4.17.23: Every Single Intraday Dip Has Been Bought, sending VIX to the 16 Region ahead of Critical Earnings

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: While I believe there are temporary tactical long opportunities in the market on an individual company level (such as TCOM as discussed inside our Private Community at 35), we believe levels in the broader indexes are quite unattractive.

In addition, several names from our Non-US signals radar in Europe are starting to demonstrate relative weakness (read more here). In our latest private community note, I discuss several Non-US names/themes that I believe offer clues to the next move for the S&P 500.

Our understanding is that certain Semiconductor companies within SOXX (discussed inside) will show its hand before end market names like NVDA truly react. So far, these companies are also showing the type of weakness that I believe will prove to be a prelude to a broader adverse turn in SOXX.

Like any major Turn in markets, this may take quite some time.

There appears to be a Group of Buyers in the market that that driving up shares/names/ETFs over the past 5-7 sessions on every intraday dip on smaller timeframes.

Due to low volume, I personally believe that this type of price action suggests that a small group of powerful People/Funds/Firms are controlling market action with the FAAMG Stocks.

Will discuss more inside Private Community once there’s market-moving earnings outcomes that changes this type of strange accumulation behavior. The Community is offered at a Globally Accessible level. Public readers should join while VIX is still at 16. By the time VIX is at 25 or 30+, the best Moves will be taken by people who planned ahead of time.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash (yielding 4%+ on idle cash) at Interactive Brokers

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4137.64

KWEB (Chinese Internet) ETF: $28.90

Analyst Team Note:

Recession drawdowns have ranged from 14% to 57%. The avg. drop has been 32%. As of the Oct 2022 bottom, the S&P 500 has lost 25% peak to trough vs. the Jan 2022 high, putting the depth of the decline in 2022 on par with a mild recession.

Typically, the stock market bottoms 4-5 months before a recession ends though it’s taken as long as 9 months. An Oct 2022 bottom is plausible from a timeline perspective if any coming recession is concentrated in 2023. But if a longer recession, or one that is concentrated in 2024, materializes, this raises the risk of putting in a new low late this year or early next.

Macro Chart In Focus

Analyst Team Note:

Following a light Week 1, 30 S&P 500 companies (including early reporters) comprising 10% of earnings have reported. Results have been solid: 90% of companies beat on EPS, 73% on sales, and 67% on both, well above last quarter’s 54%/83%/46% post-Week 1 and the historical average of 67%/64%/48%. Fueled by bank beats, 1Q EPS is tracking a 30bp surprise.

Big banks’ solid results (JPM, C, WFC beat on revenue and EPS) despite March’s bank scare helped performance. JPM saw increased deposits vs. peers declining 3% in 1Q23 but warned on outflows from here. Other non-banks benefited from March’s regional outflows – e.g. mega-cap Blackrock saw $40B+ inflows into cash-management products. Banks may be tightening credit standards, but larger ones are operating with excess capital vs. prior crises. JPM/WFC bought back stock in 1Q and expects to continue in 2023, an increasingly scarce positive amid potentially slowing buybacks in general.

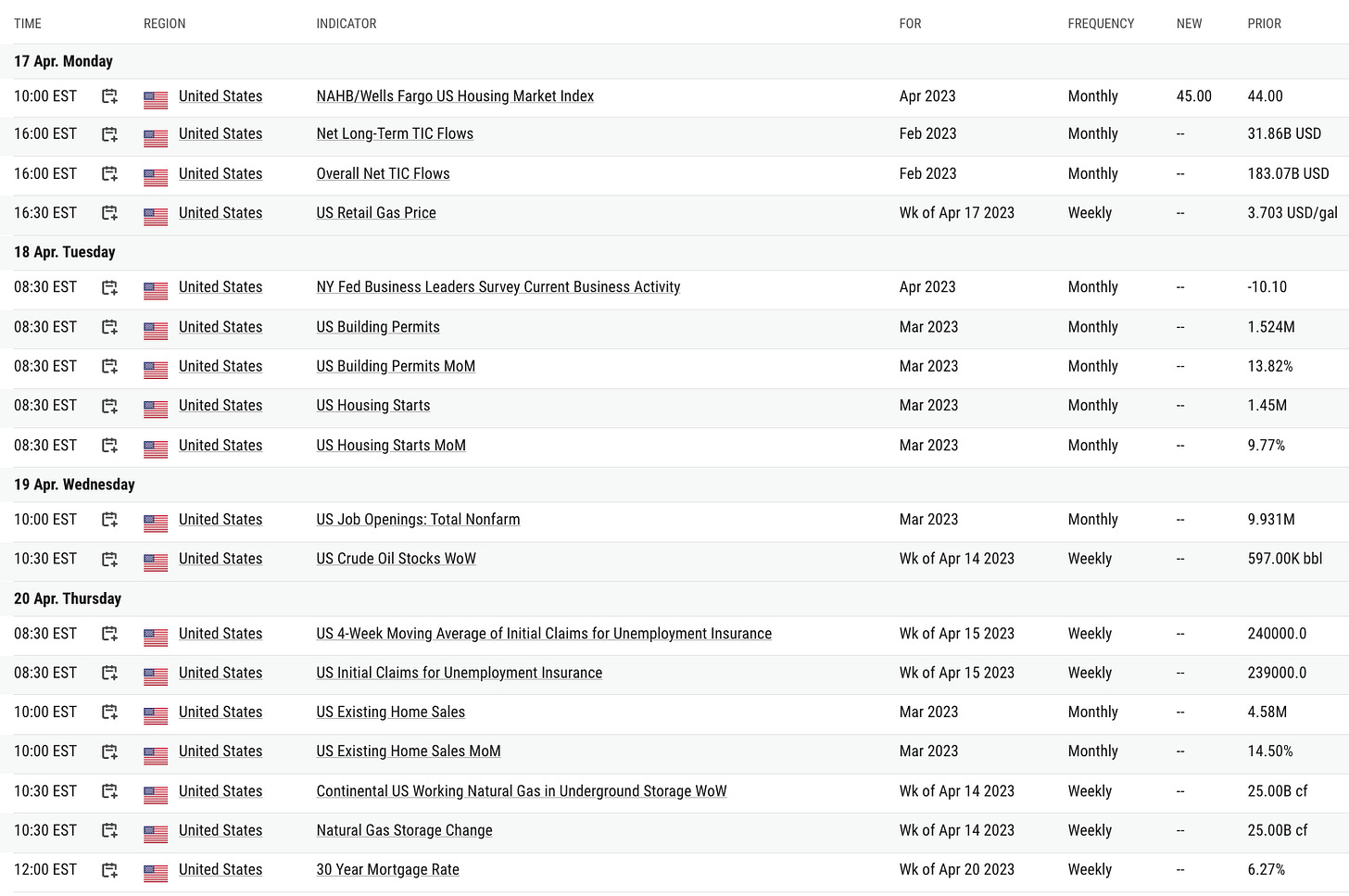

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

In April, New York state manufacturing activity experienced an unexpected expansion for the first time in five months, with new orders and shipments showing significant improvement. The Fed's general business conditions index surged to 10.8, the highest since July, exceeding all expectations.

Chart That Caught Our Eye

Analyst Team Note:

Overall equity positioning has moved higher over the past weeks, but we are still not even at neutral. There is still room for the pain trade to continue.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.