3.13.23: Several Names in Financials approach "tradable" bounce regions. Upon deeper selloffs, strong long-term investment levels start to appear in Large Cap Financials Stocks.

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

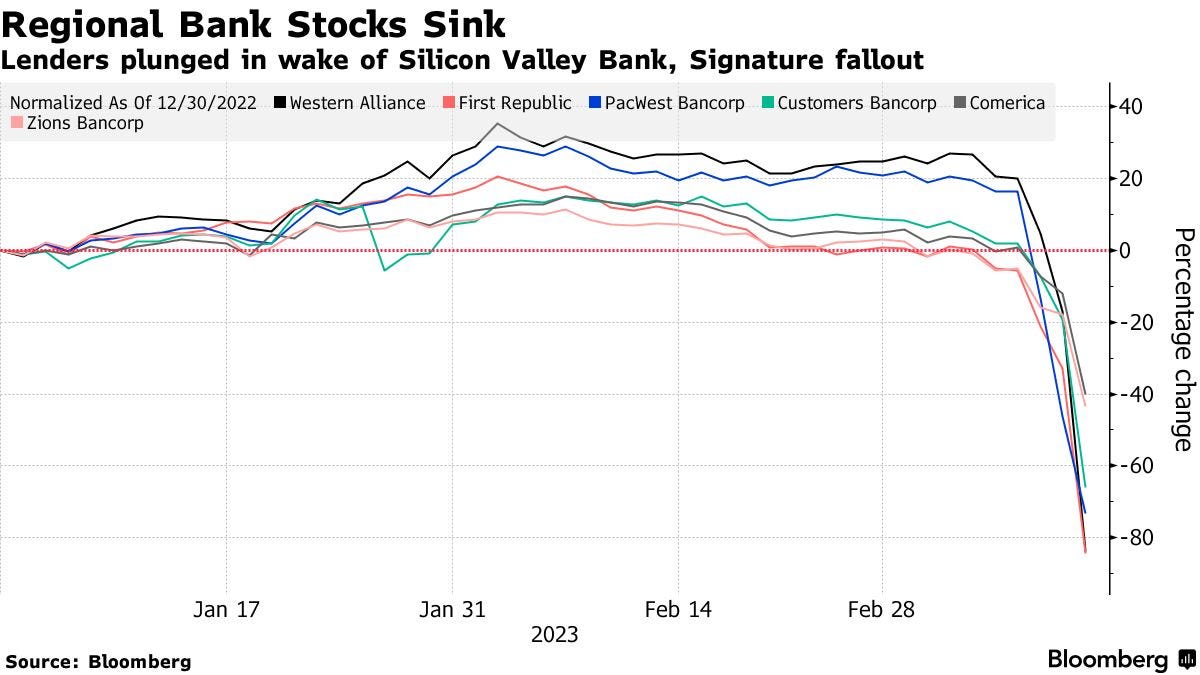

Note to Readers from Larry: We have entered an environment where an “Event Driven Situation” has led to market dislocation the banking sector. We believe that certain pockets in the financials sector are essentially at regions where a tradable bounce can take place. While it’s too early to say that these levels within Financials is an entry for long-term investment, a technical bounce could soon ensue and Investors may have an opportunity for alpha.

It is critically important to carefully select which banks and institutions you choose to trade. This is discussed in my latest Strategy note to members.

Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash (yielding 4%) at Interactive Brokers.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index & KWEB (Chinese Internet) commentary from note to Members.

Analyst Team Note:

For SPY, Larry believes that “a 2-4% tactical counter-trend brief bounce could soon emerge (ideally once we enter the 376-383 Zone) back to 390+ before further weakness”.

For the QQQ, “If SOXX stays supported above 400 and QQQ falls into the 275-280 region, that level is interesting to me for a tactical brief near-term bounce on the Qs.”.

“For China investors looking for relatively less volatile exposure to the country, FXI large cap ETF is a viable alternative to KWEB. I’m interested in FXI in the 25-26 region (if it gets there). I think today’s level can work with an ultra-long timeframe. But risk-averse investors interested in China may want to wait.”

For further analysis, check out Larry’s in-depth writeup posted yesterday.

Macro Chart In Focus

Analyst Team Note:

The government finally steps in.

The Treasury Department, Federal Reserve and the FDIC announced new programs and actions, including:

The FDIC said it will resolve SVB in a way that “fully protects all depositors.” Similarly, “all depositors” at Signature will be made whole.

The Fed also announced a new “Bank Term Funding Program” that offers one-year loans to banks under easier terms than it typically provides.

Relaxed terms for lending through its discount window, its main direct lending facility.

