4.24.23: Buy The Dip Apparently Never Fails! But is any Pattern going to last indefinitely?

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: Over the weekend, I provided a parameters to Members on themes and names that I’m focused on in the upcoming weeks ahead. Tactical opportunities for alpha is returning to the China Internet trade for experienced investors who are familiar with this theme, and my plan is highlighted inside my strategy note.

China is in fact one of the most difficult themes to trade, but we have done it before, and we plan to do so again. We do not believe China is a safe theme for Buy & Hold investors. I believe it’s only suitable for Traders ready to buy at X and exit at Y.

That said, tread carefully. The sector tends to gap up and down and that means one day can make all the difference.

Be back with more premium updates later this week. Public readers should join our Community using the link below. Special annual plan provided. Thoughtful & generous preview provided in the Note.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash (yielding 4%+ on idle cash) at Interactive Brokers

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4133.52

KWEB (Chinese Internet) ETF: $28.31

Analyst Team Note:

Week 2 of earnings is now behind us.

88 S&P 500 companies, 25% of S&P earnings, have reported.

68% beat on EPS so far, down from a record 90% last week, but still above the historical post-Week 2 avg. of 63%. 75% beat on sales (vs. 59% historical avg.) and 55% beat on both sales and EPS (vs. 44% avg.).

1Q EPS is 0.4% ahead of consensus, but in-line ex-Financials.

Macro Chart In Focus

Analyst Team Note:

Tightening credit conditions could lead to further tightening, which has historically impacted S&P 500 sales growth with a lag of about two quarters. This implies that we may see a slowdown in sales growth going forward. Industries like durable goods and capital expenditure beneficiaries have been most affected by tighter credit, while defensive sectors and some retail segments have experienced minimal impact.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

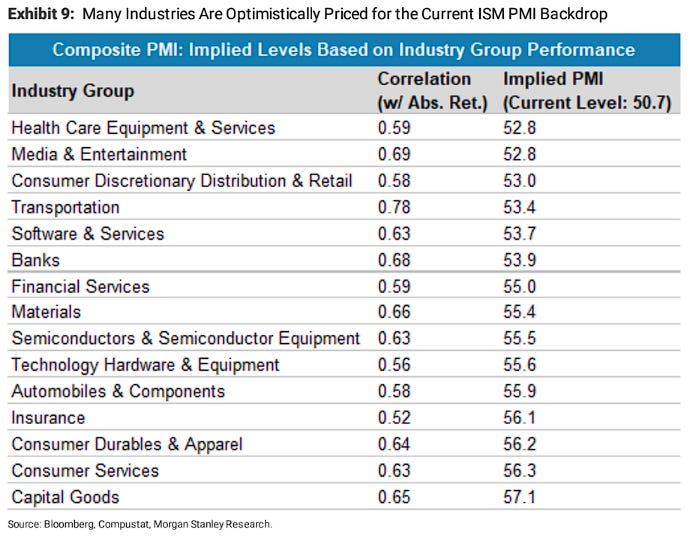

Many technology subgroups and sectors look quite expensive relative to ISM PMI surveys.

Chart That Caught Our Eye

Analyst Team Note:

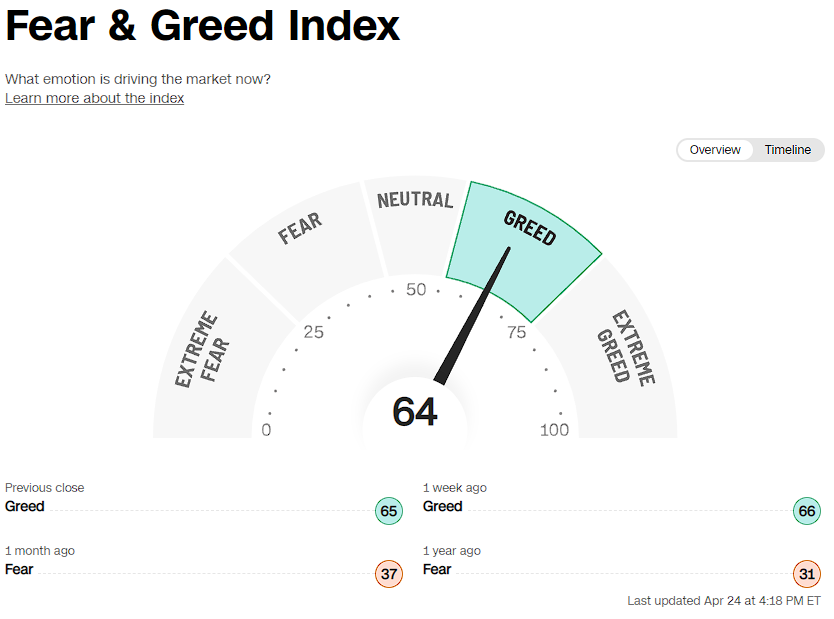

The most expected recession ever.

The good news is everyone is talking about the bad news. News trends and recession likelihood barometers are at levels only seen during actual recessions.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.