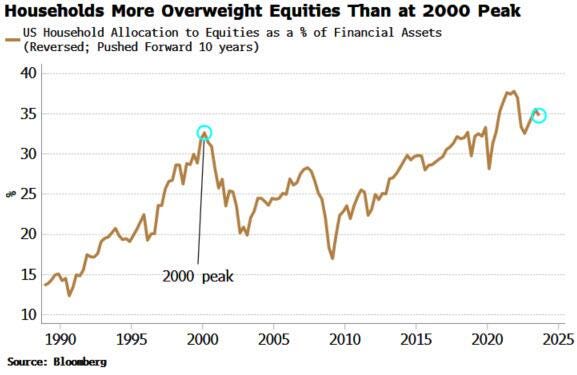

3.6.24: More Stocks Expensive Than 2000 Peak

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 5,122.10

KWEB (Chinese Internet) ETF: $25.12

Analyst Team Note:

Macro Chart In Focus

Analyst Team Note:

Recent data from the Federal Reserve Bank of Atlanta reveals a mixed picture of wage growth in the US, with most workers receiving pay increases that outpace inflation, but over 12% experiencing wage freezes, the highest in over two years.

Wage growth distribution is uneven, with significant hikes concentrated in high-demand professions such as nursing.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

China announced plans to issue 1 trillion yuan ($139 billion) in ultra-long special central government bonds in 2024, as part of a fiscal stimulus to support the economy facing challenges such as deflation, a property crisis, and low consumer confidence.

The funds from the bond issuance are earmarked for major national strategies and enhancing security in key areas, while also allowing local governments to issue new bonds, all within a fiscal deficit target set at 3% of GDP.

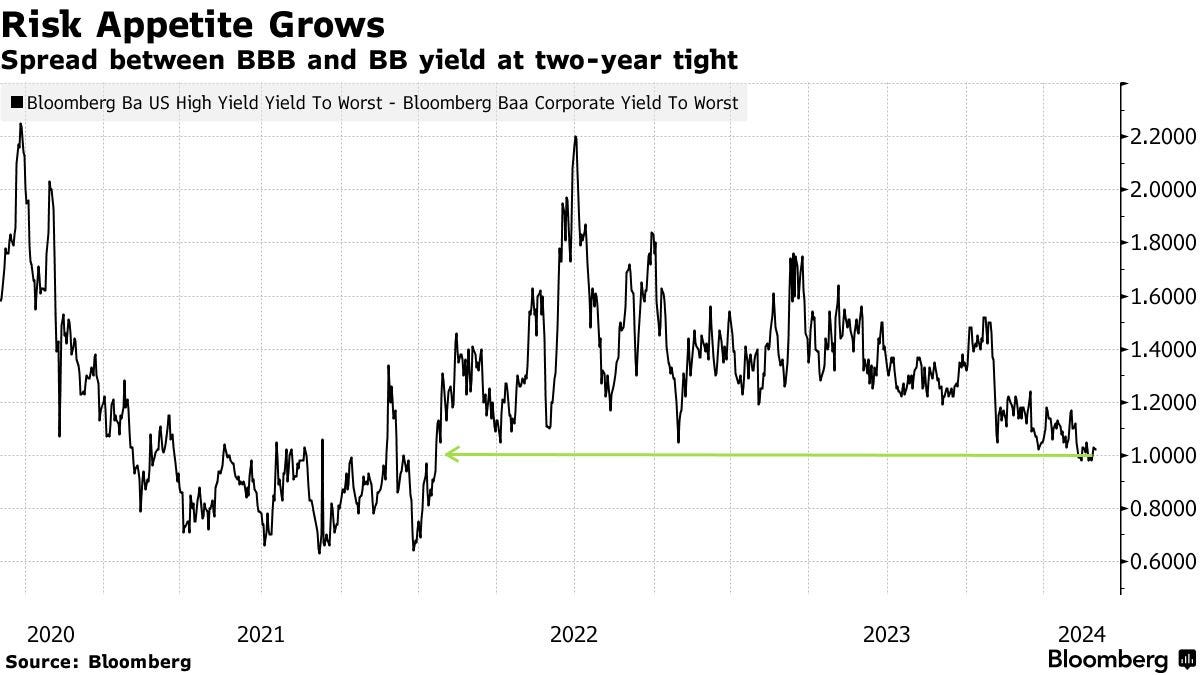

Chart That Caught Our Eye

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.