3.20.23: Markets Believe Jerome May Blink On The Interest Rates Outlook in March FOMC. Will it be right?

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: Market participants are currently pricing in a Terminal Fed Funds Rate of 4%, rather than the 5.5% expectations set from just weeks ago. We will get resolution on whether this expectation is correct or misguided by mid-week. In the meantime, evaluating companies and putting thoughtful effort behind finding key ranges where action may occur is likely a good use of an Investor’s time in this environment.

We discuss this and more inside our latest strategy note on Substack/Patreon.

On Twitter and Instagram, I provide thoughtful (and fun) commentary. Join me there for more.

Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash (yielding 4%) at Interactive Brokers.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 3916.64

KWEB (Chinese Internet) ETF: $28.94

Analyst Team Note:

Despite the massive moves in rates over the past week (7.8 std move!), the S&P 500 has not moved at all relative to the rate move. This is a major disconnect from previous unprecedented moves in rates…

The market stays complacent…

Macro Chart In Focus

Analyst Team Note:

The events over the past 11 days (the collapse of 4 banks and a 5th in danger) have caused financial conditions to tighten to the most since March 2020… Just a few weeks prior, we were discussing how financial conditions were looser than before the Fed began rate hikes…

The market is now pricing a 74.5% chance of a 25bps hike this week and a 25.5% of a Fed PAUSE… A Fed pause would send a scary message to investors as it proves that the events of the past 2 weeks may not be idiosyncratic…

