4.12.23: The Next 4 Weeks will be Epic. It's Judgement Time.

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: Everything so far is going according to plan.

Inflation CPI was actually softer than expected, yet key names within the Indexes struggled to hold their composure. What does that suggest?

I know what that suggests - and it isn’t constructive for those who haven’t planned ahead.

The next 4 Weeks will include 85% of S&P 500 Market Cap names having reported Earnings. This is the perfect time to plan ahead to tactically find alpha while protecting your capital as best as possible. Planning ahead is something that most people simply don’t do. Being prepared is nearly assured to provide you stronger psychological readiness when difficult conditions return - which they will.

Our Investment Community is globally accessible, and we are about to assess any market dislocations that this Earnings Season is about to bring upon us. Get prepared today with us on Substack or on Patreon (same Investment Community - hosted on different platforms). The long-term benefit relative to the cost is asymmetrical to Investors who would consider themselves patient and have at least 1 year of experience in markets.

My work may not be fully suitable for a complete beginner who knows nothing about investing.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash (yielding 4%+ on idle cash) at Interactive Brokers

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4105.94

KWEB (Chinese Internet) ETF: $29.97

Analyst Team Note:

Bloomberg Intelligence's compilation of analyst estimates suggests that profits from S&P 500 companies may decline to $50.62 per share in the January-March timeframe. This would represent the largest profit drop since the 31% decrease experienced during the pandemic lockdown.

As the earnings reporting period approaches, with major Wall Street banks set to release their results later this week, analysts have reduced their profit expectations. Over the past three months, anticipated earnings for this quarter have decreased by more than 6%, marking the third consecutive quarter with such significant reductions.

Despite all this, the S&P 500 has had the best pre-earnings performance since early 2009.

Macro Chart In Focus

Analyst Team Note:

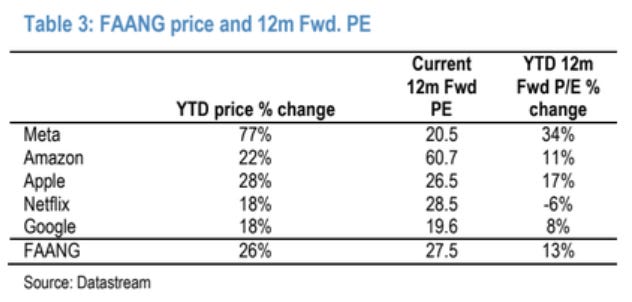

FAANG outperformance YTD has mainly been due to multiple expansion, and not because of earnings. Expect some mean reversion as Tech hits relative highs to the broader S&P 500.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

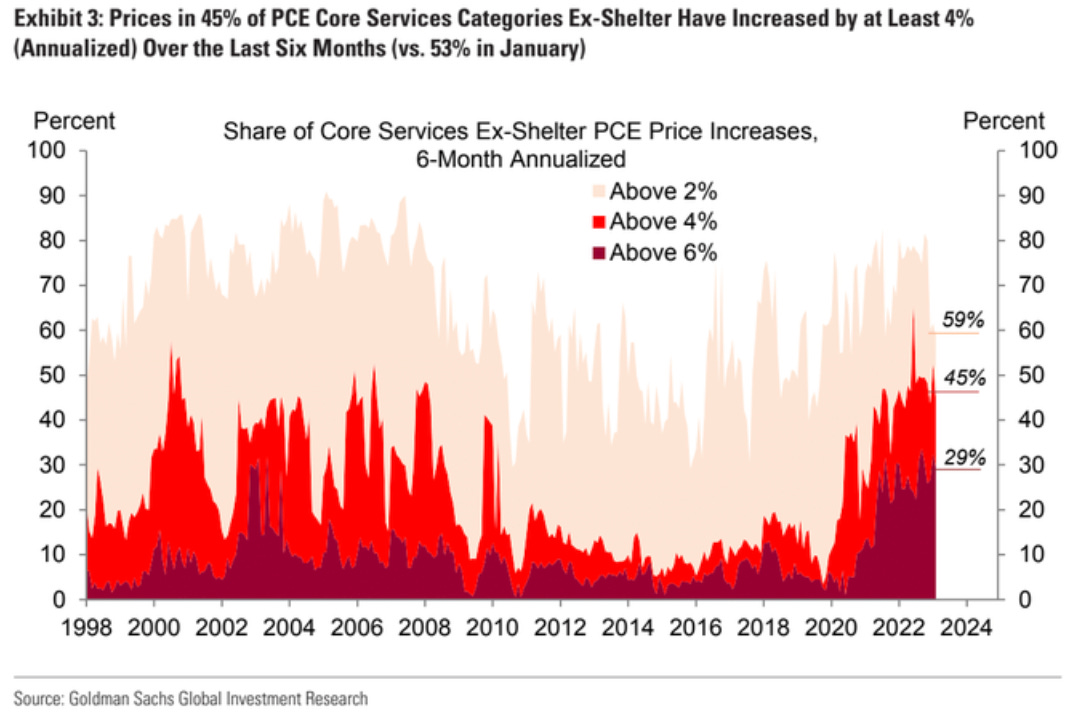

Inflation remains sticky.

