4.16.24: Retail Sales Exceeds All Expectations as Consumer Resilience Continues

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 5061.82

KWEB (Chinese Internet) ETF: $25.96

Analyst Team Note:

30 S&P 500 companies (10% of index earnings) have reported so far. Reported EPS beat by 6%, driven by Financials (+0.7% ex. Fins) and 80% beat on EPS vs. 67% post-Week 1 average.

Q1 consensus EPS is down 2% since April 1.

Consensus now expects just 1% EPS growth (vs +8% YoY in 4Q) despite easier comps.

Macro Chart In Focus

Analyst Team Note:

In March, U.S. retail sales exceeded expectations, rising by 0.7% from February, with non-auto and gasoline sales increasing by 1.0%.

This performance, bolstered by gains in e-commerce and spending at restaurants and grocery stores, suggests that consumer spending still remains strong as we enter Q2.

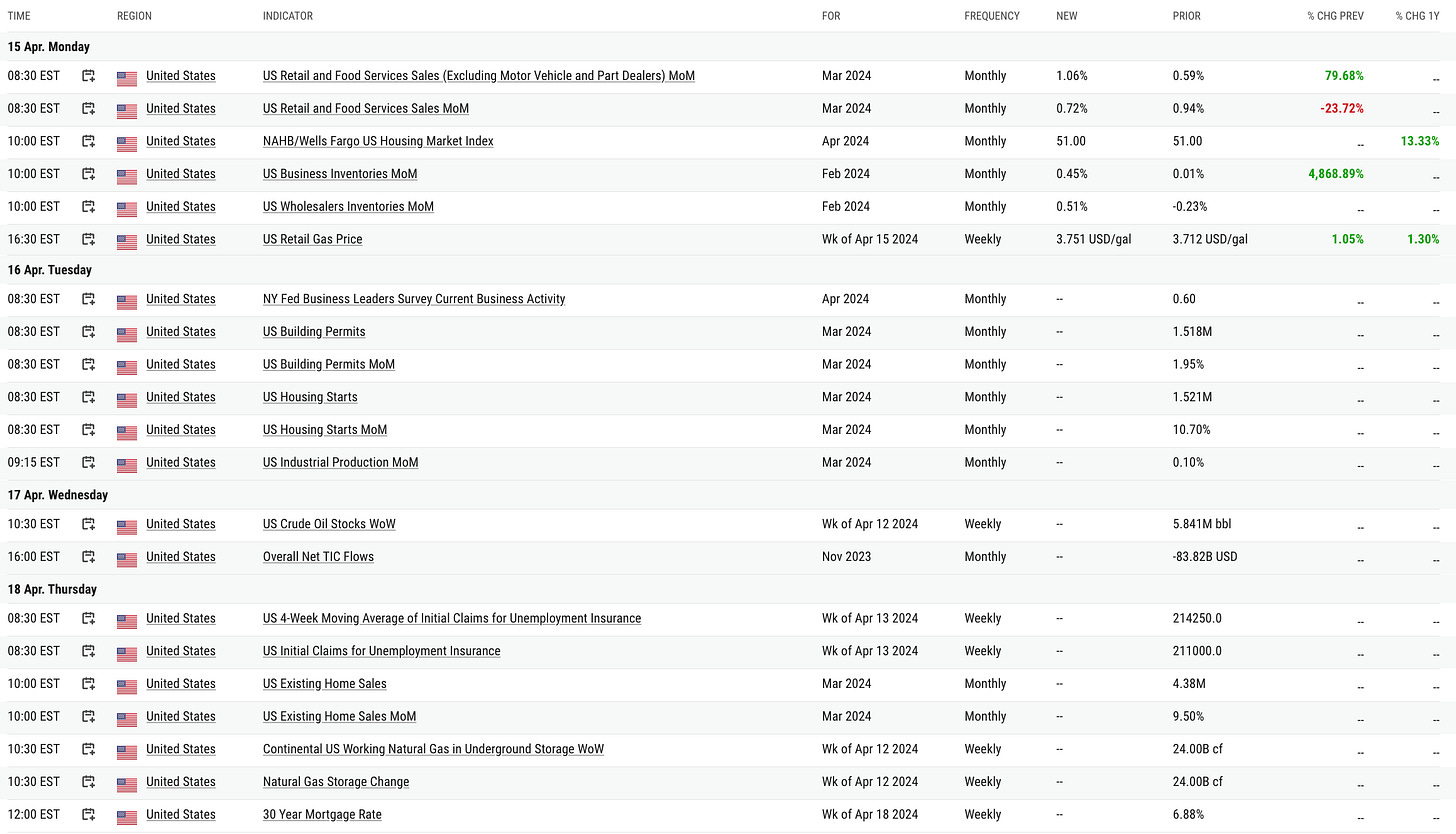

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

In the latest quarterly survey by The Wall Street Journal, economists lowered the chances of a recession within the next year to 29% from 39% in the January survey.

