5.10.23: Vicious Intraday CPI Chop means that range expansion could start to take place in coming days

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: Will have more commentary for Members inside our Investment Community later this weekend/early next week. There is much to digest to form an assessment of the coming weeks’ action.

My latest publication contains my views on the setups of the markets, none of which have changed since I’ve written this note. Stay safe.

Until the Debt Ceiling situation has a concrete solution, the markets are more appropriate for Traders looking to transact rather than Investors looking to find good stocks at good valuations (objectively hard to find at the moment).

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash (yielding 4.5%+ on idle cash) at Interactive Brokers

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4119.17

KWEB (Chinese Internet) ETF: $26.77

Analyst Team Note:

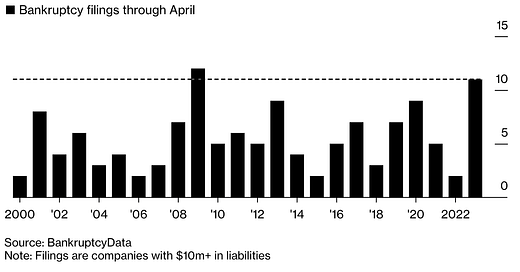

Chapter 22 filings, or repeat bankruptcies, are occurring at the fastest rate since the Great Recession, indicating the fragility of the US economy and a failure of the bankruptcy system. The system, which focuses on rehabilitating troubled companies rather than winding them down, saves thousands of jobs each year, but assumes that pausing debt collection and forcing losses on creditors is more than just delaying inevitable liquidation. Common reasons for relapses include not reducing debt sufficiently in the initial bankruptcy or failing to shed unprofitable parts of the business, leading to failure when interest rates rise or inflation drives up costs.

Macro Chart In Focus

Analyst Team Note:

Significant parallels exist between the post-WWII era and today, with both characterized by an interventionist Fed, higher-than-average public deficits, and excessive increases in the money supply. This facilitated high nominal GDP growth and eventually, very high inflation. The post-WWII era saw slowing monetary growth leading to disinflation and deflation, and so far, the post-pandemic era has followed a similar trend.

In both eras, the Fed has essentially acted as an agent of the U.S. Treasury, directly or indirectly financing the federal government's spending. In the current era, the Fed has indirectly financed stimulus payments to American citizens affected by the coronavirus. The outcome of these actions has been large deficits financed by a sizable increase in central bank balance sheets, leading to significantly higher money supply and high inflation with a lag. As money supply growth has gone negative and other factors have contributed to disinflationary trends, the peak of the inflationary spike may be behind us.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

The US consumer price index rose by 4.9% in April, the first sub-5% reading in two years, indicating that inflation is moderating. This potentially gives the Federal Reserve room to pause interest-rate increases soon.

Used car prices were the main driver of core goods inflation (+0.6% m/m). Core goods excluding used cars rose by just 4bps, its lowest reading since February 2021. This reflected deflation in household furnishings, new cars, other recreational goods, and education and communication goods. While this is just one month of data, it could be the start of broader goods price deflation given the improvement in supply chains and softening demand.

Chart That Caught Our Eye

Analyst Team Note:

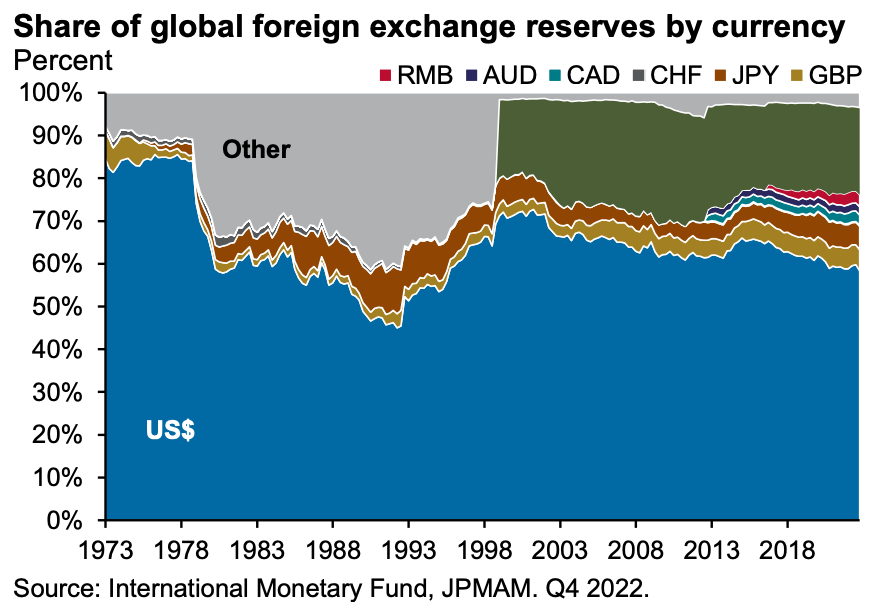

The dollar’s role in foreign exchange markets is mostly unchanged over the last 20+ years; in 2022 the dollar accounted for ~89% of all FX transactions. In other words, the dollar was involved on one side or the other in 89% of all global transactions.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.