45% of PCE core services categories have increased by at least 4% over the last 6 months. In addition, the % of CPI sub-sectors where the 3-month % change is greater than the 12-month % change remains high relative to history.

Chart That Caught Our Eye

Analyst Team Note:

Best options strategy since 2022? Buying 1-month 100%/95% put spreads.

This means buying a put option with a 100% strike price (at-the-money) and selling a put option with a 95% strike price (out-of-the-money). Put spreads help limit the cost and risk of the trade as the selling of the 95% put partially offsets the cost of buying the 100% put.

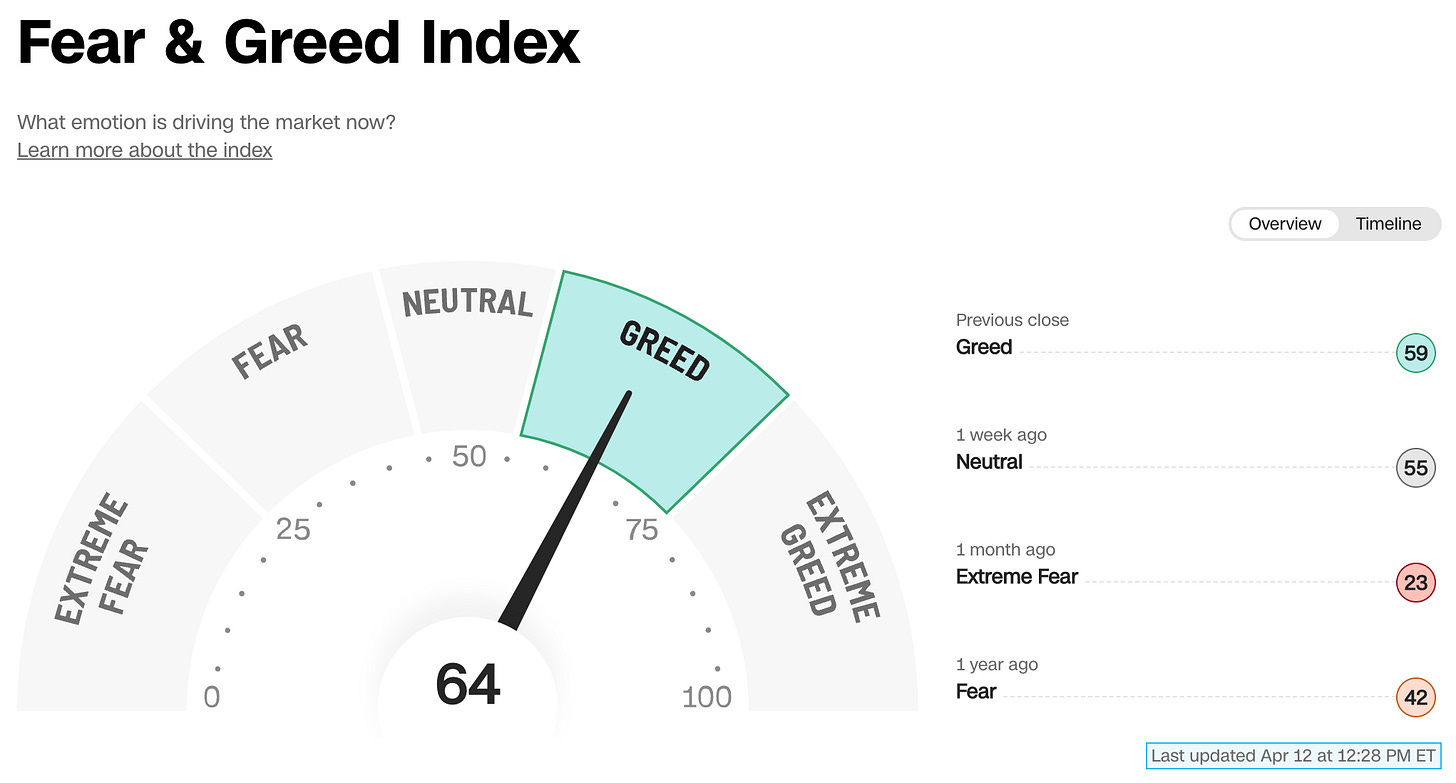

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.