4.8.24: Wall St. Remains Bullish as Wells Fargo Upgrades SPX Target to 5535

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 5209.86

KWEB (Chinese Internet) ETF: $26.66

Analyst Team Note:

Wells Fargo recently increased its 2024 target for the S&P 500 Index to 5,535, the highest among Wall Street forecasts tracked by Bloomberg.

It attributes this bullish outlook to the transformative potential of AI technology, an improved earnings landscape, and a shift in investor behavior towards longer-term growth prospects and higher valuation thresholds.

Despite potential volatility and systemic risks associated with increased risk-taking and leverage, Wells Fargo anticipates a "melt-up" in market performance in the latter half of the year, supported by favorable political developments and anticipated multi-year interest rate cuts.

Macro Chart In Focus

Analyst Team Note:

In March, the US labor market saw a significant boost with nonfarm payrolls surging by 303,000, the most substantial increase in nearly a year, surpassing all economist expectations.

Key sectors driving this growth included health care, construction, and leisure and hospitality, with the latter recovering beyond its pre-pandemic levels.

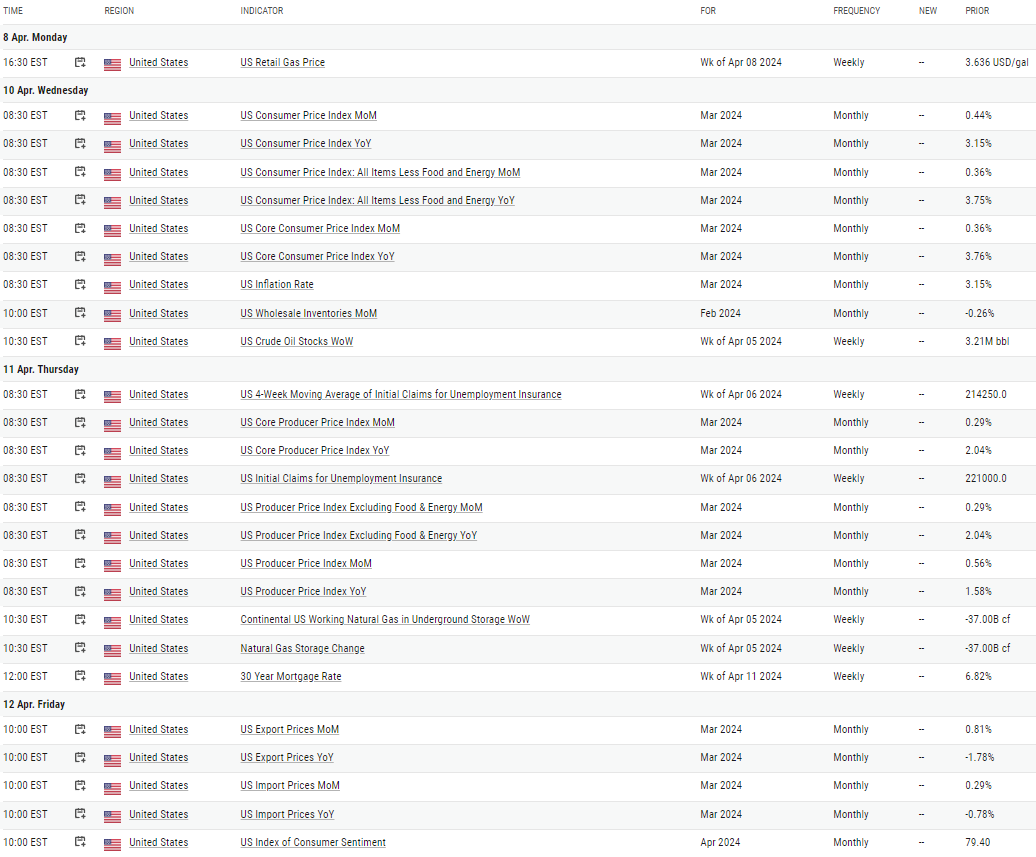

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

In March, the Federal Reserve's Survey of Consumer Expectations found that while US consumers' short-term inflation expectations remained stable at 3%, concerns about debt repayment capability are escalating, particularly among the 40 to 60 age group.

Despite a stable outlook for the coming year, the forecast for inflation over a three-year period slightly increased to 2.9%, contrasting with a dip in the five-year expectation to 2.6%.

Notably, the concern over missing minimum debt payments surged to 12.9%, the highest since the pandemic's start, driven by a combination of high interest rates and sustained inflation.

Chart That Caught Our Eye

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.