3.18.24: Markets Watching Rate Cuts Probabilities and State of QT

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 5149.42

KWEB (Chinese Internet) ETF: $26.54

Analyst Team Note:

Morgan Stanley Wealth Management recently wrote an interesting note, warning of potential shifts in the US dollar regime due to factors like worsening US-China relations, the end of Japan's yield curve management, and the rise in Bitcoin and commodity prices.

They highlight the historical correlation between the strength of the US dollar and PE ratios and point out that the strong dollar has been central to fostering a favorable investment environment in the US by reducing import-related inflation and energy costs, thereby supporting the equity market performance.

Macro Chart In Focus

Analyst Team Note:

The yield on the two-year Treasury note reached a YTD high as the market prices in fewer rate cuts this year.

The likelihood of a June rate cut is now below 50%, as markets price in a more cautious approach towards rate reductions amidst conditions such as low unemployment, persistent inflation, and strong earnings growth.

Goldman Sachs recently revised its forecast to anticipate three quarter-point rate cuts for the year, down from four, due to a slightly higher projected inflation path.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

One of the things Wall Street will be looking for from JPow will be the the potential phase-out of QT. While some anticipate an announcement or initiation of the balance sheet reduction slowdown as early as May, others expect it to start later in the second half of the year.

Per JP Morgan, any signals that the Fed will begin tapering QT within the year could positively impact Treasury markets by potentially stabilizing or lowering yields.

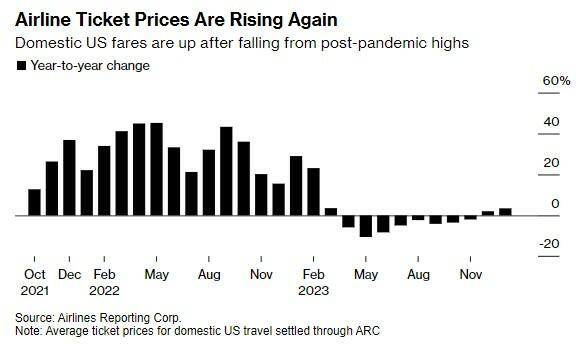

Chart That Caught Our Eye

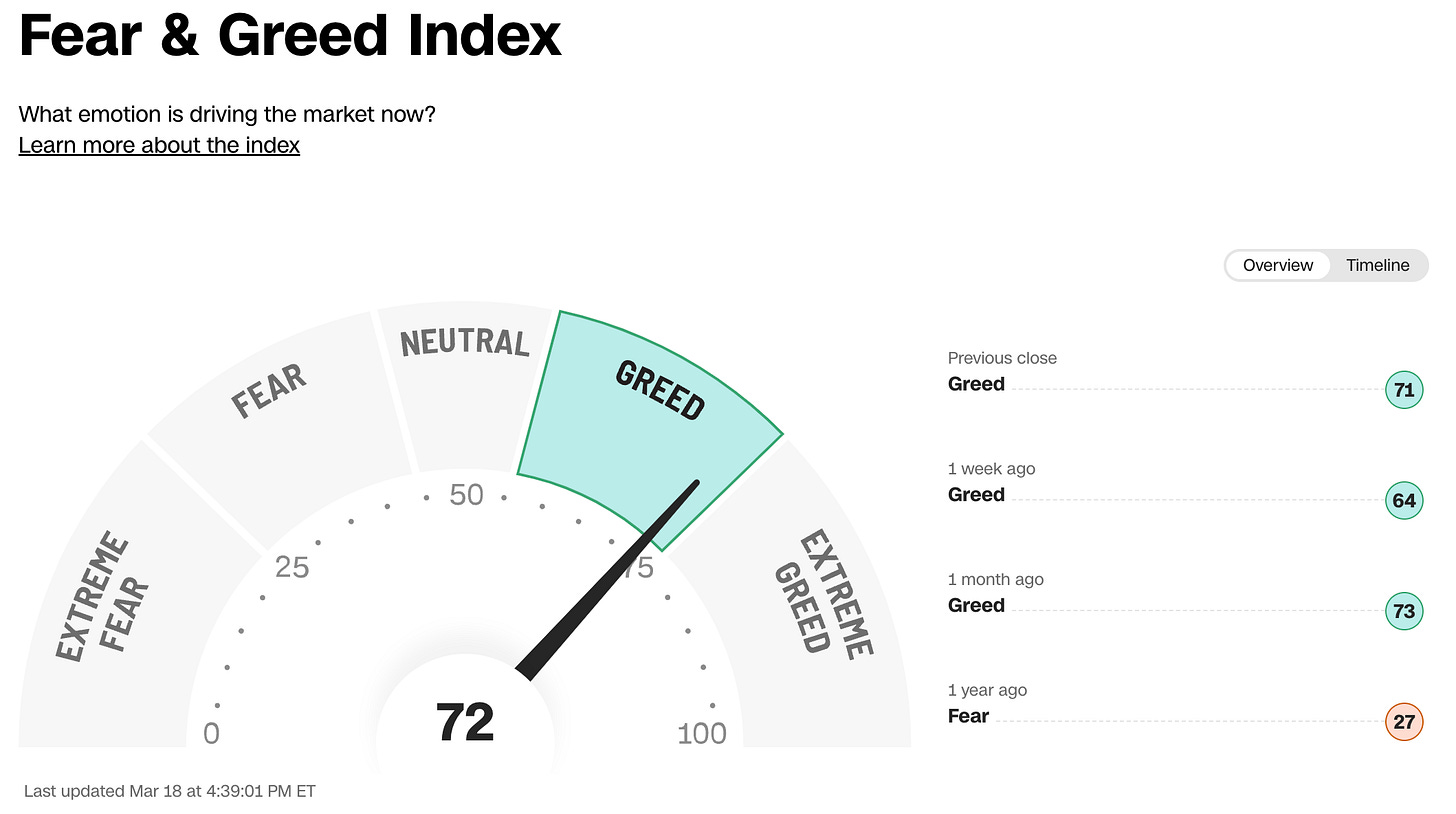

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.