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

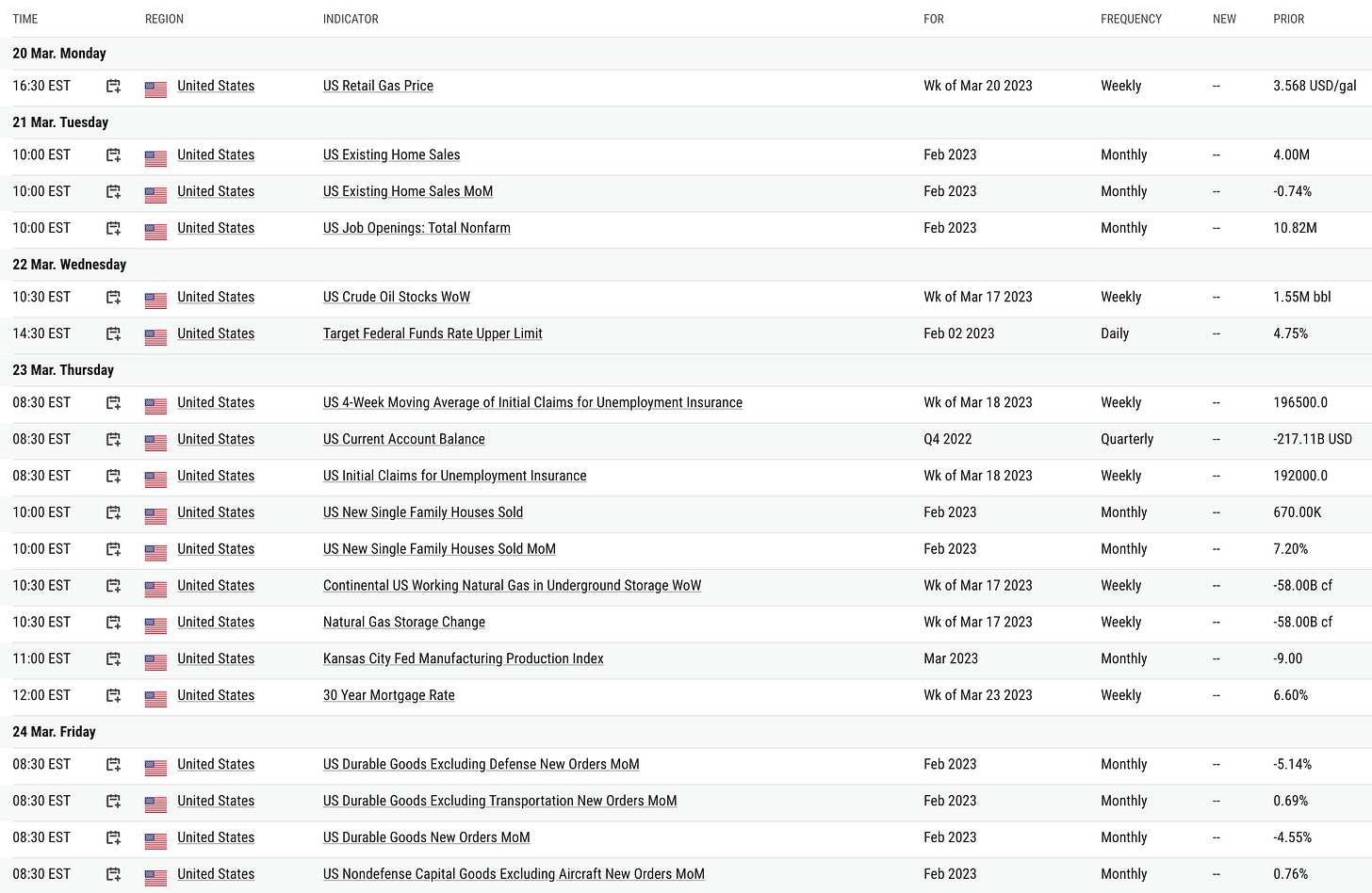

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

“The Fed's Senior Loan Officer Survey shows that banks have been tightening their credit standards since Q3 2021. As of the latest data for Q1 2023, our composite index of lending standards for consumer loans, C&I loans, and CRE loans stands at the tightest level since Q4 2020. Again, it is worth noting that these survey responses were collected before the failures of SVB, Silvergate, and SBNY. The graph above also shows that tightening lending standards tends to lead GDP growth by about 2 quarters. The pullback in lending standards that started in Q3 2021 coincided with the declines in GDP that we saw in Q1 and Q2 2022. GDP has rebounded in Q3 and Q4, but the graph shows that these spurts of growth against tightening credit standards do not tend to persist for long.” - Jeffries

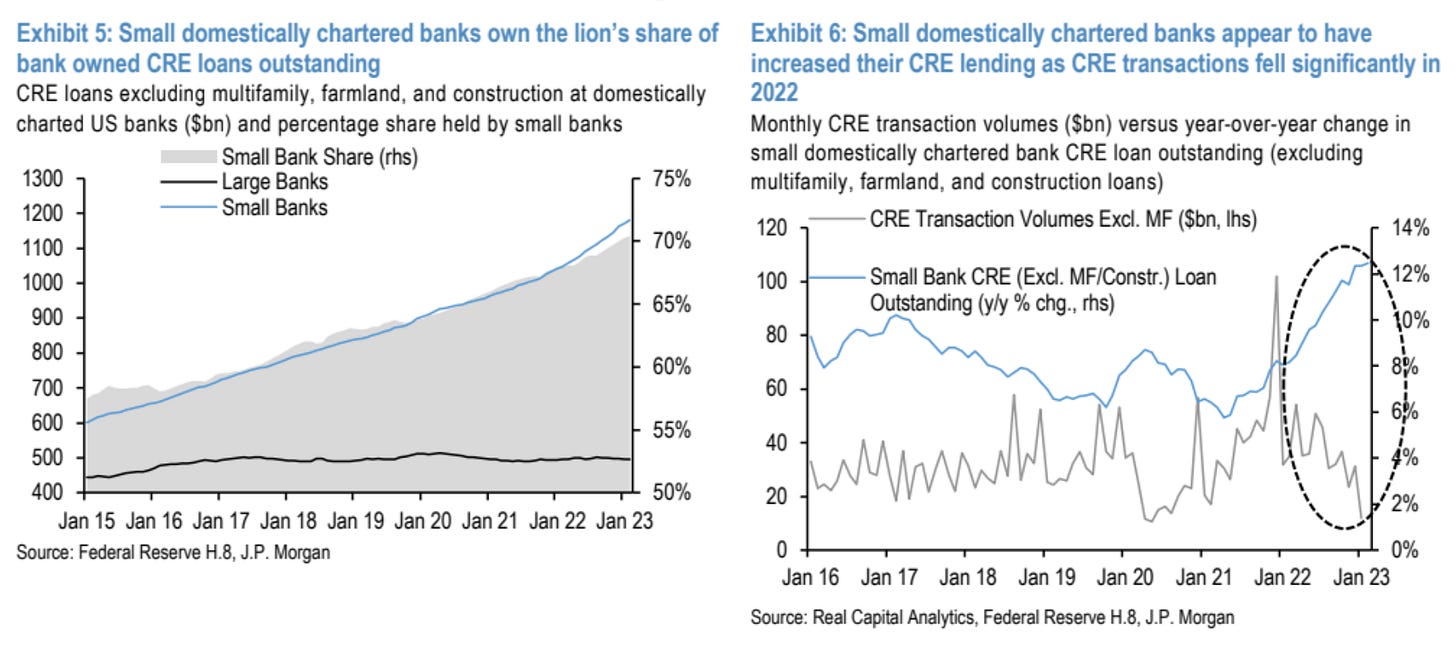

Chart That Caught Our Eye

Analyst Team Note:

As of February 2023, small banks account for 70% of total commercial real-estate loans outstanding. This share is particularly notable considering declining CRE transaction volumes.

As seen below, CMBS spreads have been widening dramatically over the past 2 weeks, which could threaten small banks’ holdings of these assets. This comes at a time when fears of solvency and a liquidity crunch have already been growing.