3.15.23: We didn't believe Credit Suisse would lead to sustained Sell.

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: This morning on Twitter, I shared an opinion that Credit Suisse is not likely the “big one” that rocks markets in a structural fashion - see Tweet below. Make sure to follow me to get my latest public thoughts.

Now 59.

In our Private Community, we discussed several tactical ideas that played out well in the timeframe for which it was intended - join our Community on Substack/Patreon and navigate this highly uncertain market with our objective key levels where we believe Institutions are likely to do business.

Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash (yielding 4%) at Interactive Brokers.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 391.73

KWEB (Chinese Internet) ETF: $28.93

Analyst Team Note:

Concerns over the US banking sector being downgraded to negative by Moody’s and the continued struggles of Credit Suisse led to another day of negative price action for bank stocks.

The big banks (BofA, JPM, etc) have seen major inflows as regional banks receive increased scrutiny. BofA reportedly received $15bn in deposits in just a few days… At the end of last year, deposits at BofA were down $8bn QoQ.

Macro Chart In Focus

Analyst Team Note:

Inflation may have peaked but it’s now broadening and getting stickier. The percent of CPI sub-categories with three-month inflation rates above its 12-month rate increased to 67%.

The Atlanta Fed divides CPI into components whose prices are flexible, meaning they can be moved up or down quickly with little difficulty, and those that are sticky, where price rises take a while to prepare and are hard to reverse.

In 2021 and early 2022, inflation was almost entirely due to flexible pricing. Now, sticky price inflation is actually higher than flexible and remains at an elevated level.

This is exactly what the Fed wants to avoid.

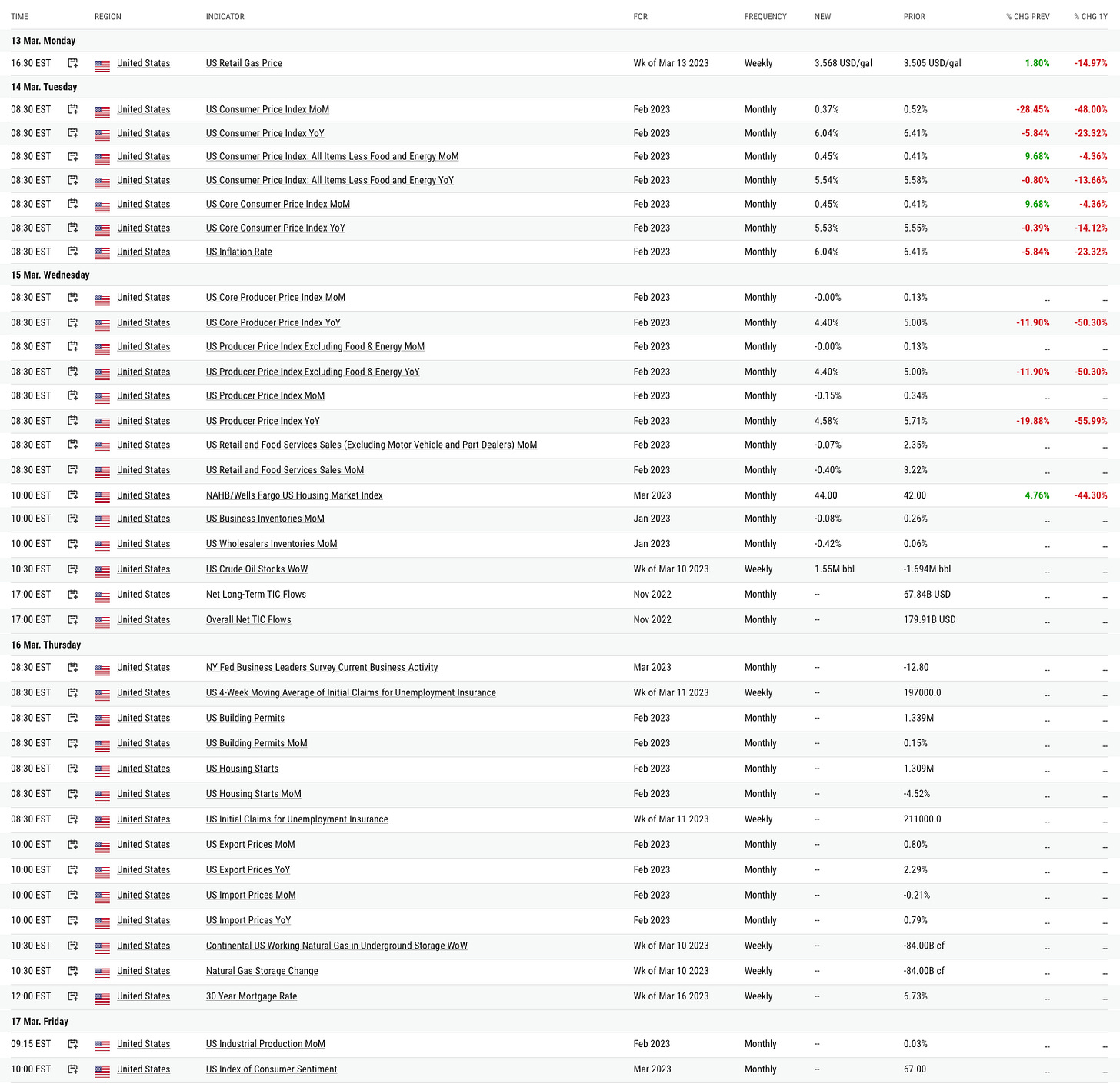

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

N/A

Analyst Team Note:

US retail sales fell in February after a surge in the prior month, suggesting consumer spending, while holding up, is getting challenged by high inflation.

The value of overall retail purchases decreased 0.4% after a 3.2% advance in January, in line with expectations.

The strongest components in February were nonstore retailers (1.6%), health and personal care (0.9%), groceries (0.5%) and general merchandise (0.5%). Restaurants and bars (-2.2%), autos ex parts (- 2.0%), furniture (-2.5%) and miscellaneous stores (-1.8%) all saw declines.

Chart That Caught Our Eye

Analyst Team Note:

FRA-OIS spreads is the difference between forward rate agreements (FRA) and overnight index swaps (OIS).

Forward Rate Agreements (FRA) are contracts where two parties exchange at a fixed interest rate swap for a certain period. The interest rates usually refer to LIBOR.

Overnight Index Swap (OIS) are contracts where overnight interest rates swap for fixed interest rates, referring to US fed funds rates.

FRA represents the interest rates demanded by banks, while OIS reflects the overnight risk-free rate.

The spread between FRA and OIS represents the trends of borrowing costs and surges when the market demands higher risk premiums. FRA-OIS spreads are seen as a proxy for the banking sector and a measure of how expensive or cheap it will be for banks to borrow in the future, relative to the risk-free rate.

The FRA-OIS spread is currently at the widest level since early in the pandemic.

Bank liquidity is drying up at a record pace.