4.21.23: Bulls tell Bears one clear simple message - "Tesla Disappointment Won't Stop Us. Not Yet."

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers: As mentioned in yesterday’s Public Email, I didn’t believe that yesterday was the beginning of an onslaught of further selling. While the day when Bears come back in full force will come, I didn’t believe that Tesla earnings would be the catalyst.

Have an amazing weekend. I will be researching all weekend ahead of FAAMG earnings next week, and will send a concise strategy note to members by early next week with fundamental/technical setups and opportunities in U.S. & China names. Stay tuned and updated with my latest analysis on markets.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash (yielding 4%+ on idle cash) at Interactive Brokers

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4129.79

KWEB (Chinese Internet) ETF: $28.91

Analyst Team Note:

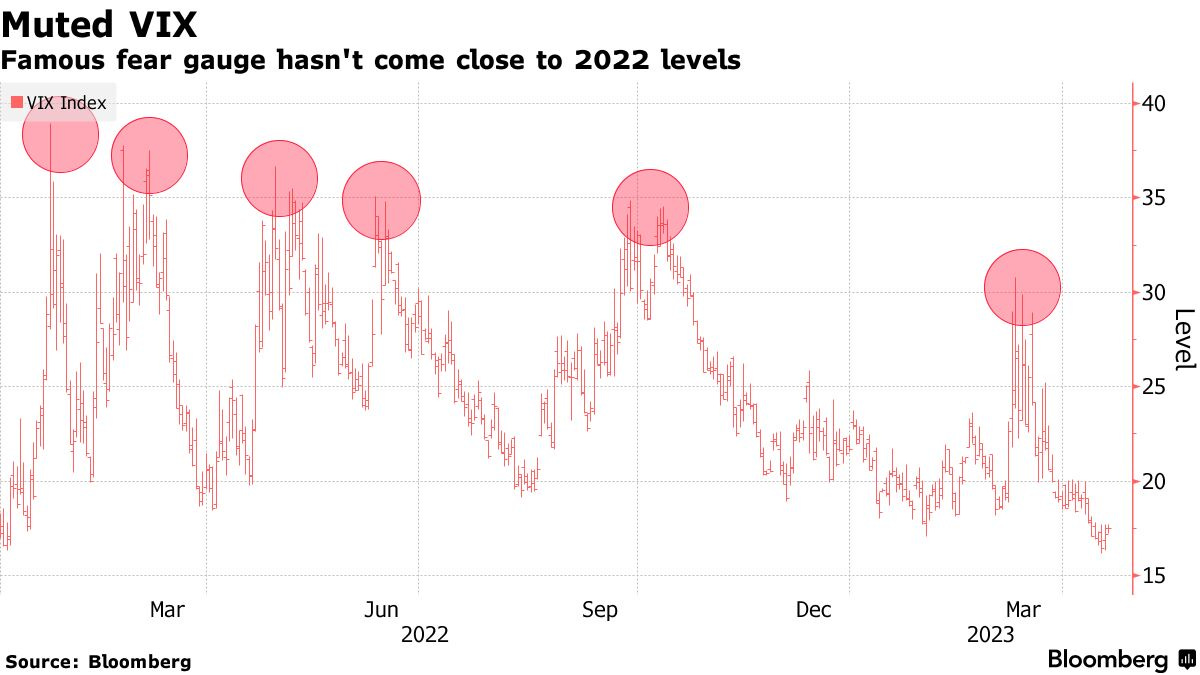

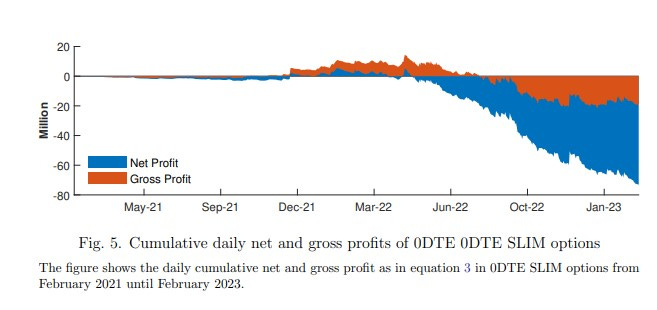