Under the new US program, which provides loans of up to one year, collateral will be valued at par, or 100 cents on the dollar. That means banks can get bigger loans than usual for bonds, reducing the pressure to generate cash by selling securities whose prices have tumbled.

So even if bank’s are holding massive unrealized losses on its Treasuries or MBS, it can pledge those securities at par, and not market value… Seems like QE to me…

Charts That Caught Our Eye

(Powered by our Channel Financial Data Provider YCharts)

Analyst Team Note:

Markets are now pricing a 100% chance of either no rate hike or a 25 bps rate CUT in March. The collapse of SVB and SBNY have stoked fears of contagion and more bank collapses to come…

Analyst Team Note:

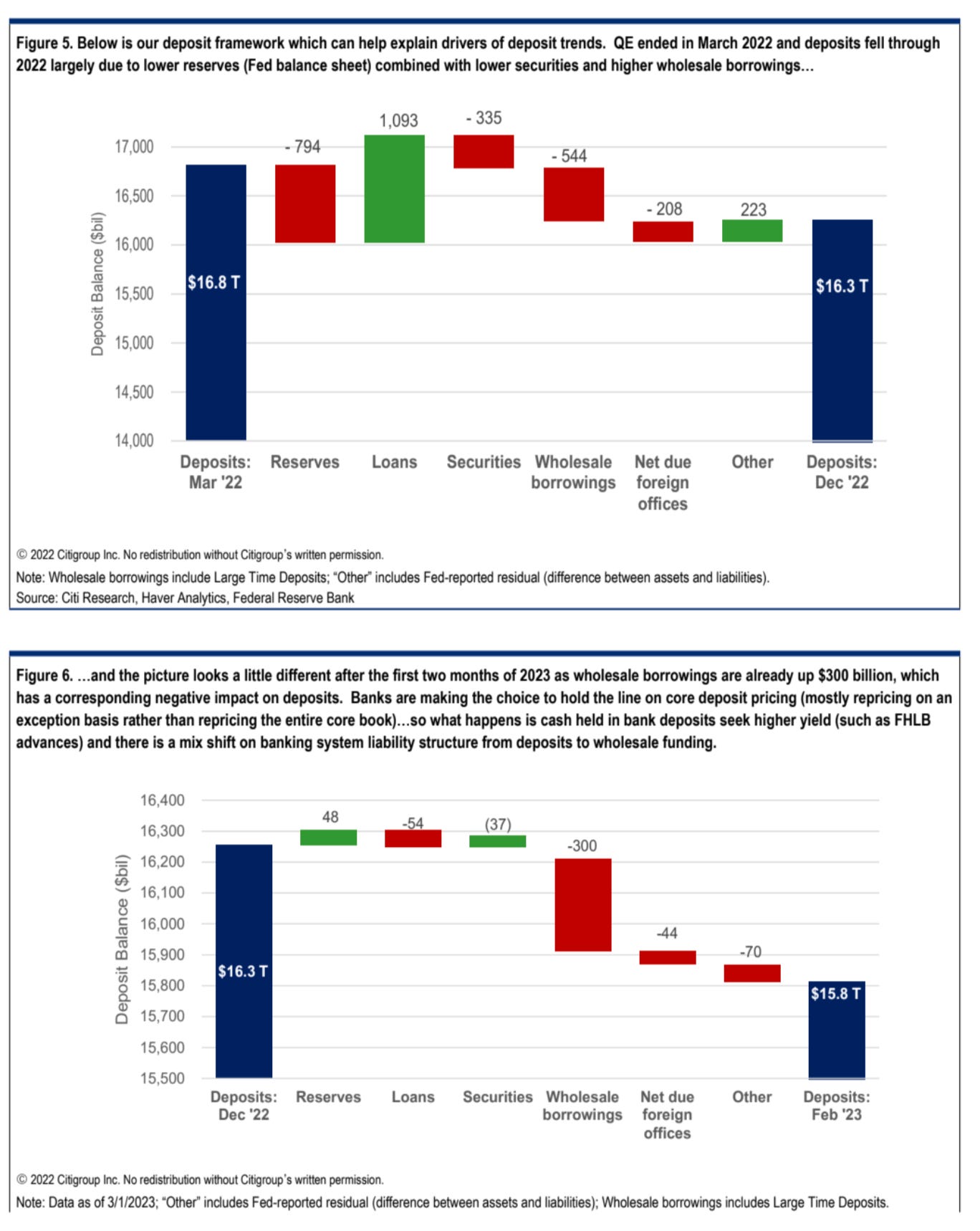

Deposits at US banks are falling fast…