3.22.24: House Passes $1.2 Trillion Funding Bill Before Deadline

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 5234.18

KWEB (Chinese Internet) ETF: 26.25

Analyst Team Note:

Over the past five months, ETFs focused on corporate bonds have received more investments, totaling $46 billion, than at any point since the Federal Reserve's market support during the pandemic. In total, ETFs covering stocks, fixed income, and commodities have attracted $374 billion in this period, marking the highest inflow in two years.

Macro Chart In Focus

Analyst Team Note:

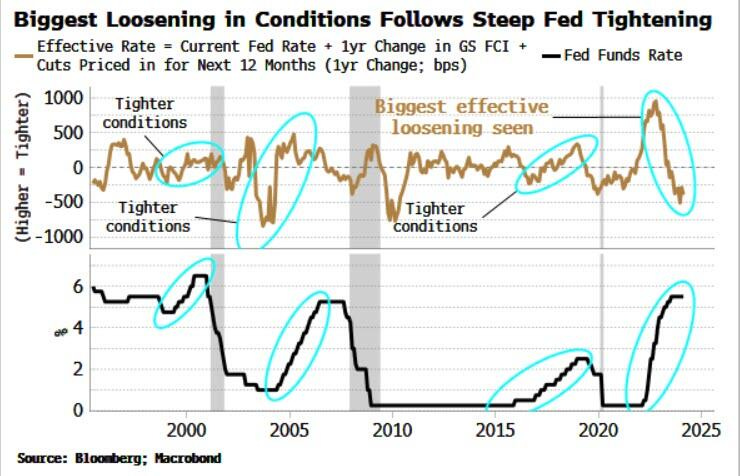

Despite over 500 basis points in rate hikes, monetary policy remains exceptionally loose, as seen in the chart above. There’s still continued high levels of cyclical PCE inflation and minimal increase in economic slack, suggesting that the Fed's rate hikes have had limited direct impact on quelling inflation.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

N/A

Analyst Team Note:

The House passed a $1.2 trillion government funding bill just hours before a deadline that would have led to a partial government shutdown, defying conservative demands for significant reductions in domestic spending.

The bill, which now heads to the Senate, aims to prevent a funding lapse by increasing defense appropriations by 3% and maintaining overall domestic spending levels, while also including raises for military personnel and funding for priorities like child care and cancer research.

Despite broad support from House Democrats, the bill faced opposition from many Republicans, including hardline conservative Marjorie Taylor Greene of Georgia, who initiated steps to remove House Speaker Mike Johnson, expressing dissatisfaction with his negotiation of the spending package.

Chart That Caught Our Eye

Analyst Team Note:

Per Bloomberg, Bitcoin put options expiring on March 29 exceeded call options in volume in the past 24 hours. That has nudged the put-to-call ratio higher.

The strike prices of puts are clustered around $50,000 and $45,000 on the platform. Bitcoin traded at around $63,500 on Friday.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.