The surge in popularity of zero-days-to-expiration (0DTE) options has led to concerns about the effectiveness of the Cboe Volatility Index (VIX) as a market sentiment indicator. As a result, Cboe Global Markets is launching a new one-day version of the VIX, the Cboe 1-Day Volatility Index (VIX1D), to better capture the near-term sentiment. With the growth in 0DTE options trading, the VIX1D may offer investors and traders a more accurate reflection of current market volatility, as the existing VIX relies on options with expirations 23 to 37 days into the future.

Macro Chart In Focus

Analyst Team Note:

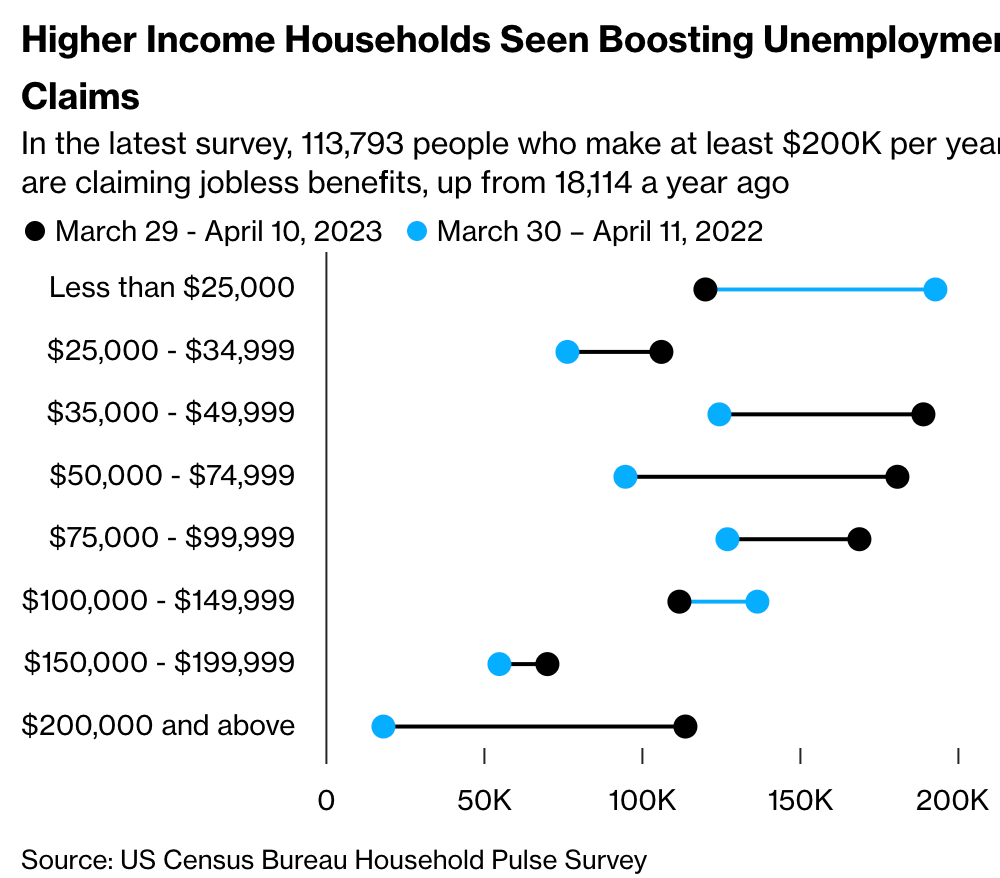

A recent Census Bureau survey reveals a significant increase in the number of high-income Americans collecting unemployment insurance benefits, with a sixfold surge in the past year. Approximately 113,800 adults from households earning at least $200,000 annually reported receiving benefits, up from 18,100 the previous year. This trend may be a result of layoffs impacting white-collar sectors such as tech and finance. Furthermore, 84% of the roughly 1.4 million individuals who reported receiving benefits in the last seven days supplemented government assistance with credit card debt, savings, retirement account withdrawals, or selling possessions to meet their needs.

