4.14.23: It Appears that Bulls are Unstoppable. Will this strength last for rest of Earnings Season?

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: Bulls have done everything they can to shatter negative sentiment, and they have been successful. If they can survive this earnings season without a large stumble, Bears will have to reduce their 2023 downside target ranges as the fundamental catalysts to drive markets lower dissipates.

The price action has been incredibly favorable for Bulls - in most objective assessments of the landscape.

My next strategy update will discuss other, less followed signals that we can follow to get an informed opinion on U.S market direction. Stay tuned.

Investors who are intensely Bullish or Bearish may want to recognize a 3rd scenario: a directionless, choppy market that challenges directional investors with “death by 1000 cuts”.

If we are indeed entering a low-volatility era (still not yet fully confirmed), I will discuss new positioning strategies within our Community inside Substack and Patreon. In this environment, we are given quite some time to plan ahead - best to use it while calmness is here.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash (yielding 4%+ on idle cash) at Interactive Brokers

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4146.22

KWEB (Chinese Internet) ETF: $29.40

Analyst Team Note:

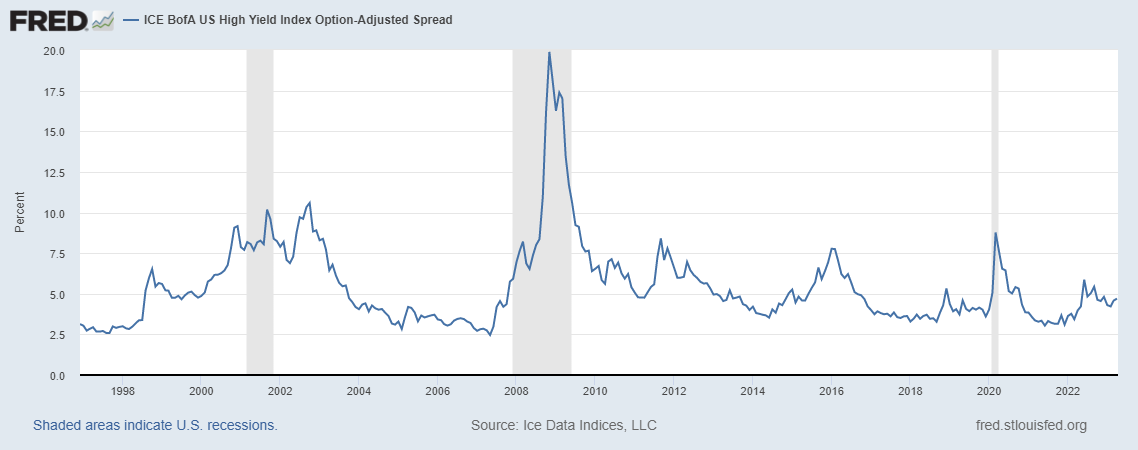

A relative peak in high yield bonds vs. investment grade indicates a risk-off signal for equities. And like we’ve discussed before, HY spreads are still quite tight.

Macro Chart In Focus

Analyst Team Note:

In March, a larger number of US small businesses reported increased challenges in obtaining loans, following multiple bank failures that resulted in stricter credit conditions. According to a National Federation of Independent Business survey released on Tuesday, a net 9% of frequent borrowers indicated that securing financing had become more difficult compared to three months prior, marking the highest level since December 2012. The same percentage of respondents anticipates more stringent credit conditions in the upcoming three months, which equals the highest level observed in ten years.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

In the past 70 years, whenever manufacturing ISM dropped below 45, a recession occurred 11 out of 12 times. New orders ISM <45 coincide with EPS recessions.

Chart That Caught Our Eye

Analyst Team Note:

