4.29.24: Fed Expected to Tilt Hawkish as Hedge Funds Buy Tech at Record Pace

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Interactive Brokers allows us to trade China/H-Shares which many other brokerages do not offer. Idle cash earns 4.8%.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 5112.59

KWEB (Chinese Internet) ETF: $28.64

Analyst Team Note:

Tech stocks saw the largest net buying by hedge funds since December 2022, driven by an increase in long positions and short-covering. Hedge funds have been net buyers of the sector for 4 straight weeks, which has been in decline for most of April.

According to Goldman, hedge fund allocation to semiconductors in particular jumped to 4.4% of overall US stock allocation, the highest level in more than 5 years.

Macro Chart In Focus

Analyst Team Note:

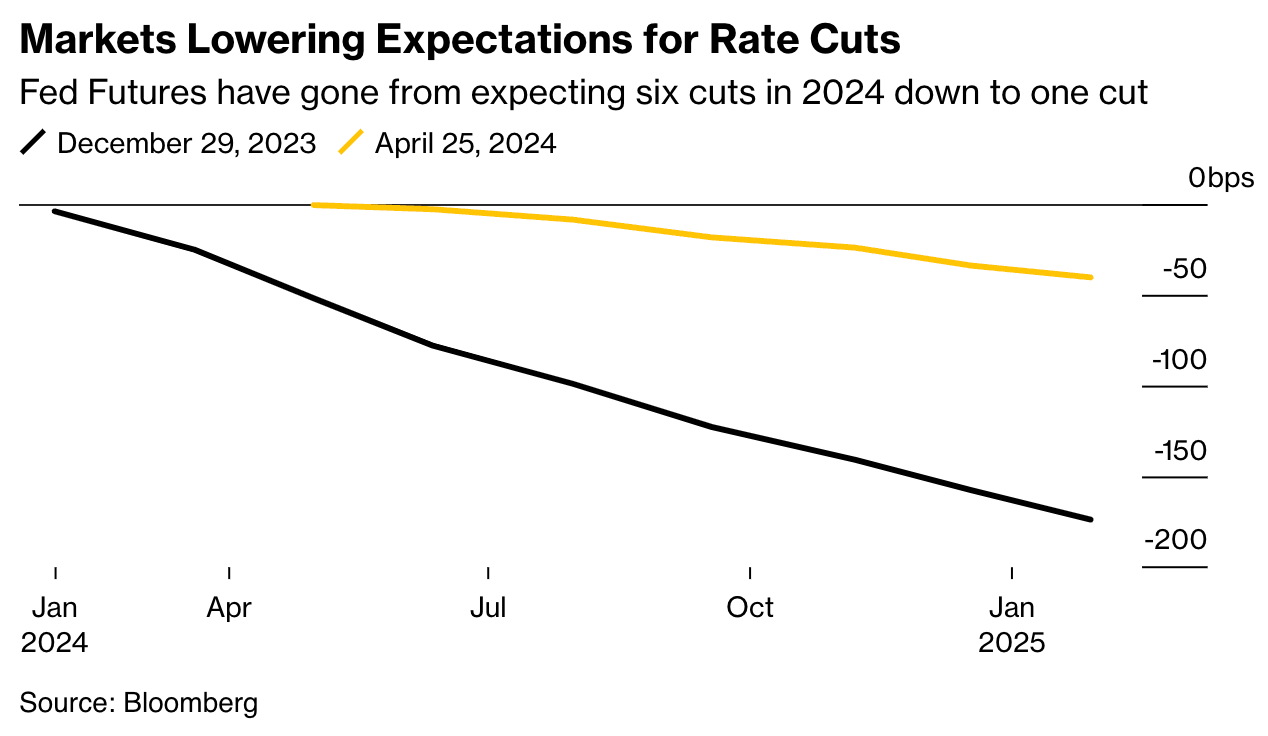

Markets have shifted expectations for Fed cuts this year from 160 basis points in forecasts at the end of 2023 to 35 basis points in late April.

According to Bloomberg’s Fed sentiment index, the Fed is expected to continue leaning hawkish in upcoming FOMC meetings.

“That raises the question, will the Fed have to deliver more hawkish surprises in order to tighten financial market conditions, and bring disinflation back on track? In our view, the answer is yes. And that process could start as soon as this Wednesday’s press conference.” - Bloomberg

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

“With initial jobless claims low and moving sideways, we don't expect the recent momentum in the labor market to slow. Moreover, catch-up effects in certain industries continue to buoy job growth.” - BofA

Chart That Caught Our Eye

Analyst Team Note:

According to BestEx Research, an trading algo developer, about a third of all S&P 500 stock trades are now executed in the final 10 minutes of the session, up from 27% in 2021.

Some academics hypothesize that passive funds may be buying at the close because the cost of making such large transactions would be less than what liquidity providers charge earlier in the day.

Assets in passive equity funds have surged over the past decade to more than $11.5 trillion in the US alone.

Sentiment Check

Make sure to check out our latest Youtube Videos: