5.1.23: Can Bulls survive this week's Big Test?

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: We believe volatility may soon return to the markets, and that Investors who are actively doing their homework will be handsomely rewarded.

As is always the case, the best opportunities always go to those who are prepared. We intend to be a part of that camp. Be proactive, and not passive.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash (yielding 4%+ on idle cash) at Interactive Brokers

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4169.48

KWEB (Chinese Internet) ETF: $27.96

Analyst Team Note:

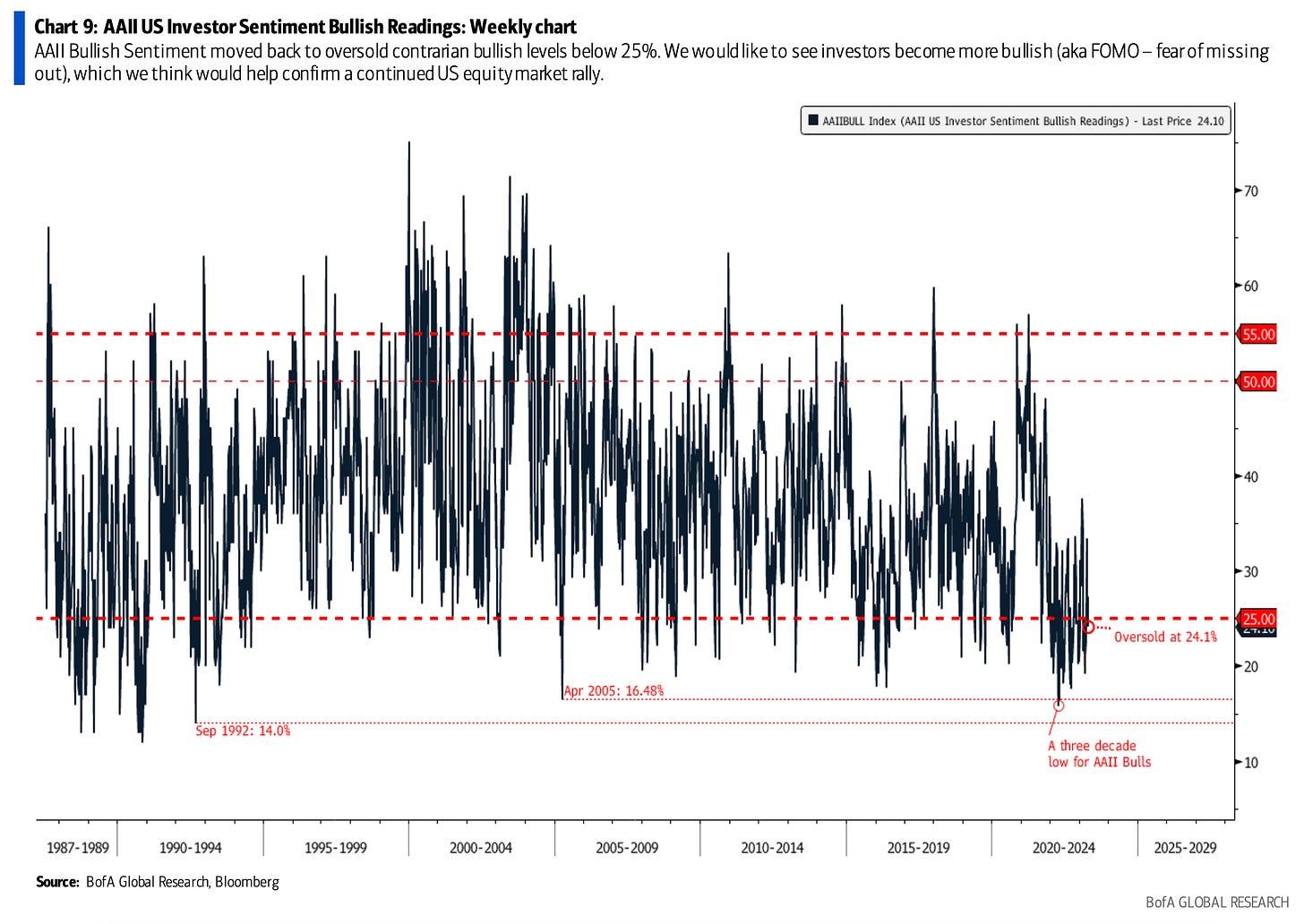

“AAII Bullish Sentiment moved back to oversold contrarian bullish levels below 25%. We would like to see investors become more bullish (aka FOMO – fear of missing out), which we think would help confirm a continued US equity market rally. However, it might take a breakout beyond the 4175-4195 resistance on the S&P 500 (SPX) to get investors to chase a rally with the next resistance at 4325.” - BofA

Macro Chart In Focus

Analyst Team Note:

JPMorgan successfully acquired the majority of assets, deposits, and certain liabilities of First Republic Bank. With this acquisition, JPMorgan adds approximately $173 billion in loans to its portfolio, which represents a 15% increase to its loan book. Additionally, the bank obtains about $30 billion of securities, accounting for a 2% increase, and $62 billion of deposits, marking a 2.6% growth. JPMorgan will not assume First Republic's corporate debt or preferred stock.