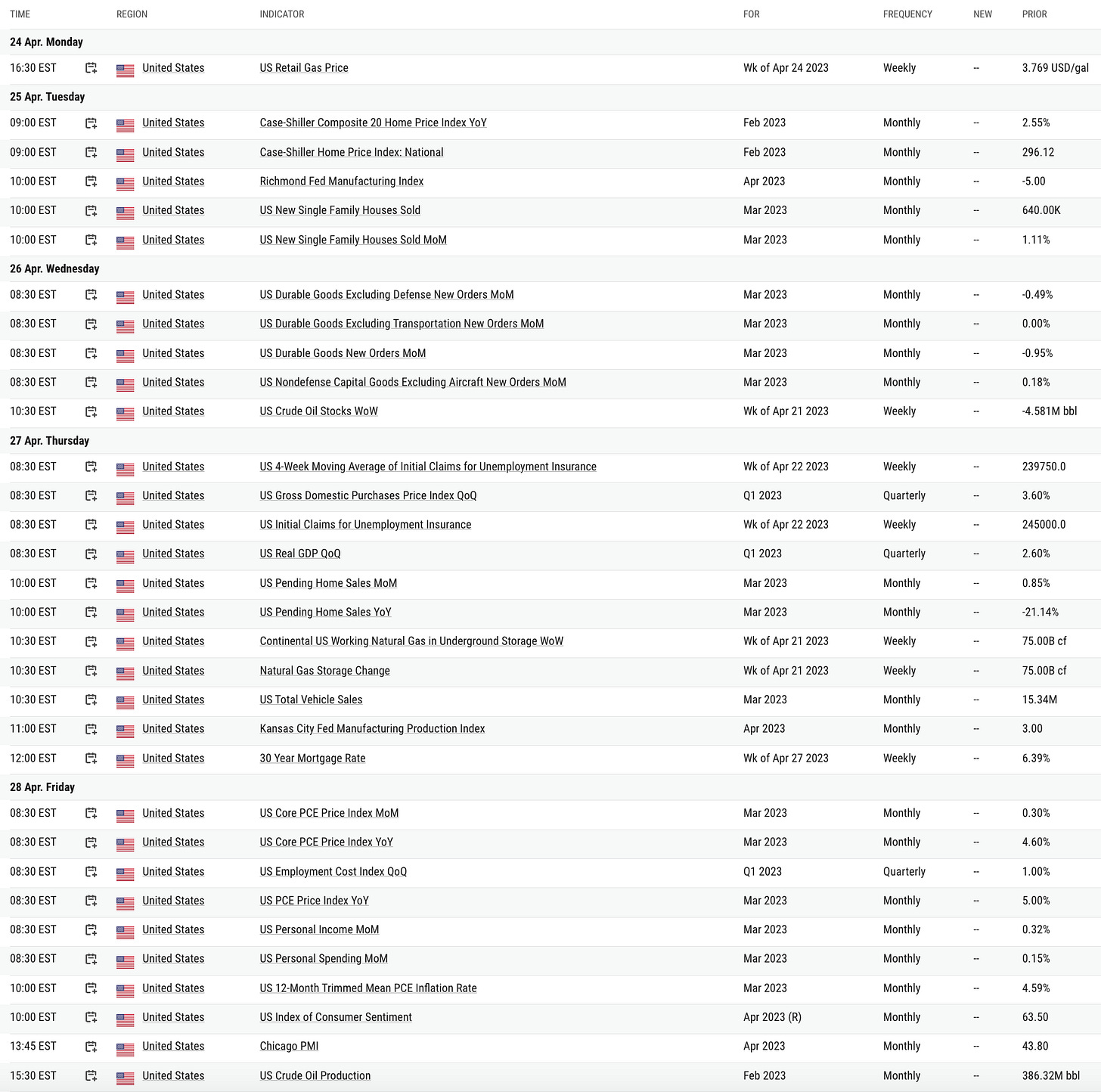

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

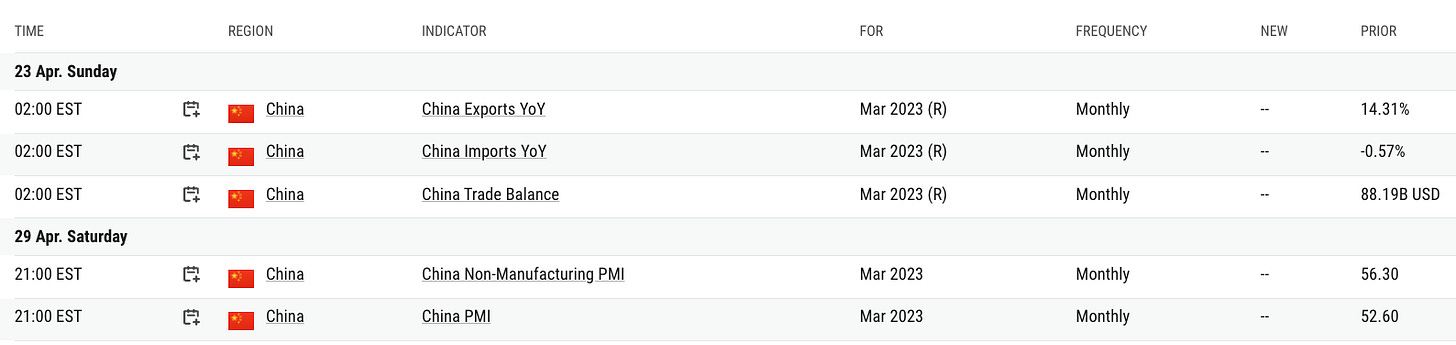

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

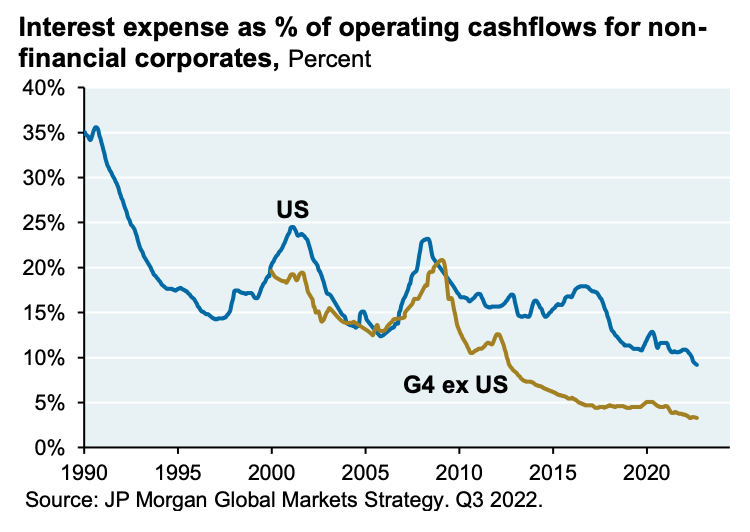

Many US and global companies termed out their fixed rate debt and have the lowest interest expense to cash flow in decades. Per JP Morgan, some companies may not feel a material impact from rising interest rates until 2030.

Turning to households, their obligations (debt, leases, property taxes and rents) are still very low relative to disposable income, suggesting any slowdown or recession would be a modest one.

Chart That Caught Our Eye

Analyst Team Note:

A recent study from the University of Muenster in Germany highlights the significant losses faced by small-time investors participating in the trading frenzy of 0DTE options, which have zero days to expiration. Since May 2022, when daily trading of expiring contracts became possible, amateur investors have reportedly lost an average of $358,000 per day. This comes as a cautionary tale for investors and regulators, as these high-risk, high-reward bets offer the opportunity to make or lose substantial amounts of money.

