4.13.24: Bank Stocks Decline as Interest Income Begin to Normalize

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 5,123.41

KWEB (Chinese Internet) ETF: $26.15

Analyst Team Note:

JPMorgan experienced its first quarterly decline in NII in nearly three years, with CEO Jamie Dimon suggesting that the high earnings from elevated interest rates are likely to normalize rather than increase. This announcement led to the worst decline in JPMorgan's stock since June 2020.

As inflation remains persistent, it raises the likelihood of delayed interest rate cuts by the Fed, complicating the outlook for bank revenues from lending.

Macro Chart In Focus

Analyst Team Note:

Fed Bank of San Francisco President Mary Daly said there is absolutely no urgency to adjust interest rates given a strong labor market, robust consumer spending, and a slower pace of moderation in inflation in recent months.

“There’s absolutely, in my mind, no urgency to adjust the policy rate… Policy is in a good place right now, and I need to be fully confident that inflation is on track to come down to 2% — which is our definition of price stability — before we would consider a rate cut.”

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

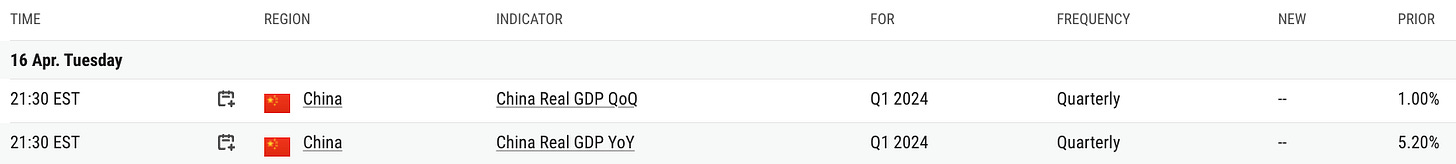

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

China's exports decreased by 7.5% in March, underscoring concerns about the country's economic recovery, as both exports and imports fell short of expectations.

Despite some earlier positive signs, such as a pick-up in manufacturing and new export orders, the latest data suggests weak domestic demand.

Chart That Caught Our Eye

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.