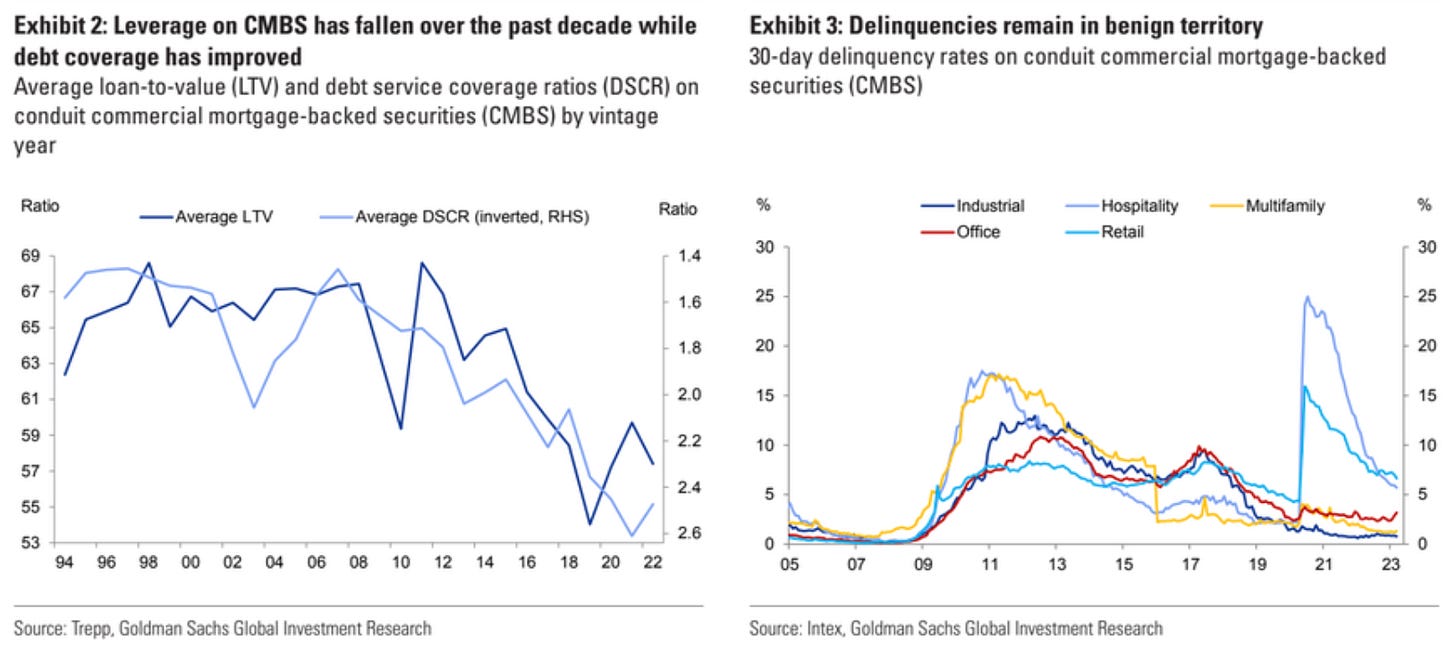

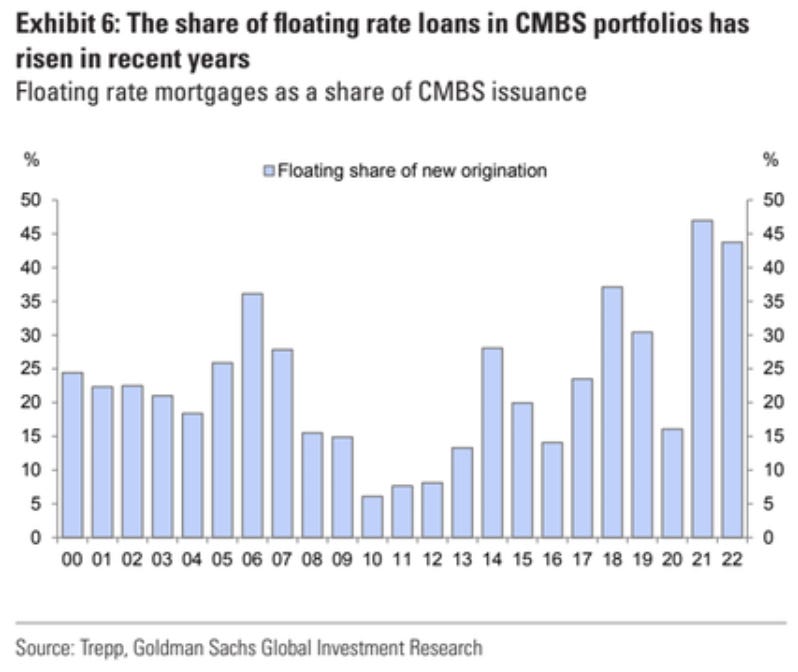

While leverage and delinquencies on commercial mortgage backed securities have both declined relative to history, the share of floating rate loans in CMBS portfolios has risen over the past 5 years.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.