To facilitate this acquisition, the FDIC will provide loss share agreements covering the acquired single-family residential loans and commercial loans. Moreover, the FDIC will offer $50 billion of five-year, fixed-rate term financing, with specific terms yet to be disclosed. The FDIC estimates that this transaction will result in a cost of around $13 billion to the Deposit Insurance Fund.

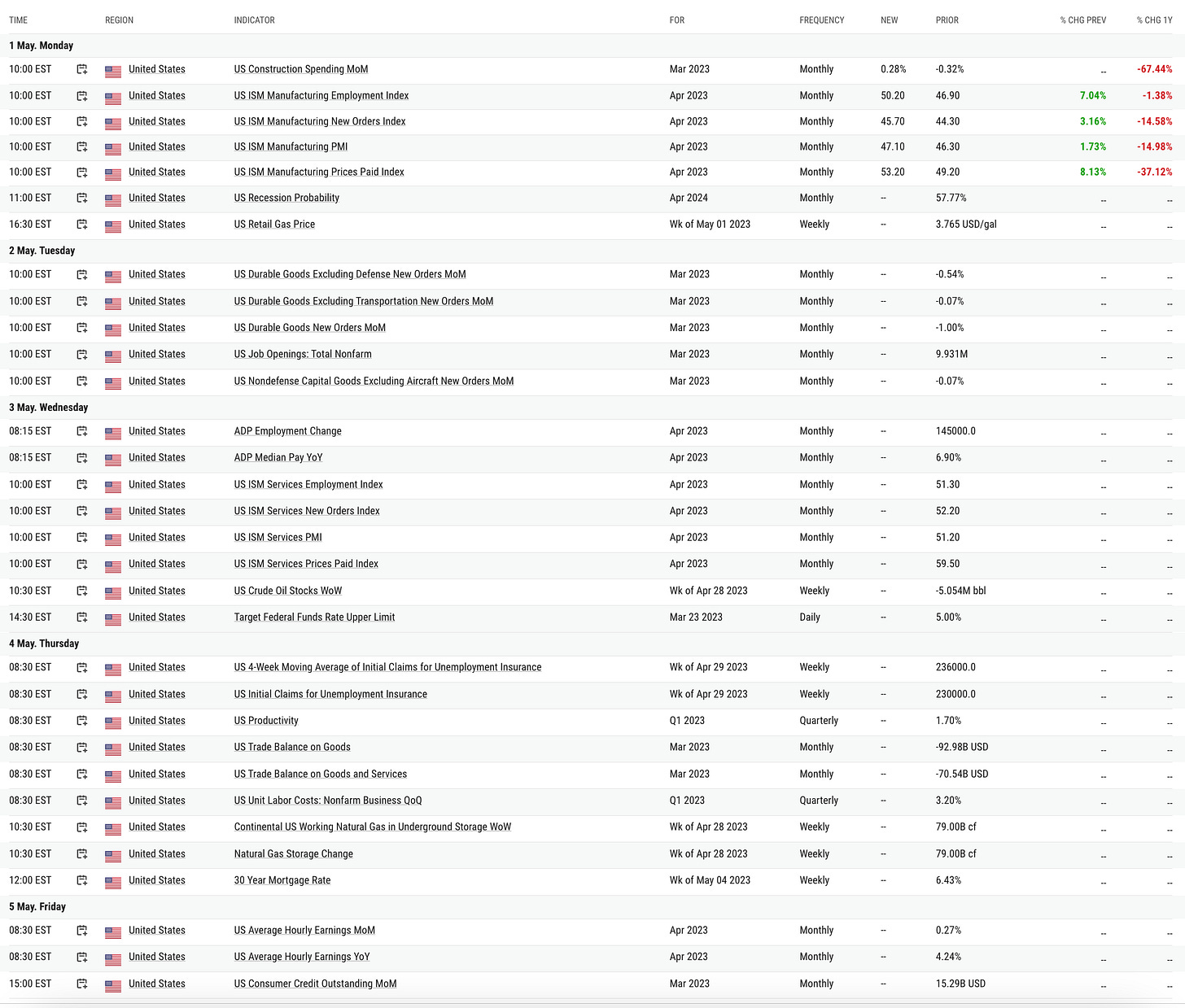

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

N/A

Analyst Team Note:

As the Fed tries to balance the need to address inflation and support the economy, striking a consensus among policymakers could become more challenging. With inflation still remaining high and Fed staff, along with many private economists, anticipating a recession in the coming months, the choices between battling inflation or dealing with higher unemployment are becoming more complex.

The Fed's March forecasts indicate a wide range of opinions among FOMC participants regarding the future path of interest rates, suggesting increasing divisions within the committee…

Chart That Caught Our Eye

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.