3.24.23: Incredible Choppiness has overtaken markets post-FOMC to the dismay of Trend Followers

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: Post-FOMC there has been a very strong oscillation between SPX 3900 and 4000 as bullish and bearish market participants attempt to take out the other side with decisive price action. However, the market’s mean-reverting pattern likely suggests that short-term directional speculators may find themselves caught off guard with the market’s gyrations.

We believe old, longer-term bears will be eventually rewarded - up to a certain point. We believe new, shorter-term bears will face the wrath of the market’s indecision (illustrated by Chop).

Remember, it’s not about whether you’re bullish or bearish but when and how you position that really matters.

Enter far too early, and an eventual correct view may need to sit through a drawdown before it is proven right. Size too large, and the volatility can take you out before you are vindicated.

These are principles that we adapt holistically inside our strategy newsletters - what’s the key levels to focus on (where to engage at objective points), what’s the level of confidence ( small/medium/large), and what’s the intended duration of mentioned ideas (short-term/intermediate-term/long-term).

Do not miss out on a valuable opportunity to plan out your Strat this weekend. Homework must be done - if you want to succeed, that is.

Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash (yielding 4%+ on idle cash) at Interactive Brokers.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 3948.72

KWEB (Chinese Internet) ETF: $30.31

Analyst Team Note:

As money market rates have increased in accordance with Fed rate hikes, MM funds have seen record inflows as it’s up >$300bn past 4 weeks. BofA notes that the prior 2 surges in MM fund inflows (’08/’20) have coincided with big Fed cuts…

Macro Chart In Focus

Analyst Team Note:

According to BofA’s March Global Fund Manager Survey, managers now view a ‘systemic’ credit event as a larger tail risk than ‘inflation staying high’.

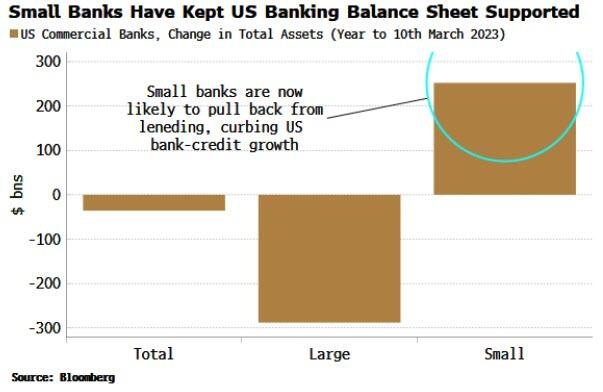

The economy’s recent resilience has been driven by the fact that the aggregate balance sheets of US banks have barely contracted. But this trend has been masking the reality that, while smaller banks’ assets were continuing to grow, those of large banks have fallen over the last year.

The fear is that the recent small bank turmoil may result this trend to reverse.