According to the study, retail investors' market share in 0DTE trading volume increased to 6% in 2022, up from 4% the previous year. Despite their popularity, these options have largely failed to pay off for traders, with day traders losing $20 million due to poor positioning over a two-year period through February 2023.

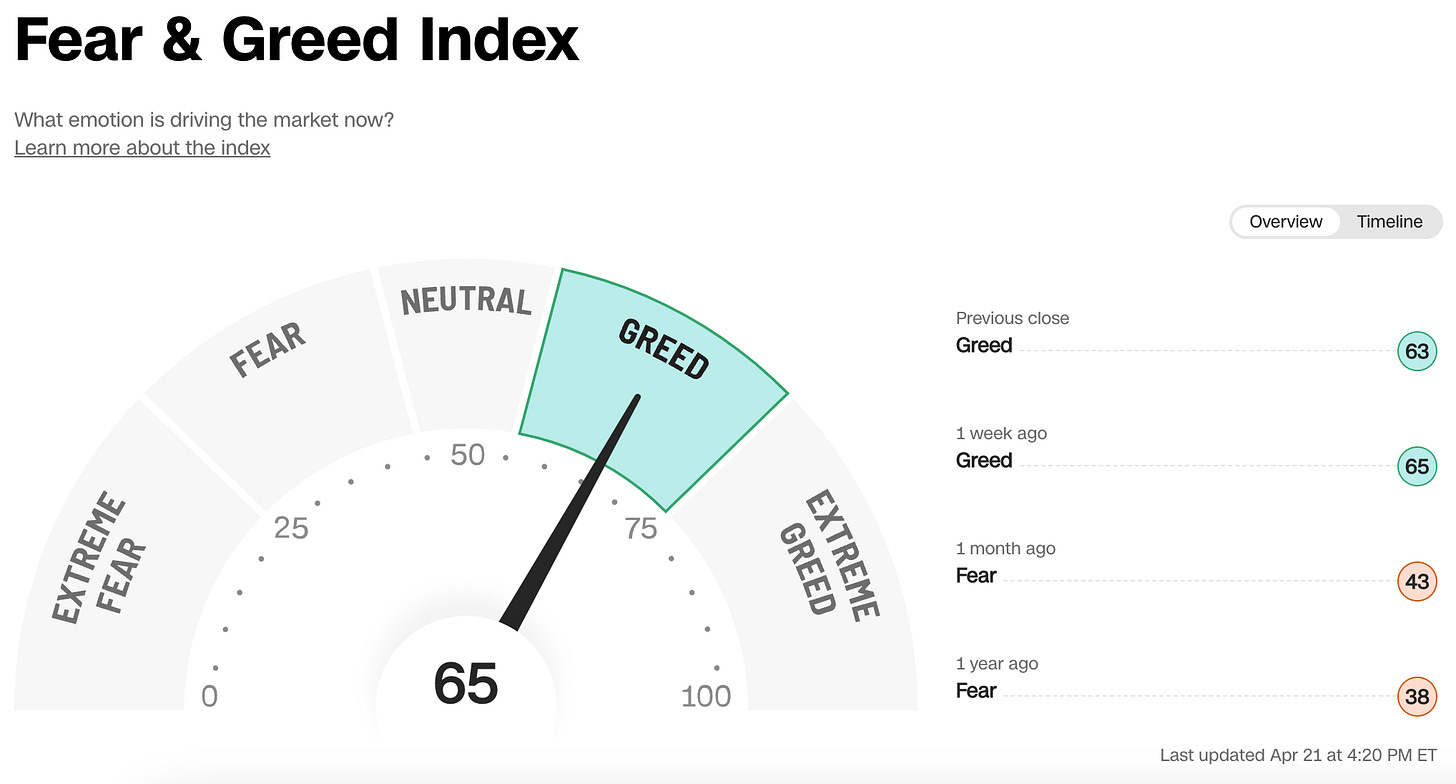

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.