3.15.24: S&P 500 Still Has Room to Rally 20% Higher

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 5123.83

KWEB (Chinese Internet) ETF: $26.45

Analyst Team Note:

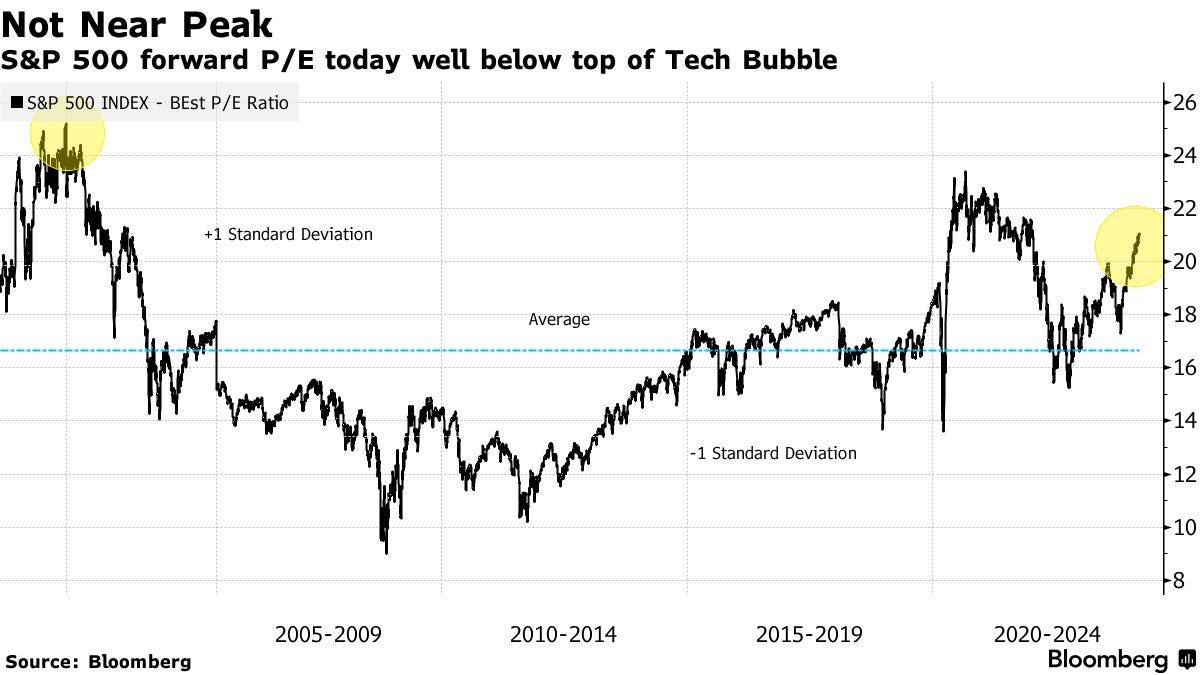

According to SocGen, the S&P 500 has the potential to rally by 20% before it reaches the valuation extremes witnessed during the dot-com bubble in 2000.

This is due to factors such as a stronger-than-expected earnings breadth, record highs in profit cycles, and positive shifts in global economic indicators.

Macro Chart In Focus

Analyst Team Note:

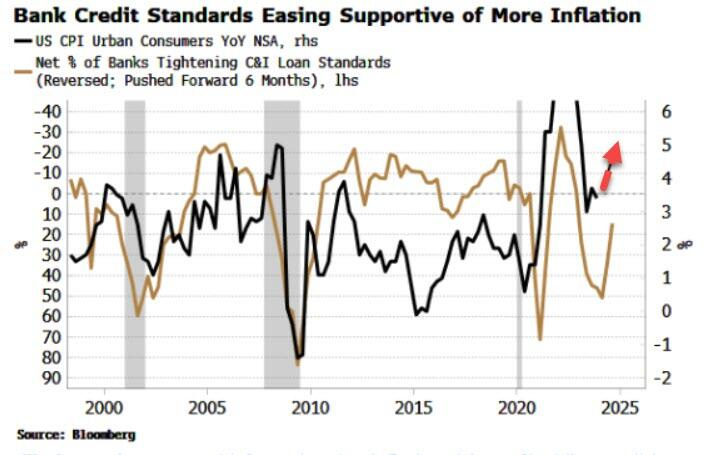

“The Biggest Picture: US headline/core CPI trending to 3.6-4.0% by June when Fed expected to cut rates; implicitly Fed tolerating higher inflation (eases US debt burden); weaker policy credibility = weaker currency… why crypto & gold at all-time highs.” - Bank of America

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

Despite optimism for a mild inflation outcome, recent data suggests that inflation is becoming entrenched, posing a risk of renewed price growth. While cyclical CPI components have contributed to a temporary decline in headline CPI, their descent is slowing.

