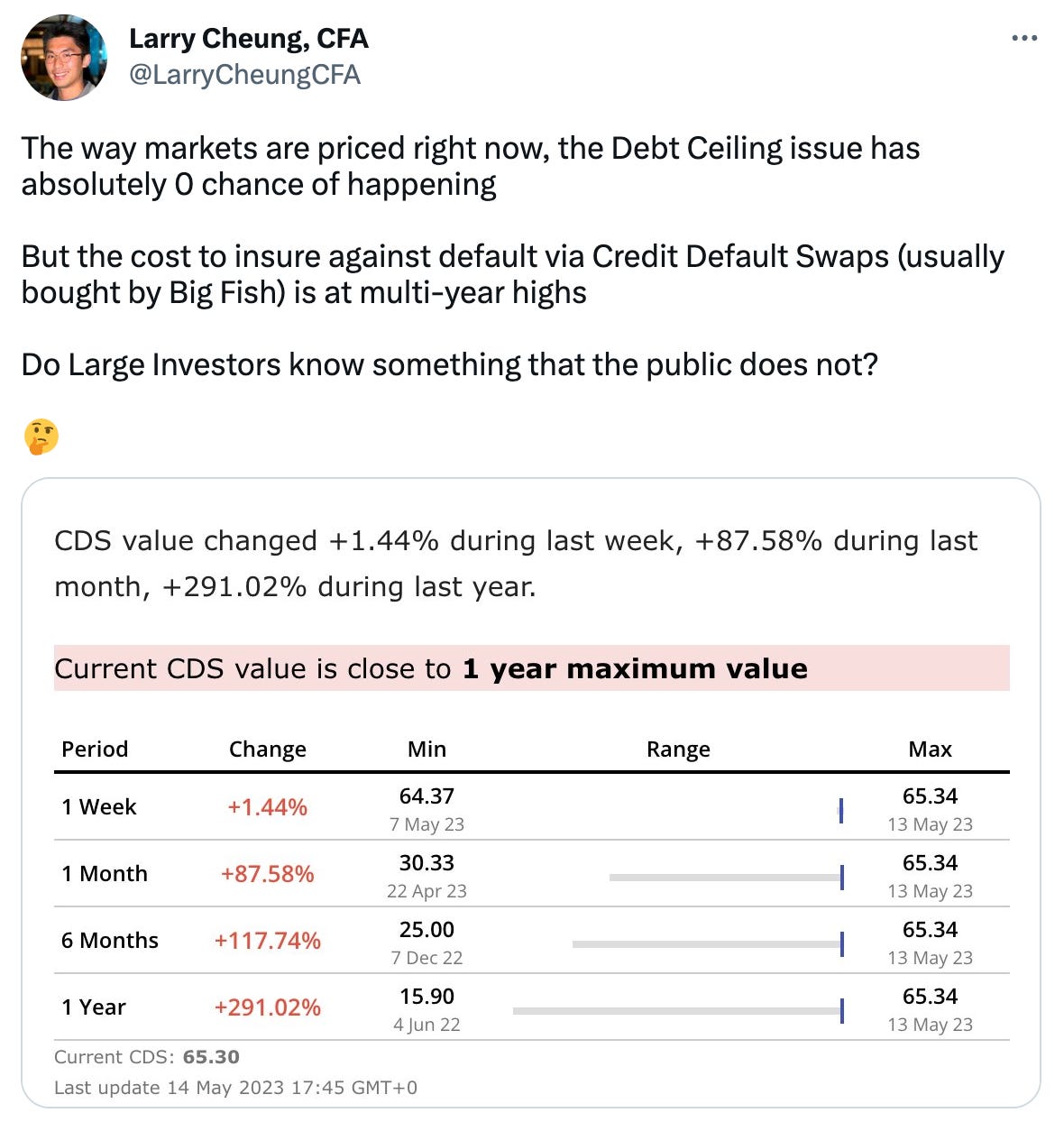

5.15.23: A Debt Ceiling Resolution can continue to sideline Bears. Failure to do so will have deep consequences.

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: I am hoping our Leaders do the right thing with the Debt Ceiling, and that the potential negative tail outcomes never play out and materialize.

Stay safe folks. Make sure to follow me on Twitter and Instagram for more commentary when I have updates. Latest Strat note is below.

