3.17.23: Great Danger Awaits both Bulls and Bears in pivotal Fed meeting next week.

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: This environment has rewarded Investors who have put in substantial time & effort towards careful name-selection as well as thoughtful input on duration and sizing of transactions. I spend every day assessing inter-market data, and I believe those who are nimble have potentially benefited from the relentless chop in the markets this week. Even when I don’t comment on markets, I’m studying them closely.

I also believe we are entering a dangerous market environment as we look forward to next week’s Fed meeting. I would encourage our public readers to join our private community either on Substack/Patreon. Our community is offered at a Globally accessible price point to help the hard working folks navigate this treacherous environment. I think the only regret that folks may have is that they join too late. The impact relative to the cost (for those who know what they’re doing) is asymmetrical.

I seek people who are longer-term in nature, have deep patience, and don’t require extensive hand-holding (this isn’t direct mentorship). My focus is to provide clear context the way I see the market, a forecasting opinion of themes I’m following, and key levels along with duration commentary. I do not recap the news.

Make sure to take a moment to follow me on Instagram, where I post Instagram Stories that expire after 24 hours, which I believe you will find thought-provoking (and maybe even fun).

Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash (yielding 4%) at Interactive Brokers.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 3960.28

KWEB (Chinese Internet) ETF: $28.95

Analyst Team Note:

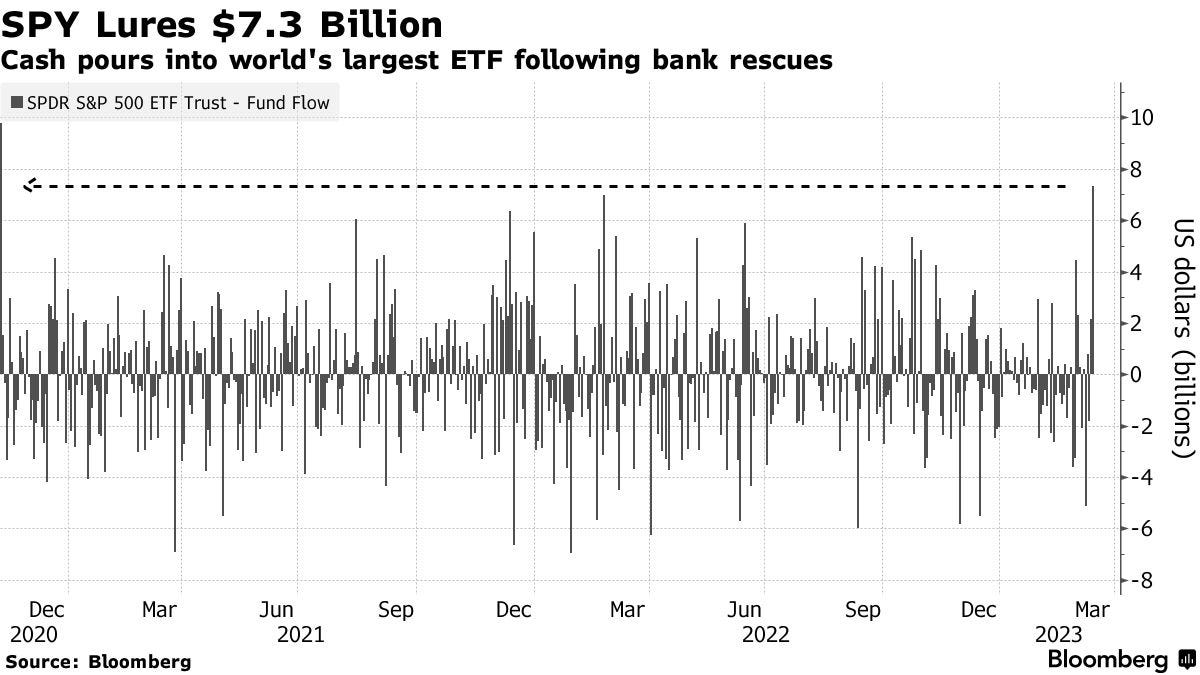

SPY stays strong as investors poured $7.3bn in the ETF on Thursday. This was the largest 1-day inflow since November 2020 and the sixth largest in over a decade…

Macro Chart In Focus

Analyst Team Note:

