4.10.24: Core CPI Tops Estimates Yet Again

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 5,147.49

KWEB (Chinese Internet) ETF: $26.92

Analyst Team Note:

Taiwan is experiencing a remarkable investment boom, particularly in ETFs, fueled by surging interest in AI stocks and significant gains by major companies like Taiwan Semiconductor Manufacturing.

The local ETF market has grown dramatically, with retail investors making up 80% of equity fund assets, a distinct contrast to Japan and China where government and central bank purchases dominate.

Macro Chart In Focus

Analyst Team Note:

Core CPI in the US rose by 0.4% from February and marked a 3.8% increase from the previous year, indicating persistent inflationary pressures and likely postponing any Federal Reserve interest rate cuts.

Despite a strong labor market and household demand, this third consecutive month of higher-than-expected core inflation, particularly in services and shelter costs, suggests inflation may not be cooling as hoped.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

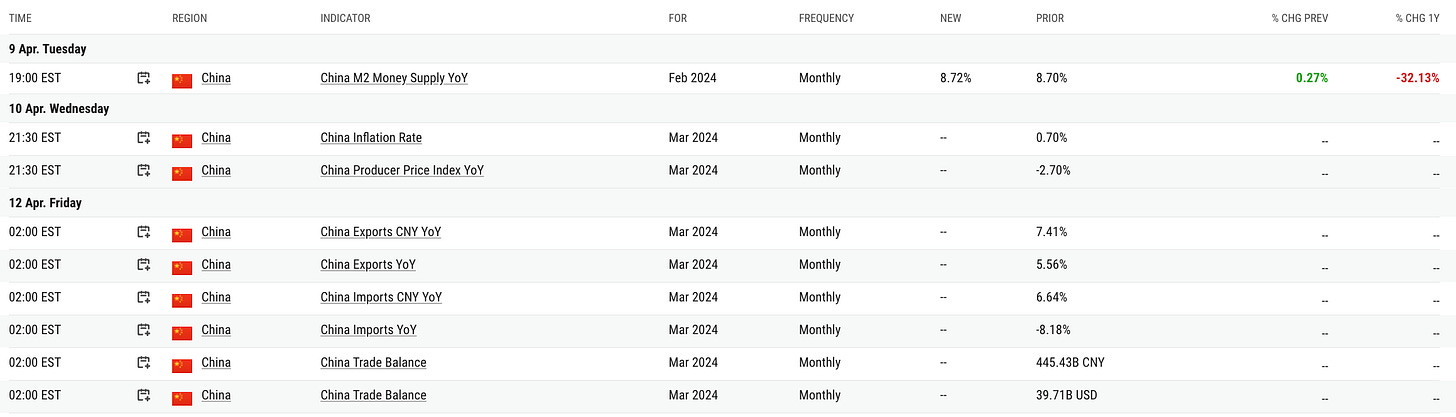

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

In March, there was a notable increase of 498,000 in household employment, which was entirely attributed to a rise in part-time employment by 525,000.

This shift resulted in the ratio of full-time employment to the civilian population falling to 50.1%, the lowest since November 2021.

Chart That Caught Our Eye

Analyst Team Note:

“Small caps have historically led in both the 6-12 months after the Fed is done hiking as well as following the first cut. However, cutting cycles usually occurred within a year of the last hike – the only exception was ‘07 (15 months after; small caps underperformed in that period between). While not a large enough sample set to draw conclusions from, we believe the longer the first rate cut gets pushed out vs our economists’ June forecast, the lower investors’ confidence that cuts will happen – ending the hiking cycle will not likely be enough.” - BofA

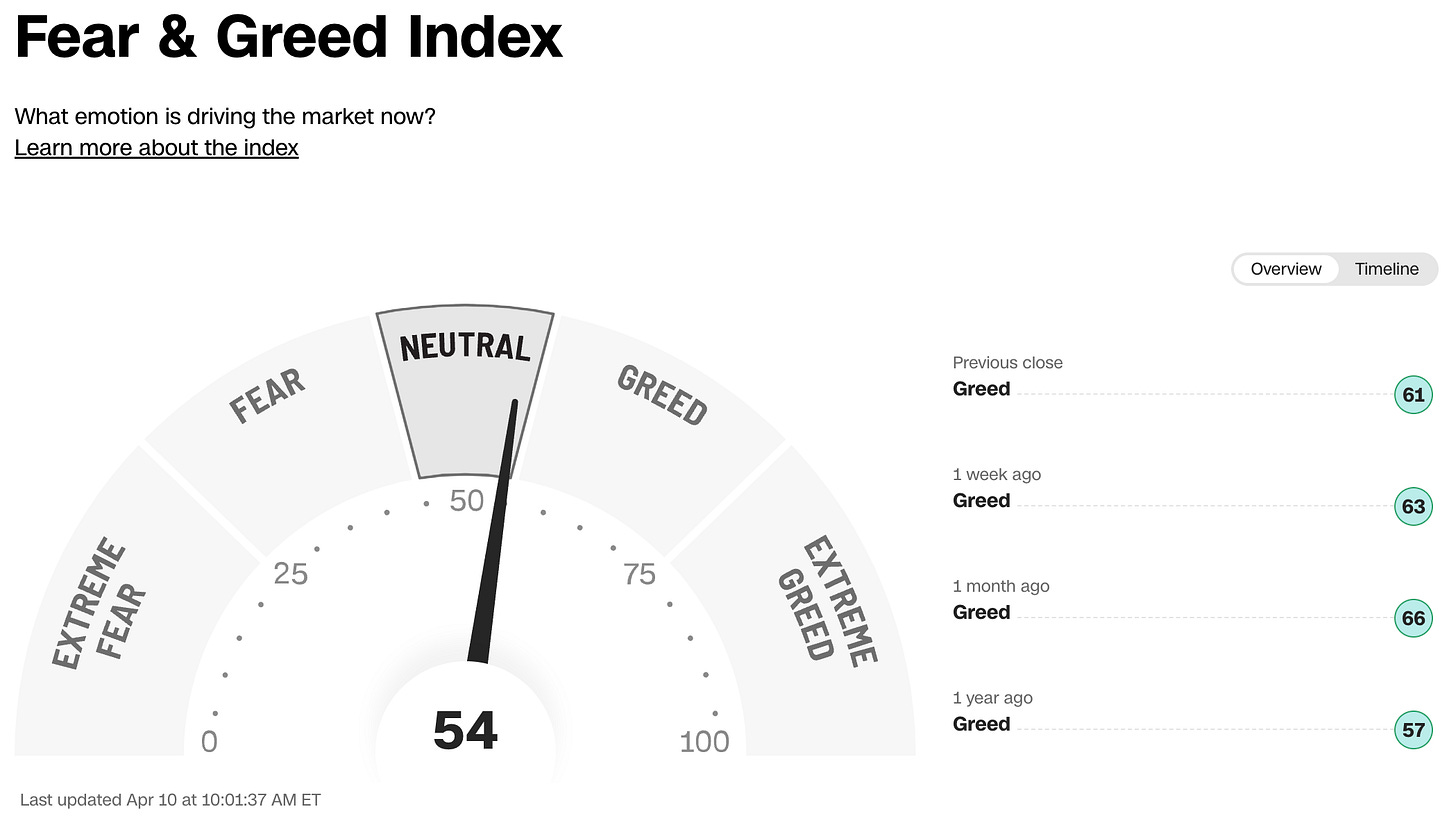

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.