Trading volumes are light and institutional market participants are awaiting Debt Ceiling progress before the next move. Slow and Steady wins the race.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash (yielding 4.5%+ on idle cash) at Interactive Brokers

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4124.08

KWEB (Chinese Internet) ETF: $26.79

Analyst Team Note:

Positioning is now so cautious and weighted toward shorts that investors should be wary of markets having the potential to break out to the upside, according to Societe Generale. Net shorts on S&P 500 contracts are striking, reaching the same extreme levels as in 2011.

The lack of confirmation of a recession scenario could result in a quick and drastic reversal of positions, that would potentially help send equities higher.

Macro Chart In Focus

Analyst Team Note:

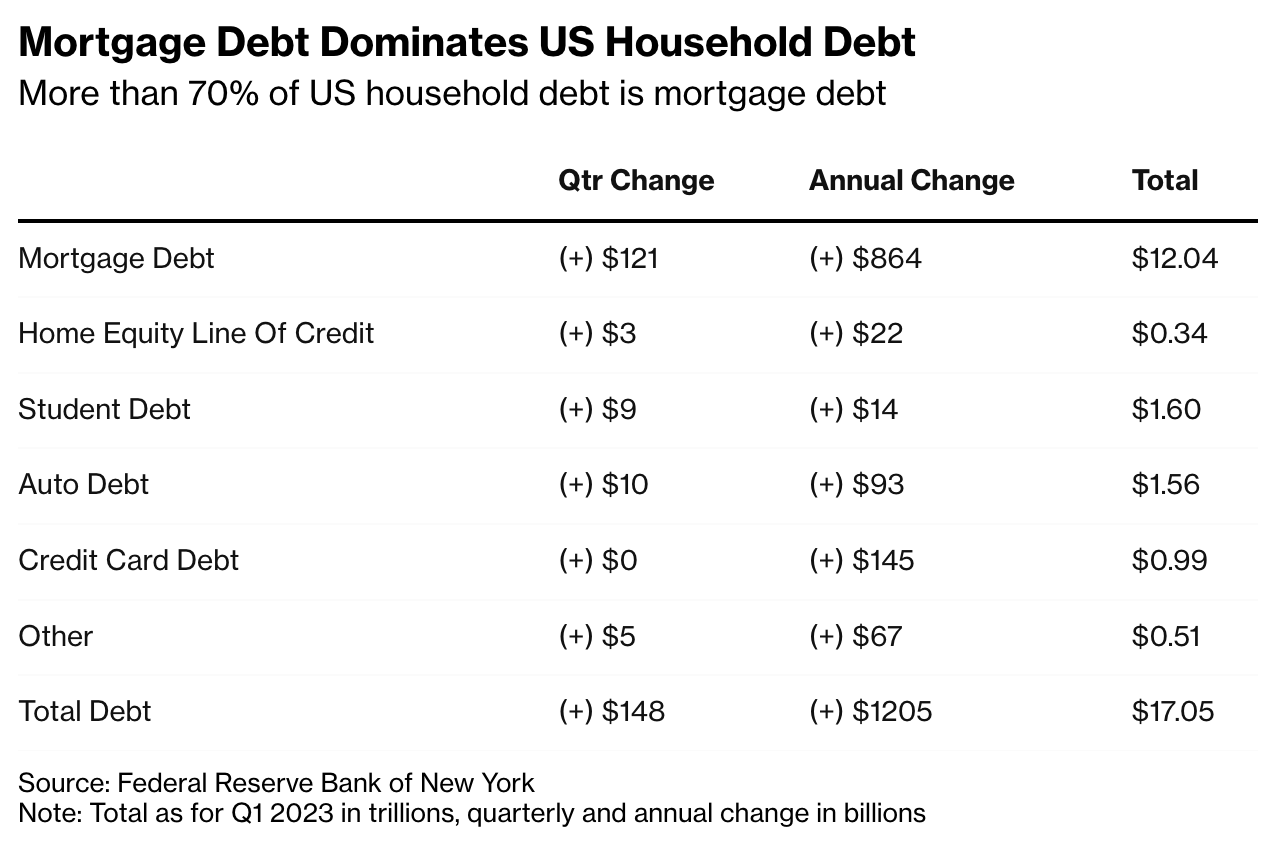

The first quarter of 2023 saw an increase in financial strain for US households, as reflected by rising credit card balances and delinquencies in most types of consumer loans. Households added $148 billion in overall debt, raising the total to $17.05 trillion, a $2.9 trillion increase from pre-pandemic levels, according to a Federal Reserve Bank of New York report. Unlike the usual trend of households reducing credit card debt at the beginning of the year, this pattern did not hold true in 2023, suggesting a reliance on credit cards to offset the impact of higher prices.