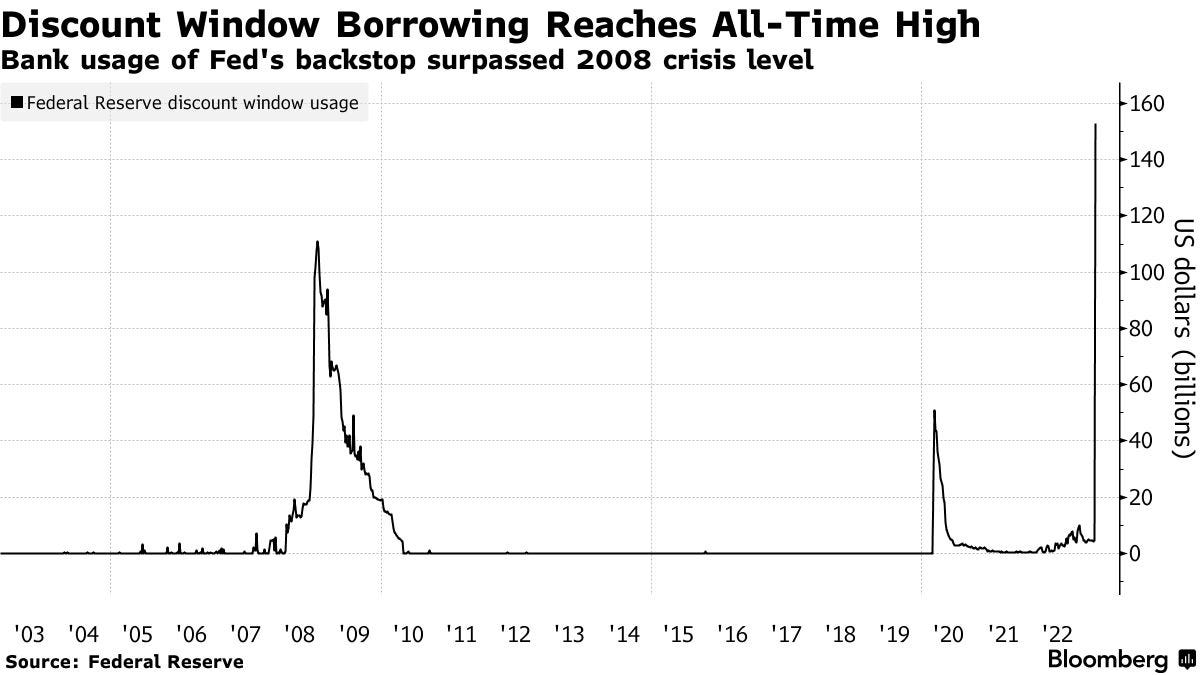

The discount window is a lending facility provided by the Fed to support stability and provide liquidity to the US banking system, where the central bank can lend banks money for up to 90 days. Although the service is available at all times, it becomes more popular during times of institutional or market stress when obtaining funds from other sources is challenging. Banks are required to provide collateral, such as government bonds, in exchange for the cash loaned by the central bank. If the loan is not repaid, the central bank can retain the collateral.

Over the past week, banks borrowed $152.85 billion through the discount window, up from $4.58 billion the week before. The previous record was $111 billion, a mark reached during the 2008 financial crisis…

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

UMich inflation expectations fell to 3.8% in the next 12 months, the lowest since April 2021. UMich notes that the decrease was surveyed before the failure of SVB and that expects inflation expectations to be volatile in the months ahead.

Chart That Caught Our Eye

Analyst Team Note:

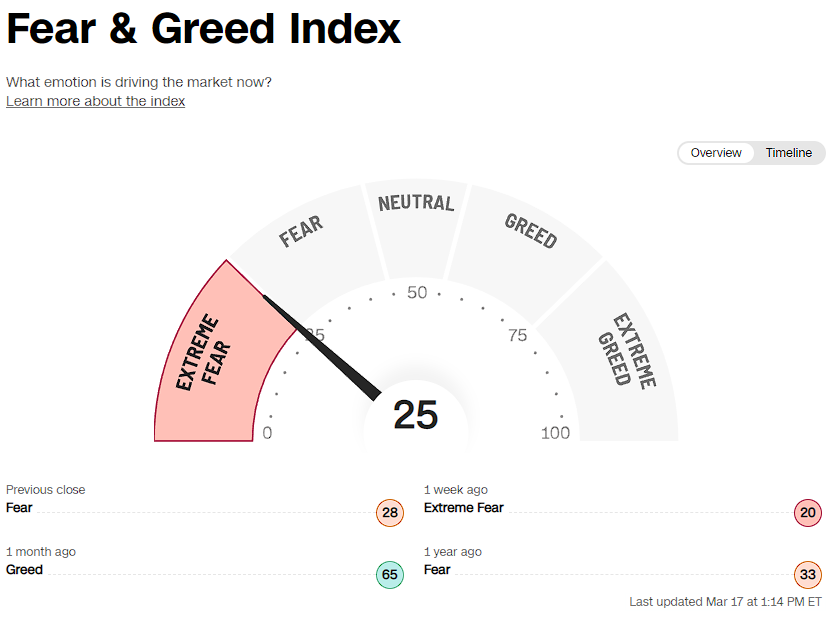

“US equities deliver strong returns going into the first rate cut, about twice their usual returns, but offer almost no return 3 months following the cut. Twelve months after the first cut, returns tend to be positive but below average. The poorer returns are largely a reflection of weaker growth. However, as Exhibit 16 illustrates, the first rate cut has not always been received positively by the markets. Growing growth concerns in 2001 and 2007, for example, overwhelmed the support that rate cuts provided.” - Goldman Sachs