This was the lowest probability since April 2022, when the chances of a recession were set at 28%.

Economists also expect growth to bottom out this year at an inflation-adjusted 1.4% in the third quarter. Just 10% of survey respondents think the economy will experience at least one quarter of negative growth over the next 12 months, down from 33% in January.

Chart That Caught Our Eye

Analyst Team Note:

The premium for one-month put options to protect against a pullback in US equities reached the highest since October.

The skew on the VIX index has shown growing demand for calls as traders position for protection. For one-month options, the skew is the highest since October.

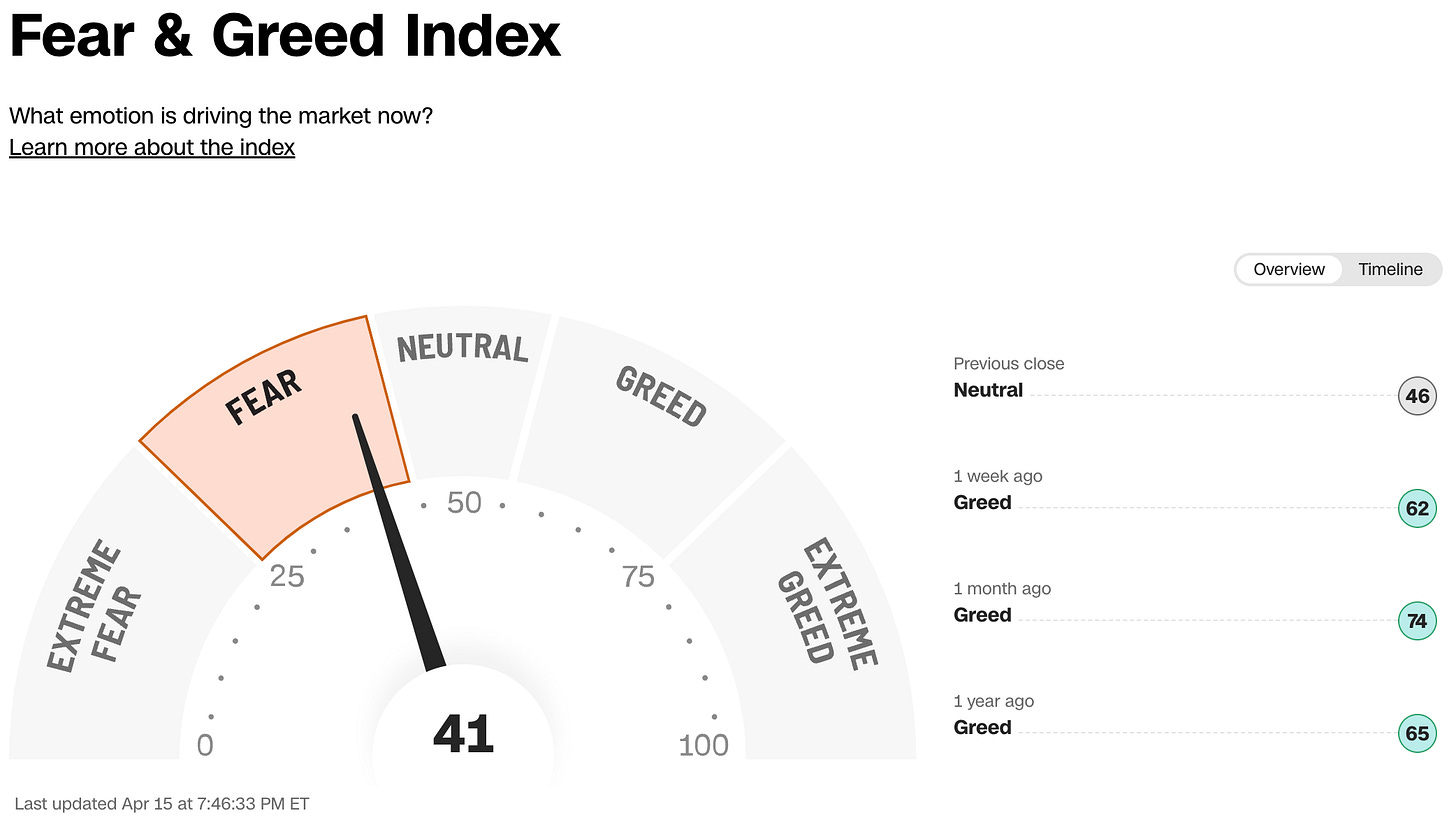

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.