Mortgage debt trends reveal a sharp drop in mortgage originations to $324 billion, the lowest since Q2 2014. However, balances on home equity lines of credit increased for the fourth consecutive quarter after a 13-year decline, indicating that consumers are resorting to available credit. Despite the rise in delinquencies, many households managed to improve their financial positions during the pandemic, especially through mortgage refinancing. The New York Fed reports that 14 million mortgages were refinanced between Q2 2020 and Q4 2021, extracting $430 billion of home equity through cash-out refinances. This led to an average monthly payment reduction of $220 for those borrowers.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

N/A

Analyst Team Note:

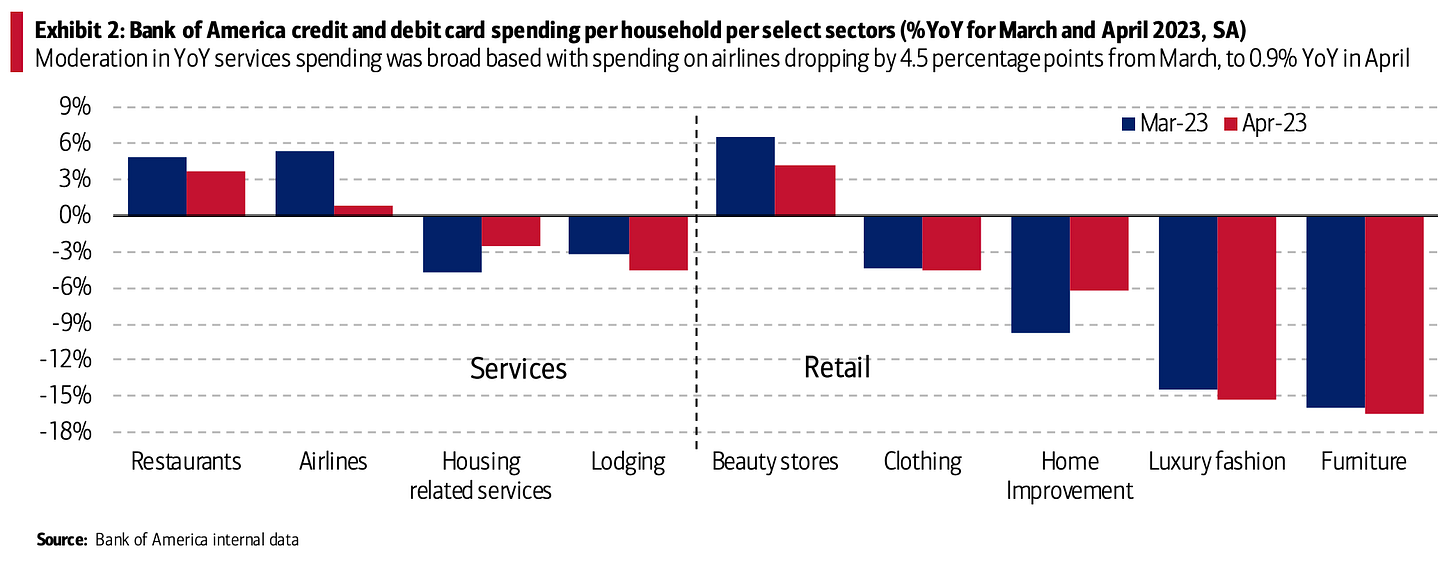

Bank of America's internal data reveals a marked differentiation in the labor market among income groups. Notably, the number of higher-income households receiving unemployment benefits saw a surge, increasing over 40% in April from the relatively low levels a year prior. This represents the most substantial increase among all income cohorts and is five times greater than the year-over-year increase for lower-income recipients.

Meanwhile, consumer spending in April showed signs of further deceleration. Aggregate credit and debit card spending per household fell to -1.2% year-over-year, marking the first negative monthly reading since February 2021. Services, which had been the primary driver of overall spending growth, saw only a modest rise of +0.9% YoY. This slowdown was reflected across various sectors, with airline spending notably dropping by 4.5 percentage points to +0.9% YoY in April.

Chart That Caught Our Eye

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.