3.25.24: New-home Sales Decline as Supply Increases

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 5218.19

KWEB (Chinese Internet) ETF: $26.17

Analyst Team Note:

The S&P 500 finished last week 14% above its 200-day moving average.

Consensus earnings estimates have been revised lower, with analysts currently expecting EPS to grow about 9% this year versus 11% at the start of November.

Macro Chart In Focus

Analyst Team Note:

New-home sales in the US fell in February for the first time in three months. Purchases of new single-family homes decreased 0.3% to a 662,000 annual pace last month, below the 677,000 estimate.

Median sales price of a new house decreased 7.6% from a year ago to $400,500 in February. Supply of new homes rose to 463,000 during the month, the highest since October 2022.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

N/A

Analyst Team Note:

AAA believes that US gas prices will soar to their highest levels since the summer of 2022, reaching around $4 per gallon due to escalating oil prices and dwindling supplies.

The lowest inventory levels since December and reduced refinery output due to attacks on Russian facilities, has significantly pushed prices up. The situation is further affected by maintenance and unforeseen disruptions in US refineries, such as leaks and fires.

Chart That Caught Our Eye

Analyst Team Note:

Global cryptocurrency funds experienced a significant decline last week, with investors withdrawing a record $942 million. This shift follows a seven-week period of inflows totaling over $12 billion, which had propelled Bitcoin to a record high.

Meanwhile, funds for other cryptocurrencies like Ether, Solana, and Cardano also experienced net outflows.

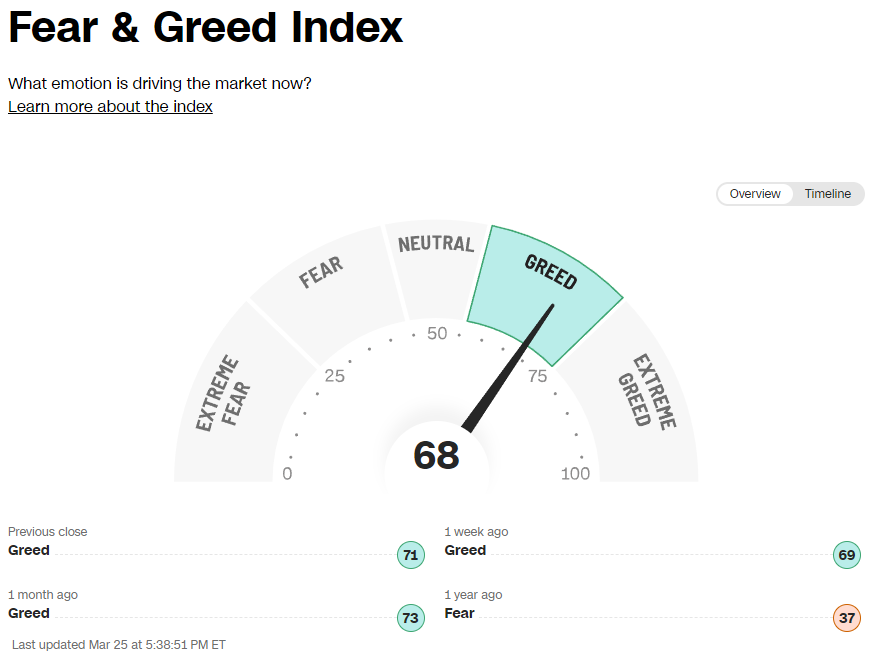

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.