3.8.24: Unemployment Rate Hits 2-Year HIGH

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 5148.03

KWEB (Chinese Internet) ETF: $24.82

Analyst Team Note:

Despite the most aggressive interest-rate hikes since the 1980s and ongoing uncertainties in the financial landscape, credit investors are displaying a remarkable level of optimism.

The lowest-rated corporate bonds are outperforming safer assets, with a notable increase in demand for junk bonds, a resurgence of negative-yielding bonds, and a general ease in funding for companies across credit qualities.

Macro Chart In Focus

Analyst Team Note:

“Prior market bubble conditions include (1) a gap between asset price and intrinsic value, (2) democratization of the asset class, and (3) rampant speculation, often amplified by the use of leverage. Housing in 2007, Tech in 2000, tulips in 1637 are examples that tick these boxes. But for the S&P 500, passive makes up just over half of float, where Japan passive equity reached 80% of AUM. CFTC data show net short positions by speculators. The gap between price and intrinsic value is high on snapshot multiples, but S&P 500 ex-Magnificent 7 trades closer to long-term multiples; and more importantly, today’s index is incomparable to prior decades’, in our view.” - Bank of America

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

The US unemployment rate rose to a two-year high of 3.9%, even as nonfarm payrolls saw a healthy increase of 275,000 jobs.

Despite the higher unemployment rate and a slowdown in wage growth, the labor market remains robust, with significant job additions in service sectors and moderate pay gains supporting consumer spending.

Chart That Caught Our Eye

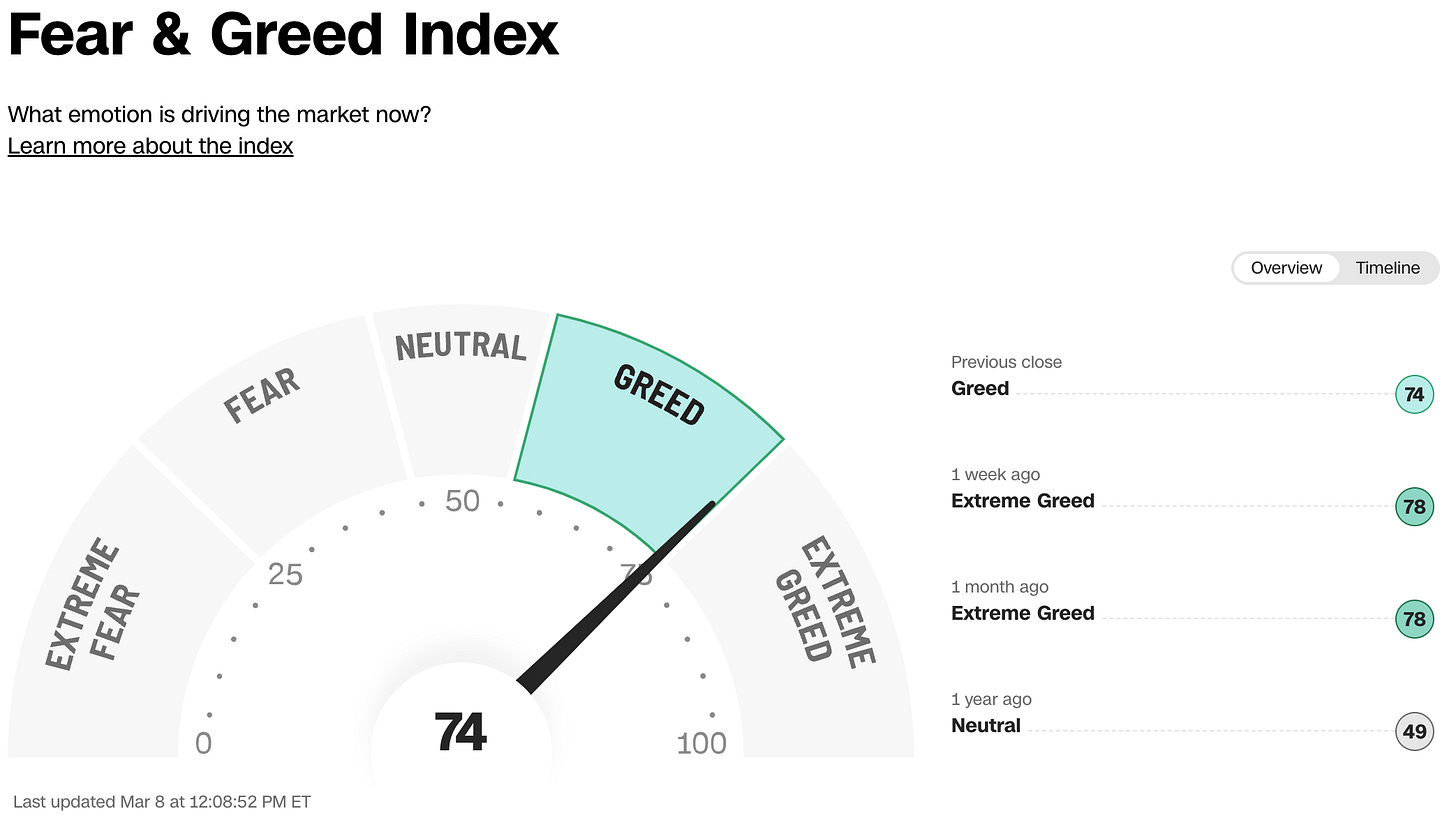

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.