5.1.24: US Job Openings Decrease to Lowest in 3 Years

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 5024.04

KWEB (Chinese Internet) ETF: $28.09

Analyst Team Note:

US large cap stocks are priced at a significant premium compared to European equities, trading at 21 times forward earnings versus Europe's 14 times, a 52% premium.

According to BofA, when adjusting for sector composition by applying European industry weightings to the S&P 500, the price-to-earnings ratio re-adjusts to 18.1 times, reducing the premium to 30% and indicating that nearly half of the original valuation discrepancy is due to differences in sector composition.

Macro Chart In Focus

Analyst Team Note:

According to Morgan Stanley's Mike Wilson, rising Treasury yields are dampening the positive impact of a strong earnings season for companies.

Despite many companies beating earning estimates, stock price responses have been subdued. This lackluster reaction is also attributed to already inflated valuations resulting from a record-breaking rally earlier in the year.

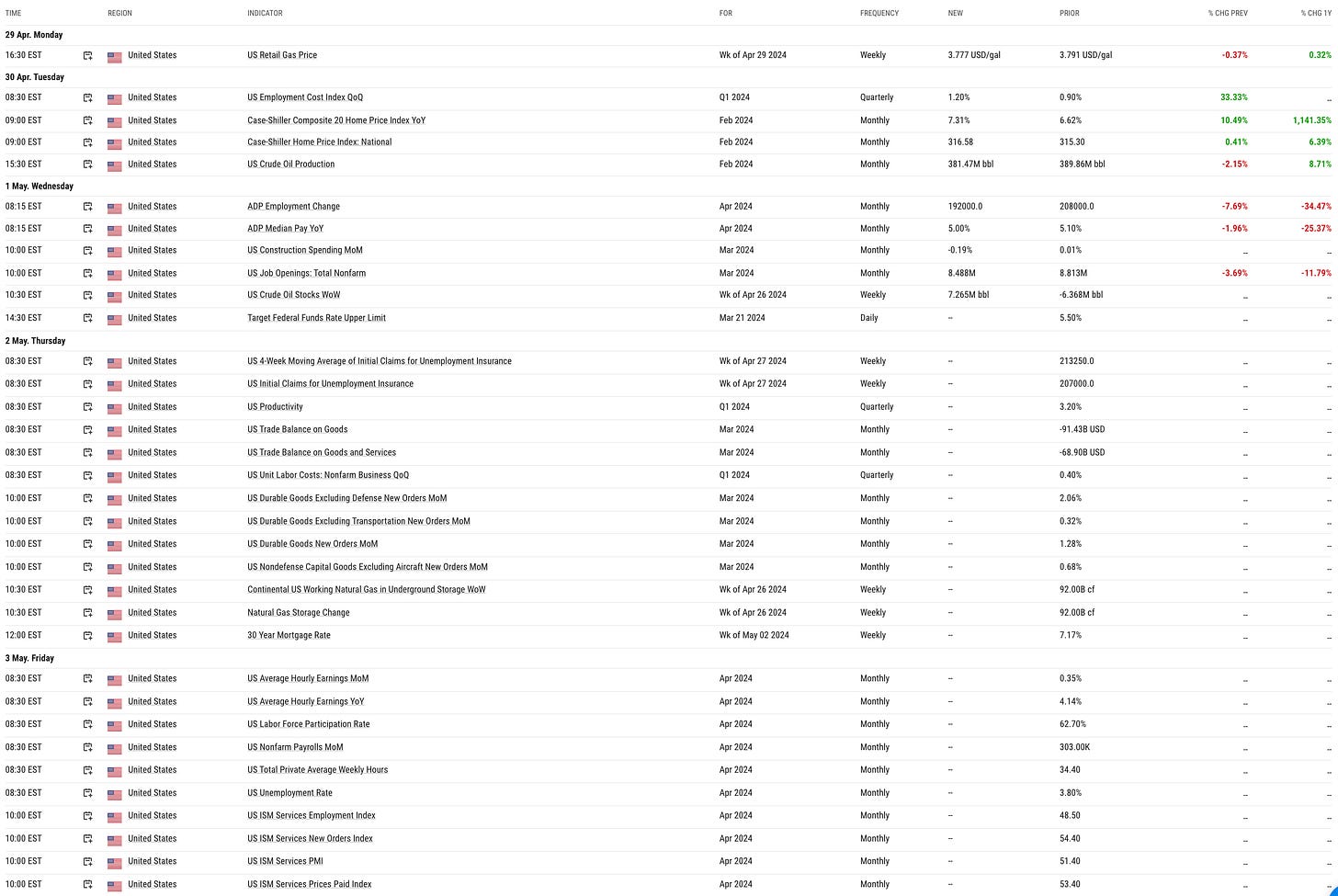

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

In March, US job openings decreased to 8.49 million, the lowest level in three years, signaling a softening labor market.

Additionally, the quits rate dropped to 2.1%, indicating that workers are less confident about finding better job opportunities, which may help reduce wage pressures despite ongoing inflation concerns.

Chart That Caught Our Eye

Analyst Team Note:

Goldman Sachs is predicting a significant increase in corporate share buybacks in 2024, expecting them to rise by 13% to $934 billion, and potentially surpassing $1 trillion in 2025.

This forecast marks a recovery from a 13% decline in 2023, driven by economic uncertainties and higher borrowing costs that prompted companies to conserve cash rather than buy back stock.

This trend aligns with data indicating that companies engaging in strong buyback programs often see positive market responses, with room for further growth especially in the U.S. where buyback-exposed shares have yet to fully capitalize on the recent rally.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.