The market continues to overlook inflationary pressures, thanks to supportive liquidity conditions…

Chart That Caught Our Eye

Analyst Team Note:

China's augmented fiscal deficit is projected to reach 11.1 trillion yuan in 2024, amounting to an 8.2% deficit-to-GDP ratio, the highest since 2020, based on Bloomberg's analysis.

Deflation could amplify the deficit's proportion of GDP, especially since the budget assumes a price growth above 2%, whereas many economists anticipate a lower inflation rate, further elevating deficit-to-GDP.

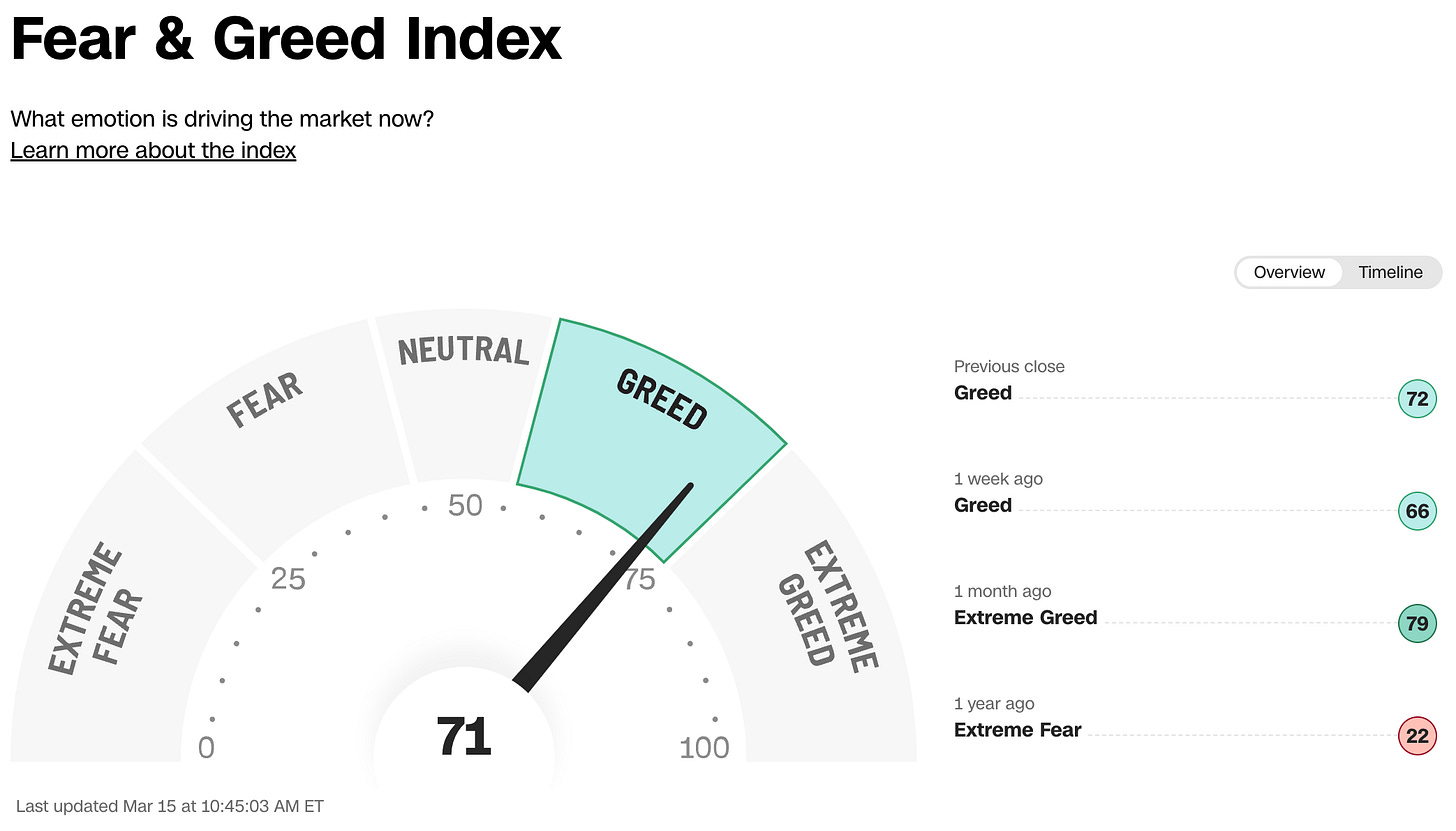

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.