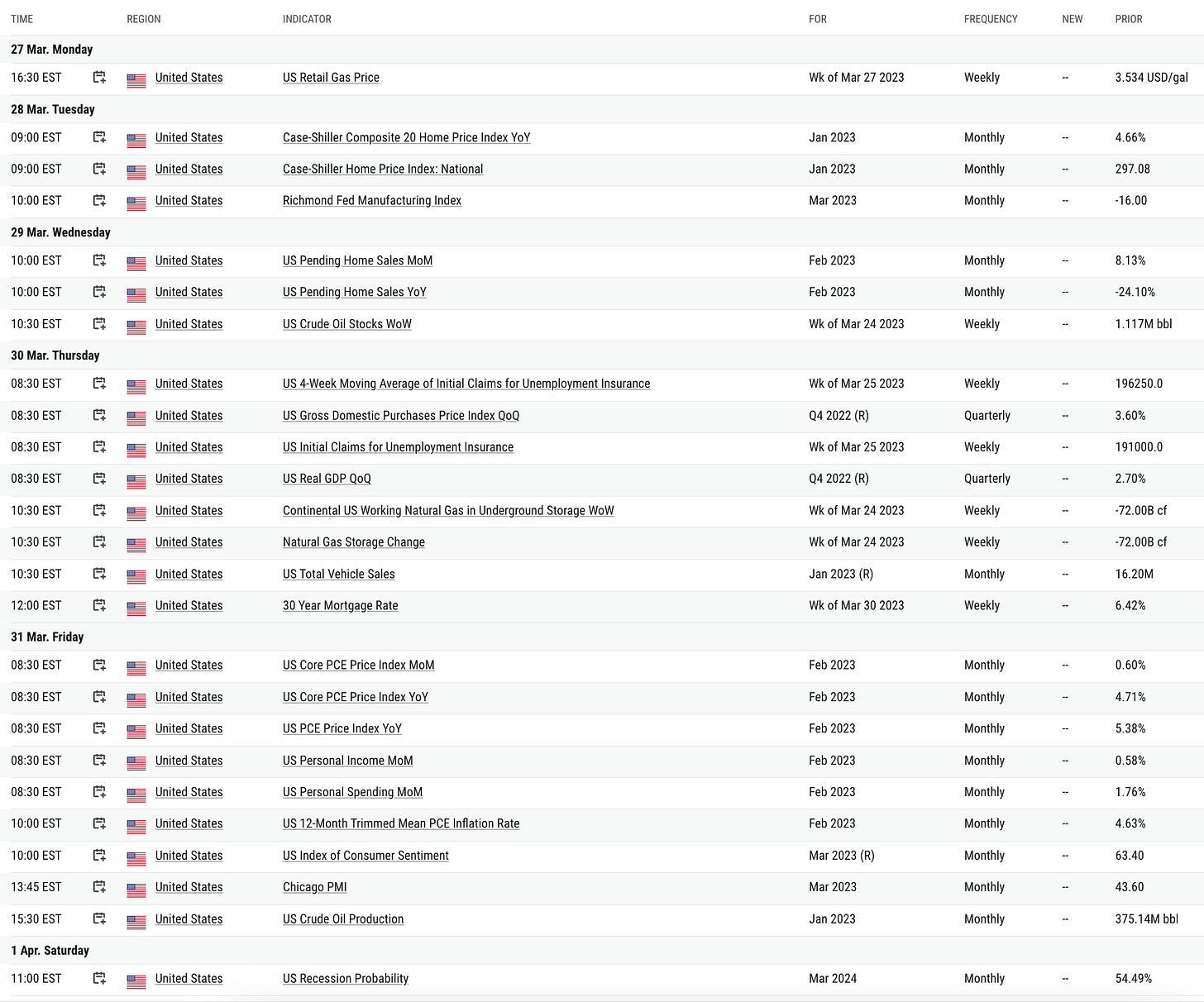

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

N/A

Analyst Team Note:

Deposits at US lenders reported the biggest decline in nearly a year during the week when multiple bank failures triggered global financial turmoil.

The decline was entirely due to a record plunge in deposits at smaller banks. According to data by the Federal Reserve, bank deposits fell by $98.4 billion to $17.5 trillion in the week ended March 15. Deposits at small banks slumped $120 billion, while those for the 25 largest banks rose almost $67 billion.

We’re seeing rotation into the big banks from small banks.

Chart That Caught Our Eye

Analyst Team Note:

“Banks are complicit in their current predicament by funding loan growth by pulling reserves rather than selling securities. This left them with more exposure to interest rate risk against deposits being purchased at market. Put another way, banks have borrowed short to lend long ever since banking began, but the rate paid for the largest deposits reflects a bank credit spread over Treasurys while the rates charged on loans carry a much wider spread to Treasury yields.

This spread difference delivers a cushion against an inverted Treasury curve – up to a point. Had they sold securities instead to fund lending, trusting that the Fed was really going to raise the funds rate and market yields would follow, the banks (small banks especially) would today be earning more on reserves than they are paying for deposits on average and have ample funds with no market risk to fund withdrawals.” - TS Lombard

Sentiment Check

Strategist Larry’s Latest Popular Tweet:

Make sure to follow Larry on Twitter and Instagram.